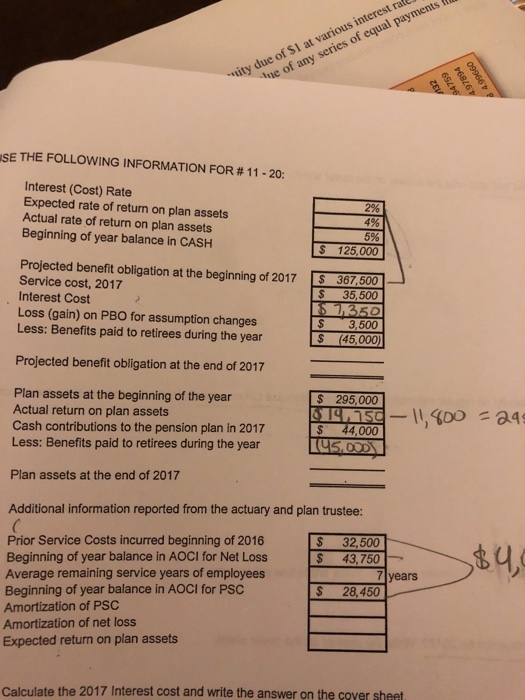

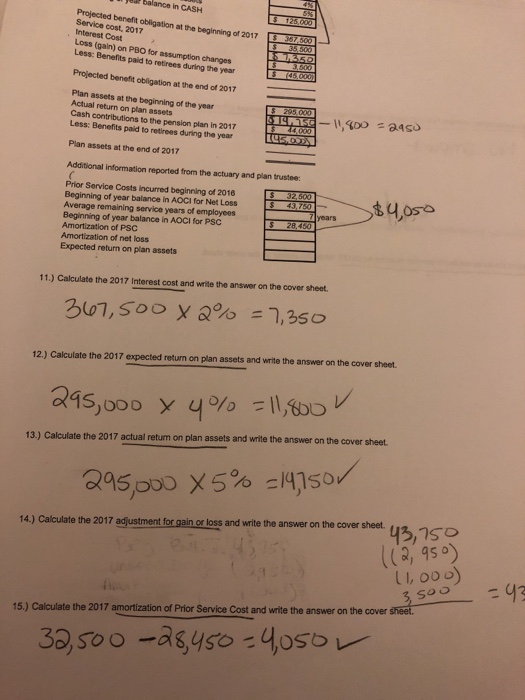

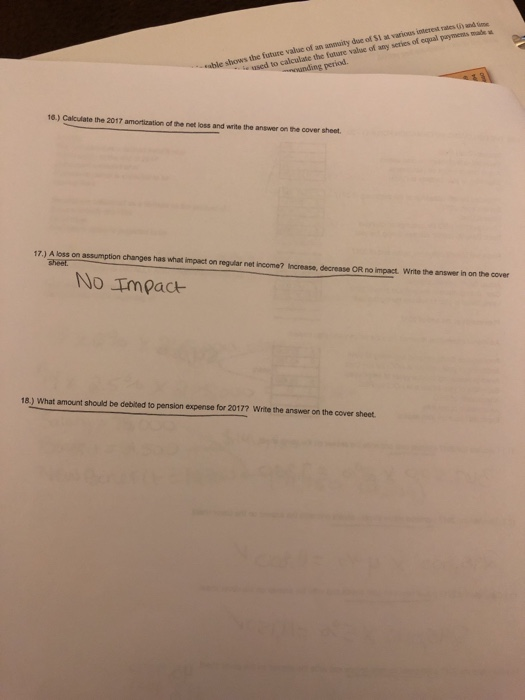

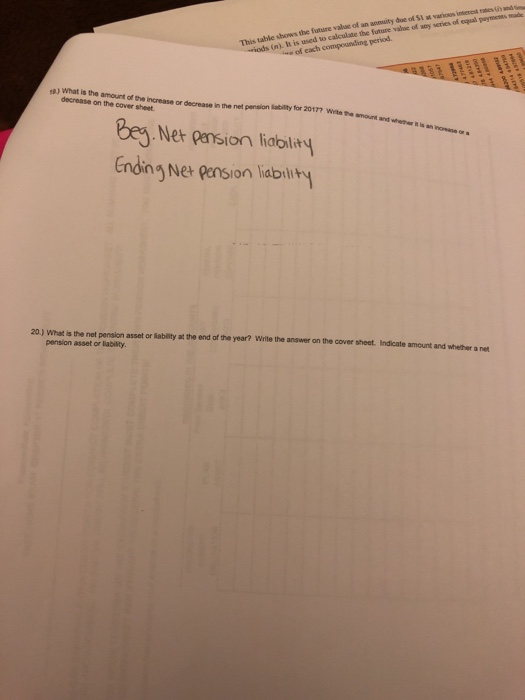

series of equal payments ty due of S1 at various i e of any SE THE FOLLOWING INFORMATION FOR # 11-20: Interest (Cost) Rate Expected rate of return on plan assets Actual rate of return on plan assets 4% 5% 125,000 S367,500 Beginning of year balance in CASH S Projected benefit obligation at the beginning of 2017 Service cost, 2017 Interest Cost $ 35,500 Loss (gain) on PBO for assumption changes Less: Benefits paid to retirees during the year S 3,500 S (45,000) Projected benefit obligation at the end of 2017 Plan assets at the beginning of the year Actual return on plan assets Cash contributions to the pension plan in 2017 Less: Benefits paid to retirees during the year $ 295,000 S 44,000 0i Plan assets at the end of 2017 Additional information reported from the actuary and plan trustee: Prior Service Costs incurred beginning of 2016 S 32,500 $ 43,750 Beginning of year balance in AOCI for Net Loss Average remaining service years of employees Beginning of year balance in AOCI for PSC S years S 28,450 Amortization of PSC Amortization of net loss Expected return on plan assets Calculate the 2017 Interest cost and write the answer on the cover sheet balance in CASH at the beginning of 2017 Service cost, 2017 Interest Cost Loss (gain) on PBO for assumption changes Less: Benefits paid to retirees during the year Projected benefit obligation at the end of 2017 Plan assets at the beginning of the year Actual return on plan assets Cash contributions to the pension plan in 2017 Less: Benefits paid to retirees during the year Plan assets at the end of 2017 Additional information reported from the actuary and plan trustee: Prior Service Costs incurred beginning of 2018 Beginning of year balance in AOCI for Net Losts Average remaining service years of employeos Beginning of year balance in AOCI for PSC Amortization of PSC Anortization of net loss Expected return on plan assets 11.) Calculate the 2017 Interest cost and write the answer on the cover sheet 12.) Calculate the 2017 expected return on plan assets and write the answer on the cover sheet answer on the cover sheet 13.) Calculate the 2017 actual return on plan assets and write the 43,15 (2, 45 LI, ooo) 14.) Calculate the 2017 adjustment for gain or loss and write the answer on the cover sheet 15.) Calculate the 2017 amortization of Prior Service Cost and write the answer on the cover sheet shows the future valuc of an anmuity duc of S1 at various interest rates (i) ae used to calculate the future value of any series of equal payments mads 16.) Calculate the 2017 amortization of the net loss and write the answer on the cover sheet 17.) A loss on assumption changes has what impact on regular net income? Increase, decrease OR no impact. Write the answer in on the cover 18.) What amount should be debited to pension expense for 2017? Write the answer on the cover sheet auaity due of S1 at various interest aes (' and period. t value of wey veries of egal paymicms made This table shows the future value of an od (n). t is used to calculade the future 1B) What is the amount of the increase or decrease in the net pension latslity decrease on the cover sheet. for 20177 Wite the smount and whether it is an increae or Net pansion liability Endin Net Rension liabiy 20) What is the net pension asset or iability at the end of the year? Write the