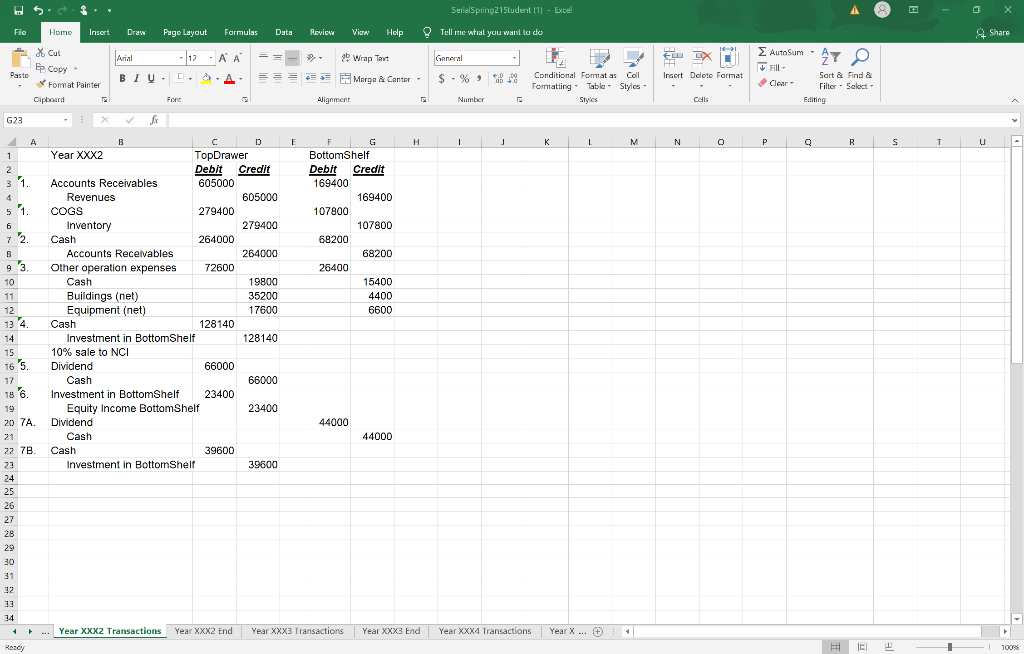

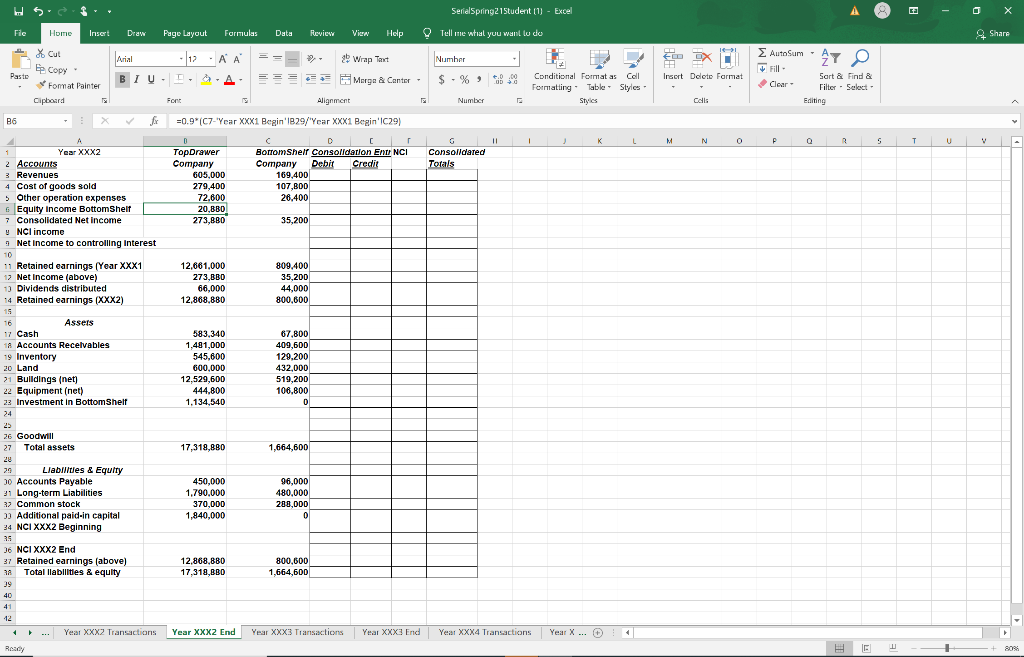

SerialSpring215tudent [1] - Excel File Home Insert Draw Page Layout Formulas Data Review View Help Tell me what you want to de Share 16 Arial - 12AA 2 Wrap Tant AutoSum - EX General 27 Pasto % Cut e Copy Fomat Painter Clipboard BIU. === * Marga & Canter - $ %, .. Insert Delote Format Clear Conditional Formatas Coll Formatting - Table - Styles Styles Sart & Find & Filter - Select Editing Fort E Alignment Number Cells G23 3 fx A E H H 1 1 J K 1 M N 0 R S u 1 2 3 1. 4 5 1. 6 7 2. B 93 10 11 12 134 B D Year XXX2 TopDrawer Debit Credit Accounts Receivables 605000 Revenues 605000 COGS 279400 Inventory 279400 Cash 264000 Accounts Receivables 264000 Other operation expenses 72600 Cash 19800 Buildings (net) 35200 Equipment (net) 17600 Cash 128140 Investment in BottomShelf 128140 10% sale to NCI Dividend 66000 Cash 66000 Investment in BottomShelf 23400 Equity Income BottomShelf 23400 Dividend Cash Cash 39600 Investment in BottomShelf 39600 F G BottomShelf Debit Credit 169400 169400 107800 107800 68200 68200 26400 15400 4400 6600 15 16 5. 17 186. 19 20 74 44000 44000 44000 22 7B 23 24 25 26 27 28 29 30 31 32 14 Year XXX2 Transactions Year XXX2 End Year XXX3 Transactions Year XXX3 End Year XXX4 Transactions Year X... + 1 Ready 1 100% % SerialSpring2 Student (1) - Excel File Home Insert Draw Page Layout Formulas Data Review View Help Tell me what you want lu do 2 Share Auto Sum Arial 12 Number % Cut Copy Format Painter 12 NA A 27 O 2 Wrap Tart Morge & Cantor !! D FE Insert Dolote Format Pasto BIU. $ -% B. Conditional Format as cal Formatting Table Styles Styles Clear - Sort & Find & Filter - Select- Editing Clipboard Fort Alignment Number Calls B6 fx =0.9 (07-"Year XXX1 Begin'1829/"Year XXX1 Begin'IC29) 11 ! L M N N O 0 P R S T U w Consolldated Totals D TopDrawer Company 605,000 279,400 72.800 20,880 273,880 C [ r BottomShell Consolidation Entr NCI Company Debit Credit 169,400 107,800 26.400 35,200 12,661,000 273,BBD 66,000 12,868,880 809,400 