Answered step by step

Verified Expert Solution

Question

1 Approved Answer

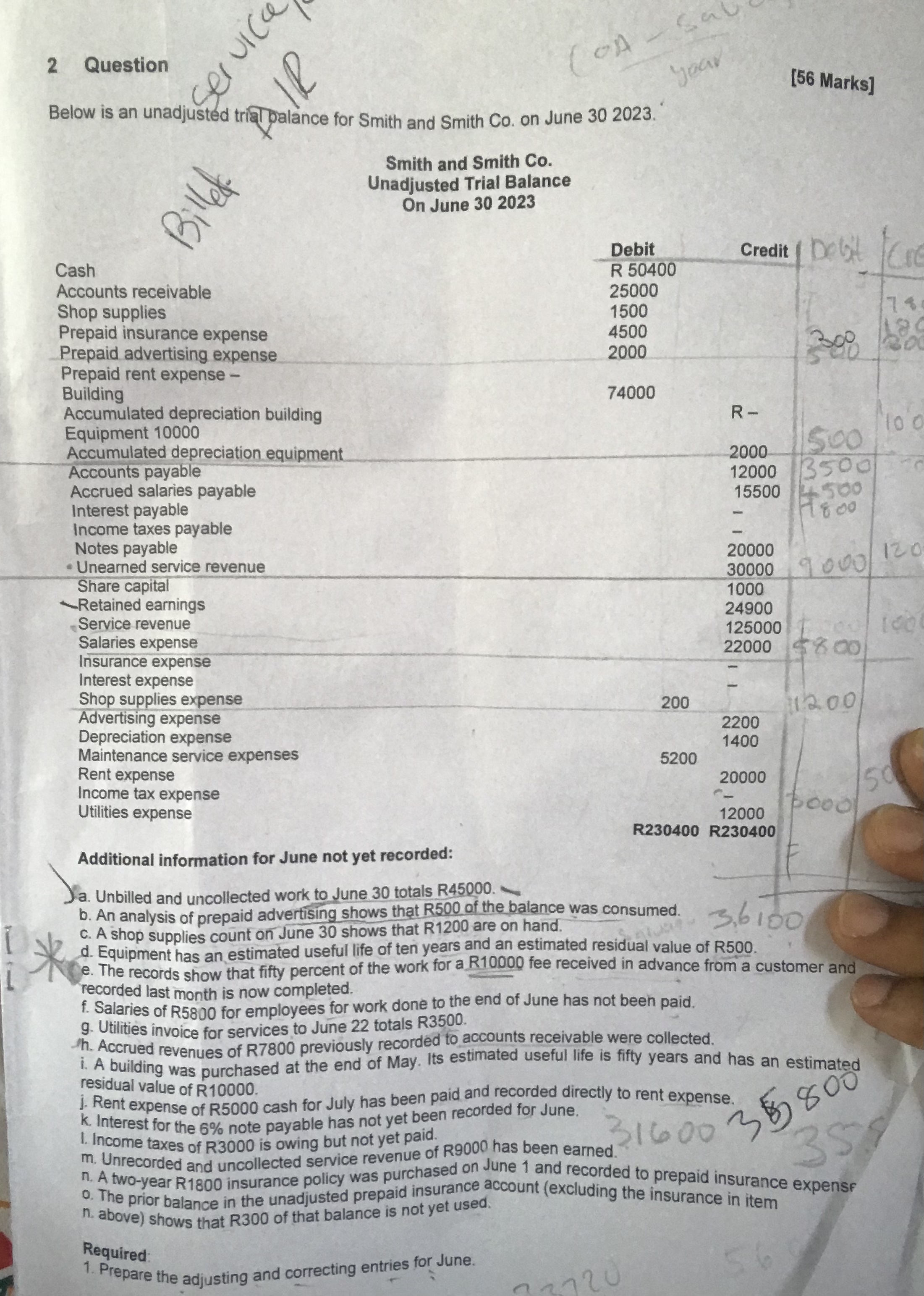

2 Question Service Billed R COA Sa Below is an unadjusted trial palance for Smith and Smith Co. on June 30 2023. Cash Accounts

2 Question Service Billed R COA Sa Below is an unadjusted trial palance for Smith and Smith Co. on June 30 2023. Cash Accounts receivable Shop supplies Prepaid insurance expense Prepaid advertising expense Prepaid rent expense - Smith and Smith Co. Unadjusted Trial Balance On June 30 2023 year [56 Marks] Debit R 50400 Credit Deb Debt Co Building Accumulated depreciation building Equipment 10000 Accumulated depreciation equipment Accounts payable Accrued salaries payable Interest payable Income taxes payable * Notes payable Unearned service revenue Share capital Retained earnings Service revenue Salaries expense Insurance expense Interest expense Shop supplies expense Advertising expense Depreciation expense Maintenance service expenses Rent expense Income tax expense Utilities expense Additional information for June not yet recorded: a. Unbilled and uncollected work to June 30 totals R45000. 25000 1500 4500 2000 74 300 74000 R- 100 2000 500 12000 3500 15500 500 18.00 20000 120 30000 9000 1000 24900 125000 100 22000 800 200 1200 2200 1400 5200 20000 50 12000 3000 R230400 R230400 b. An analysis of prepaid advertising shows that R500 of the balance was consumed. 3,6100, c. A shop supplies count on June 30 shows that R1200 are on hand. d. Equipment has an estimated useful life of ten years and an estimated residual value of R500. e. The records show that fifty percent of the work for a R10000 fee received in advance from a customer and recorded last month is now completed. f. Salaries of R5800 for employees for work done to the end of June has not been paid. g. Utilities invoice for services to June 22 totals R3500. h. Accrued revenues of R7800 previously recorded to accounts receivable were collected. i. A building was purchased at the end of May. Its estimated useful life is fifty years and has an estimated residual value of R10000. j. Rent expense of R5000 cash for July has been paid and recorded directly to rent expense. k. Interest for the 6% note payable has not yet been recorded for June. 1. Income taxes of R3000 is owing but not yet paid. 35 316003 $800 m. Unrecorded and uncollected service revenue of R9000 has been earned. n. A two-year R1800 insurance policy was purchased on June 1 and recorded to prepaid insurance expense o. The prior balance in the unadjusted prepaid insurance account (excluding the insurance in item n. above) shows that R300 of that balance is not yet used. Required: 1. Prepare the adjusting and correcting entries for June. 2720 56 2. Prepare an adjusted trial balance on June 30, 2023. 3. Using the adjusted trial balance above (2): a. Prepare an income statement, statement of changes in equity and a balance sheet as of June 30, 2023. 4. using the adjusted trial balance from the previous question (3): a. Assuming that June 30, 2023, is the year-end prepare the closing journal entries b. Prepare a post-closing trial balance at June 30 2023. (5) [21] [10] [5]

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the adjusting and correcting entries for June we need to analyze the additional information provided and make the necessary adjustments to the accounts Based on the information given here a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started