answer on the cover sheet. pension asset or lability Indicate amount and whether a net series of equal payments ty due of S1 at various i e of any SE THE FOLLOWING INFORMATION FOR # 11-20: Interest (Cost) Rate Expected rate of return on plan assets Actual rate of return on plan assets 4% 5% 125,000 S367,500 Beginning of year balance in CASH S Projected benefit obligation at the beginning of 2017 Service cost, 2017 Interest Cost $ 35,500 Loss (gain) on PBO for assumption changes Less: Benefits paid to retirees during the year S 3,500 S (45,000) Projected benefit obligation at the end of 2017 Plan assets at the beginning of the year Actual return on plan assets Cash contributions to the pension plan in 2017 Less: Benefits paid to retirees during the year $ 295,000 S 44,000 0i Plan assets at the end of 2017 Additional information reported from the actuary and plan trustee: Prior Service Costs incurred beginning of 2016 S 32,500 $ 43,750 Beginning of year balance in AOCI for Net Loss Average remaining service years of employees Beginning of year balance in AOCI for PSC S years S 28,450 Amortization of PSC Amortization of net loss Expected return on plan assets Calculate the 2017 Interest cost and write the answer on the cover sheet balance in CASH at the beginning of 2017 Service cost, 2017 Interest Cost Loss (gain) on PBO for assumption changes Less: Benefits paid to retirees during the year Projected benefit obligation at the end of 2017 Plan assets at the beginning of the year Actual return on plan assets Cash contributions to the pension plan in 2017 Less: Benefits paid to retirees during the year Plan assets at the end of 2017 Additional information reported from the actuary and plan trustee: Prior Service Costs incurred beginning of 2018 Beginning of year balance in AOCI for Net Losts Average remaining service years of employeos Beginning of year balance in AOCI for PSC Amortization of PSC Anortization of net loss Expected return on plan assets 11.) Calculate the 2017 Interest cost and write the answer on the cover sheet 12.) Calculate the 2017 expected return on plan assets and write the answer on the cover sheet answer on the cover sheet 13.) Calculate the 2017 actual return on plan assets and write the 43,15 (2, 45 LI, ooo) 14.) Calculate the 2017 adjustment for gain or loss and write the answer on the cover sheet 15.) Calculate the 2017 amortization of Prior Service Cost and write the answer on the cover sheet shows the future valuc of an anmuity duc of S1 at various interest rates (i) ae used to calculate the future value of any series of equal payments mads 16.) Calculate the 2017 amortization of the net loss and write the answer on the cover sheet 17.) A loss on assumption changes has what impact on regular net income? Increase, decrease OR no impact. Write the answer in on the cover 18.) What amount should be debited to pension expense for 2017? Write the answer on the cover sheet auaity due of S1 at various interest aes (' and period. t value of wey veries of egal paymicms made This table shows the future value of an od (n). t is used to calculade the future 1B) What is the amount of the increase or decrease in the net pension latslity decrease on the cover sheet. for 20177 Wite the smount and whether it is an increae or Net pansion liability Endin Net Rension liabiy 20) What is the net pension asset or iability at the end of the year? Write the answer on the cover sheet. pension asset or lability Indicate amount and whether a net