35,200 44,000 800,000 1 Year XXX2 2 Accounts 3 Revenues 4 Cost of goods sold 5 Other operation expenses 6 Equity Income Bottom Shelf 7 Consolidated Net income y NCI income 9 Net Income to controlling interest 10 11 Retained earnings (Year XXX1 17 Net Income (above) 13 Dividends distributed 14 Retained earnings (XXX2) 15 Assers 17 Cash 18 Accounts Recelvables 19 Inventory 20 Land 21 Buildings (net) 22 Equipment (net) 22 Investment in BottomShelf 24 25 26 Goodwill 27 Total assets 28 29 Liabilities & Equity 00 Accounts Payable 31 Long-term Liabilities 32 Common stock 2 Additional paid-in capital 34 NCI XXX2 Beginning 583,340 1,481,000 545,600 600,000 12,529,600 444.800 1,134,540 67,800 409,600 129.200 432,000 519,200 106.800 0 17.319,880 1,664,600 450,000 1,790,000 370,000 1,840,000 96,000 480,000 288,000 0 36 NCI XXX2 End 37 Retained earnings (above) NA Total llabilities & equity 39 40 12,868,880 17,318,BBO 800,600 1,664,600 ... Year XXX2 Transactions Year XXX2 End Year XXX3 Transactions Year XXX End Year XXX4 Transactions Year X.. ... F 1 1 + 8091 SerialSpring215tudent [1] - Excel File Home Insert Draw Page Layout Formulas Data Review View Help Tell me what you want to de Share 16 Arial - 12AA 2 Wrap Tant AutoSum - EX General 27 Pasto % Cut e Copy Fomat Painter Clipboard BIU. === * Marga & Canter - $ %, .. Insert Delote Format Clear Conditional Formatas Coll Formatting - Table - Styles Styles Sart & Find & Filter - Select Editing Fort E Alignment Number Cells G23 3 fx A E H H 1 1 J K 1 M N 0 R S u 1 2 3 1. 4 5 1. 6 7 2. B 93 10 11 12 134 B D Year XXX2 TopDrawer Debit Credit Accounts Receivables 605000 Revenues 605000 COGS 279400 Inventory 279400 Cash 264000 Accounts Receivables 264000 Other operation expenses 72600 Cash 19800 Buildings (net) 35200 Equipment (net) 17600 Cash 128140 Investment in BottomShelf 128140 10% sale to NCI Dividend 66000 Cash 66000 Investment in BottomShelf 23400 Equity Income BottomShelf 23400 Dividend Cash Cash 39600 Investment in BottomShelf 39600 F G BottomShelf Debit Credit 169400 169400 107800 107800 68200 68200 26400 15400 4400 6600 15 16 5. 