Question

Nowadays, a pervasive and important issue concerns healthcare costs and healthcare services. This case will examine the role of allocations on reimbursement amounts at High

Nowadays, a pervasive and important issue concerns healthcare costs and healthcare services. This case will examine the role of allocations on reimbursement amounts at High Desert Hospital. To simplify the case, there are two classes of patients: Plan One patients, whose care is reimbursed by the government and ?Others,? whose care is reimbursed by a private plan. Reimbursement to the XYZ hospital for the care of Plan One patients is 'limited to the costs of treating these Plan One patients." The reimbursement to the XYZ hospital for the care of ?Others? is based on a negotiated total amount that is set once a year based on negotiations with the private plan. (NOTE: these are fictitious plans!)

Hospital services may be divided into two categories: (1) revenue producing departments and (2) non-revenue producing departments. This classification is simple, but useful. The traditional accounting concepts associated with "service department cost allocation' while appropriate to this context, lead to a great deal of confusion in terminology since all of the hospital's departments are considered to be rendering services.

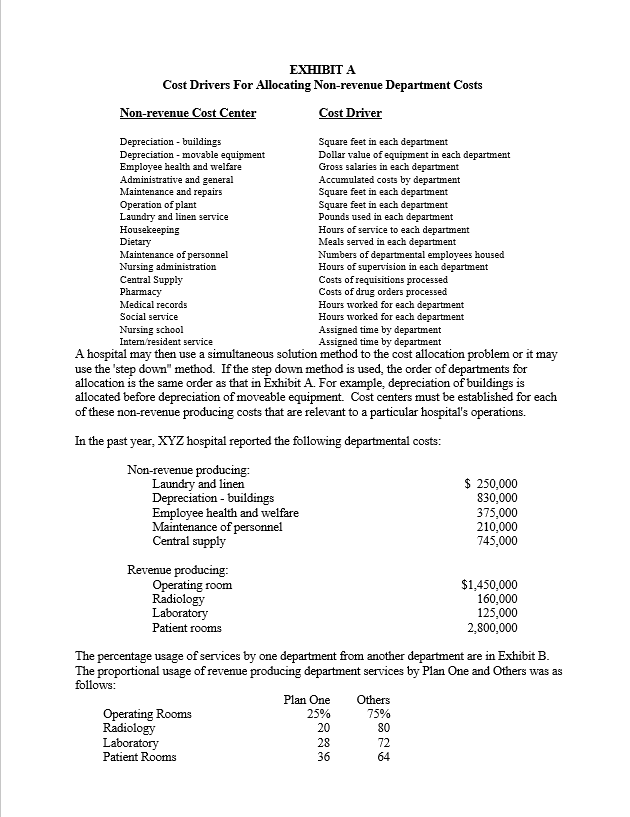

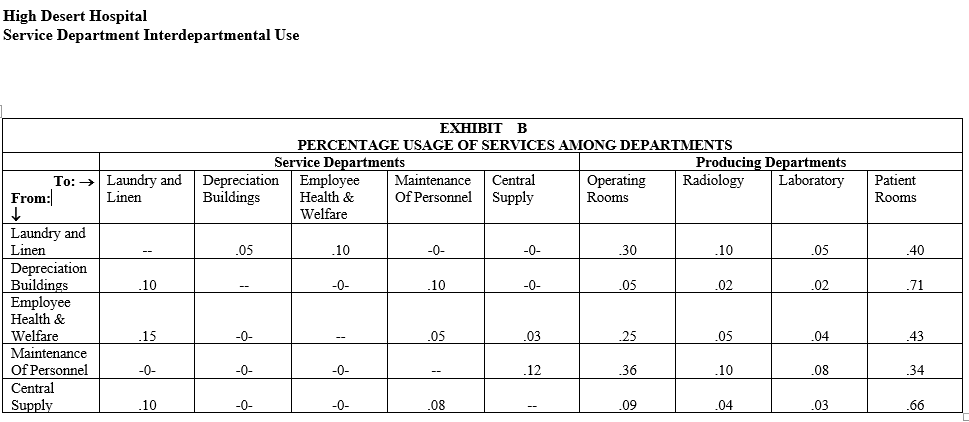

Costs of revenue producing departments are charged to Plan One patients on the basis of actual usage of the departments. These costs are relatively simple to apportion. The costs of non-revenue producing departments are somewhat more difficult to apportion. The approach to finding the appropriate distribution of these costs begins with the establishment of a reasonable basis for allocating non-revenue producing department costs to revenue producing departments. Statistical measures of the relationships between departments must be ascertained. The cost allocation bases listed in Exhibit A have been established by Plan One regulations as acceptable for cost reimbursement purposes. The regulated order of allocation (as listed below) must be used for Plan One reimbursement even though the general rule may call for another order.

REQUIRED:

Develop a spreadsheet (data section and analysis section) to do the following:

- Using the?step down method, compute the reimbursement claim for Plan One and the minimum reimbursement that XYZ would accept in its negotiations with the private plan.

- Using the?simultaneous or reciprocal method, compute the reimbursement claim for Plan One and the minimum reimbursement that XYZ would accept in its negotiations with the private plan.

- Assess the impact of a doubling of Plan One patients including a consideration of capacity issues.

- Evaluate each allocation method. Discuss the impact of the change in Plan One patients on each method. Make a recommendation as to which allocation method should be chosen. Be sure to include your reasons for choosing the method. Be sure to hand in the cell formulas for your program. Don't forget to clearly identity all assumptions that you are making.

EXHIBIT A Cost Drivers For Allocating Non-revenue Department Costs Cost Driver Non-revenue Cost Center Depreciation - buildings Depreciation - movable equipment Employee health and welfare Administrative and general Maintenance and repairs Operation of plant Laundry and linen service Housekeeping Dietary Square feet in each department Dollar value of equipment in each department Gross salaries in each department Accumulated costs by department Square feet in each department Square feet in each department Pounds used in each department Hours of service to each department Meals served in each department Numbers of departmental employees housed Hours of supervision in each department Costs of requisitions processed Social service Costs of drug orders processed Hours worked for each department Hours worked for each department Assigned time by department Assigned time by department Nursing school Intern/resident service A hospital may then use a simultaneous solution method to the cost allocation problem or it may use the 'step down" method. If the step down method is used, the order of departments for allocation is the same order as that in Exhibit A. For example, depreciation of buildings is allocated before depreciation of moveable equipment. Cost centers must be established for each of these non-revenue producing costs that are relevant to a particular hospital's operations. In the past year, XYZ hospital reported the following departmental costs: Maintenance of personnel Nursing administration Central Supply Pharmacy Medical records Non-revenue producing: Laundry and linen Depreciation - buildings Employee health and welfare Maintenance of personnel Central supply Revenue producing: Operating room Radiology Laboratory Patient rooms Operating Rooms Radiology Laboratory Patient Rooms Plan One 25% The percentage usage of services by one department from another department are in Exhibit B. The proportional usage of revenue producing department services by Plan One and Others was as follows: 20 28 36 $ 250,000 830,000 Others 75% 80 72 64 375,000 210,000 745,000 $1,450,000 160,000 125,000 2,800,000

Step by Step Solution

3.55 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Thomas Aquinas is credited with introducing the principle of double effect in his discussion of the permissibility of selfdefense in the Summa Theologica IIII Qu 64 Art7 Killing ones assailant is just...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started