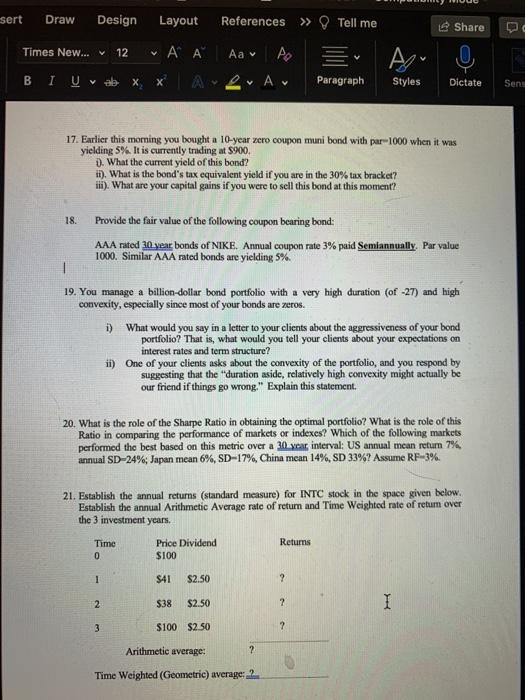

sert Draw Design Layout References >> Tell me Share Times New... 12 Aav A ALA A- 0, BI V ab X Paragraph Styles Dictate Sens 17. Earlier this morning you bought a 10-year zero coupon muni bond with par 1000 when it was yielding 5%. It is currently trading at $900. D. What the current yield of this bond? it). What is the bond's tax equivalent yield if you are in the 30% tax bracket? iii). What are your capital gains if you were to sell this bond at this moment? 18. Provide the fair value of the following coupon bearing bond: AAA rated 30 year bonds of NIKE. Annual coupon rate 3% paid Semiannually. Par value 1000. Similar AAA rated bonds are yielding 5% 19. You manage a billion-dollar bond portfolio with a very high duration (of -27) and high convexity, especially since most of your bonds are zeros. i) What would you say in a letter to your clients about the aggressiveness of your bond portfolio? That is, what would you tell your clients about your expectations on interest rates and term structure? ii) One of your clients asks about the convexity of the portfolio, and you respond by suggesting that the duration aside, relatively high convexity might actually be our friend if things go wrong." Explain this statement. 20. What is the role of the Sharpe Ratio in obtaining the optimal portfolio? What is the role of this Ratio in comparing the performance of markets or indexes? Which of the following markets performed the best based on this metric over a 30 year interval: US annual mean return 7% annual SD-24%; Japan mean 6%, SD-17% China mean 14%, SD 33%? Assume RF-3%. 21. Establish the annual returns (standard measure) for INTC stock in the space given below. Establish the annual Arithmetic Average rate of return and Time Weighted rate of retum over the 3 investment years. Returns Time 0 Price Dividend $100 1 $41 $2.50 ? 2 $38 $2.50 2 I 3 $100 $2.50 ? Arithmetic average: ? Time Weighted (Geometric) average: 2 sert Draw Design Layout References >> Tell me Share Times New... 12 Aav A ALA A- 0, BI V ab X Paragraph Styles Dictate Sens 17. Earlier this morning you bought a 10-year zero coupon muni bond with par 1000 when it was yielding 5%. It is currently trading at $900. D. What the current yield of this bond? it). What is the bond's tax equivalent yield if you are in the 30% tax bracket? iii). What are your capital gains if you were to sell this bond at this moment? 18. Provide the fair value of the following coupon bearing bond: AAA rated 30 year bonds of NIKE. Annual coupon rate 3% paid Semiannually. Par value 1000. Similar AAA rated bonds are yielding 5% 19. You manage a billion-dollar bond portfolio with a very high duration (of -27) and high convexity, especially since most of your bonds are zeros. i) What would you say in a letter to your clients about the aggressiveness of your bond portfolio? That is, what would you tell your clients about your expectations on interest rates and term structure? ii) One of your clients asks about the convexity of the portfolio, and you respond by suggesting that the duration aside, relatively high convexity might actually be our friend if things go wrong." Explain this statement. 20. What is the role of the Sharpe Ratio in obtaining the optimal portfolio? What is the role of this Ratio in comparing the performance of markets or indexes? Which of the following markets performed the best based on this metric over a 30 year interval: US annual mean return 7% annual SD-24%; Japan mean 6%, SD-17% China mean 14%, SD 33%? Assume RF-3%. 21. Establish the annual returns (standard measure) for INTC stock in the space given below. Establish the annual Arithmetic Average rate of return and Time Weighted rate of retum over the 3 investment years. Returns Time 0 Price Dividend $100 1 $41 $2.50 ? 2 $38 $2.50 2 I 3 $100 $2.50 ? Arithmetic average: ? Time Weighted (Geometric) average: 2