17 186. 19 20 74 44000 44000 44000 22 7B 23 24 25 26 27 28 29 30 31 32 14 Year XXX2 Transactions Year XXX2 End Year XXX3 Transactions Year XXX3 End Year XXX4 Transactions Year X... + 1 Ready 1 100% % SerialSpring2 Student (1) - Excel File Home Insert Draw Page Layout Formulas Data Review View Help Tell me what you want lu do 2 Share Auto Sum Arial 12 Number % Cut Copy Format Painter 12 NA A 27 O 2 Wrap Tart Morge & Cantor !! D FE Insert Dolote Format Pasto BIU. $ -% B. Conditional Format as cal Formatting Table Styles Styles Clear - Sort & Find & Filter - Select- Editing Clipboard Fort Alignment Number Calls B6 fx =0.9 (07-"Year XXX1 Begin'1829/"Year XXX1 Begin'IC29) 11 ! L M N N O 0 P R S T U w Consolldated Totals D TopDrawer Company 605,000 279,400 72.800 20,880 273,880 C [ r BottomShell Consolidation Entr NCI Company Debit Credit 169,400 107,800 26.400 35,200 12,661,000 273,BBD 66,000 12,868,880 809,400 35,200 44,000 800,000 1 Year XXX2 2 Accounts 3 Revenues 4 Cost of goods sold 5 Other operation expenses 6 Equity Income Bottom Shelf 7 Consolidated Net income y NCI income 9 Net Income to controlling interest 10 11 Retained earnings (Year XXX1 17 Net Income (above) 13 Dividends distributed 14 Retained earnings (XXX2) 15 Assers 17 Cash 18 Accounts Recelvables 19 Inventory 20 Land 21 Buildings (net) 22 Equipment (net) 22 Investment in BottomShelf 24 25 26 Goodwill 27 Total assets 28 29 Liabilities & Equity 00 Accounts Payable 31 Long-term Liabilities 32 Common stock 2 Additional paid-in capital 34 NCI XXX2 Beginning 583,340 1,481,000 545,600 600,000 12,529,600 444.800 1,134,540 67,800 409,600 129.200 432,000 519,200 106.800 0 17.319,880 1,664,600 450,000 1,790,000 370,000 1,840,000 96,000 480,000 288,000 0 36 NCI XXX2 End 37 Retained earnings (above) NA Total llabilities & equity 39 40 12,868,880 17,318,BBO 800,600 1,664,600 ... Year XXX2 Transactions Year XXX2 End Year XXX3 Transactions Year XXX End Year XXX4 Transactions Year X.. ... F 1 1 + 8091