Service Revenue Per Hour: $82.25

Sales Revenue Per Unit: $60.25

Cost of Inventory Per Unit: $29.5

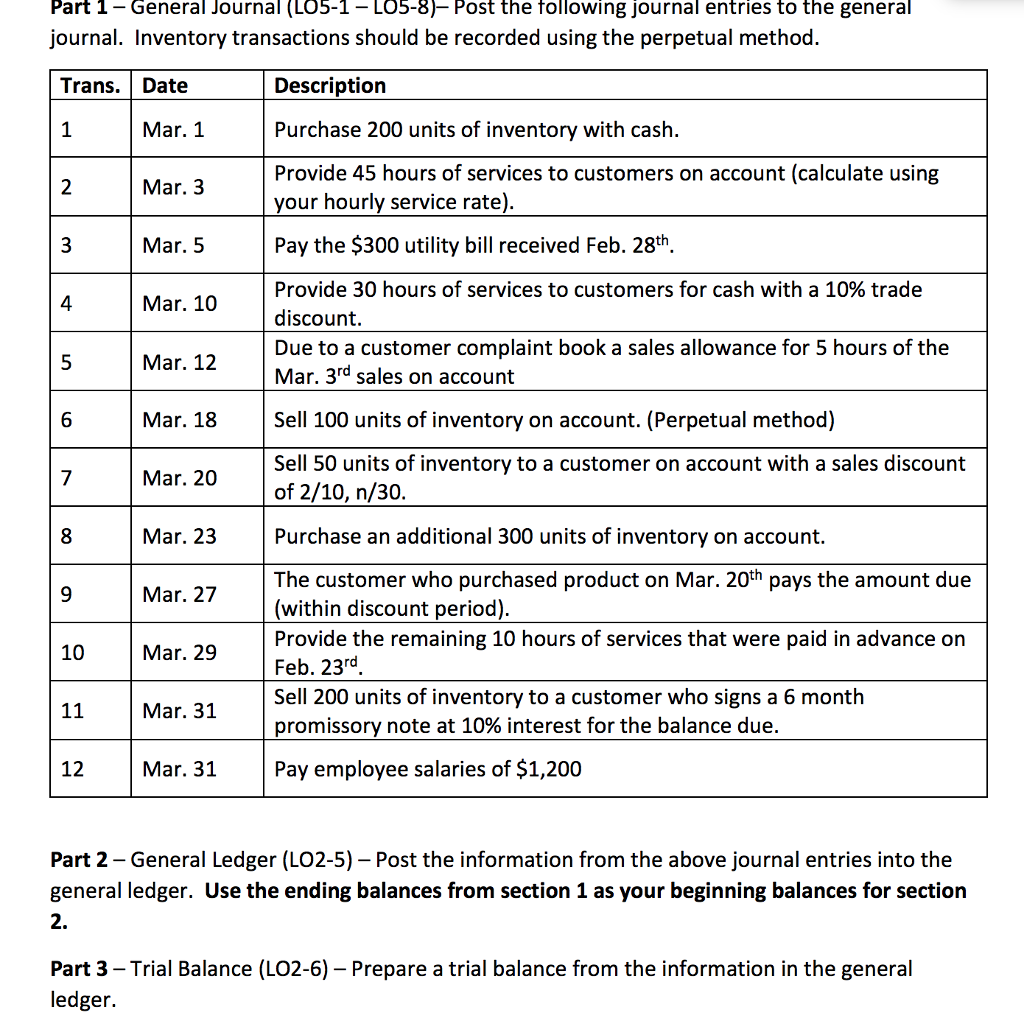

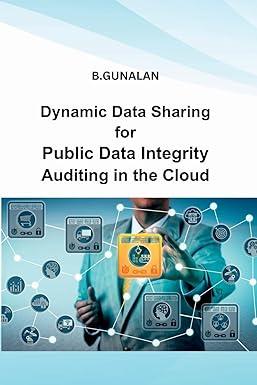

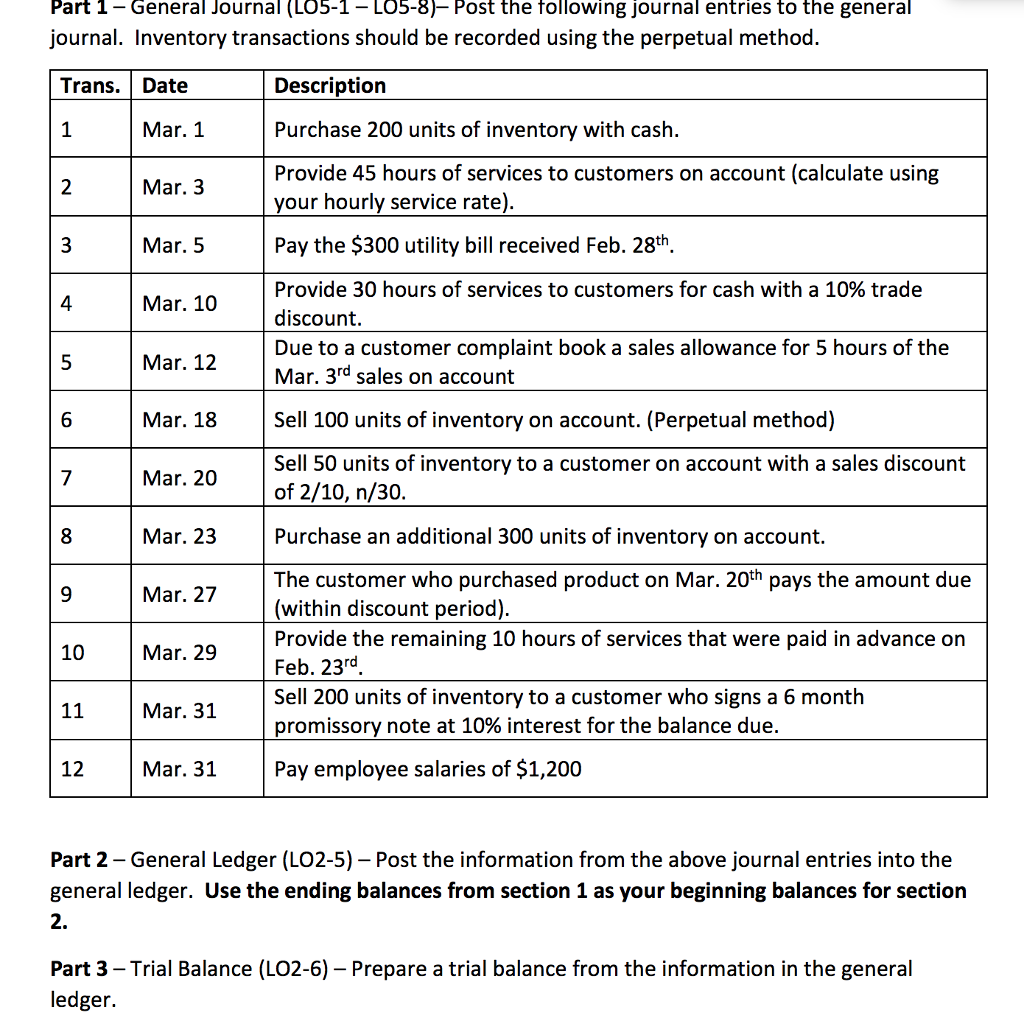

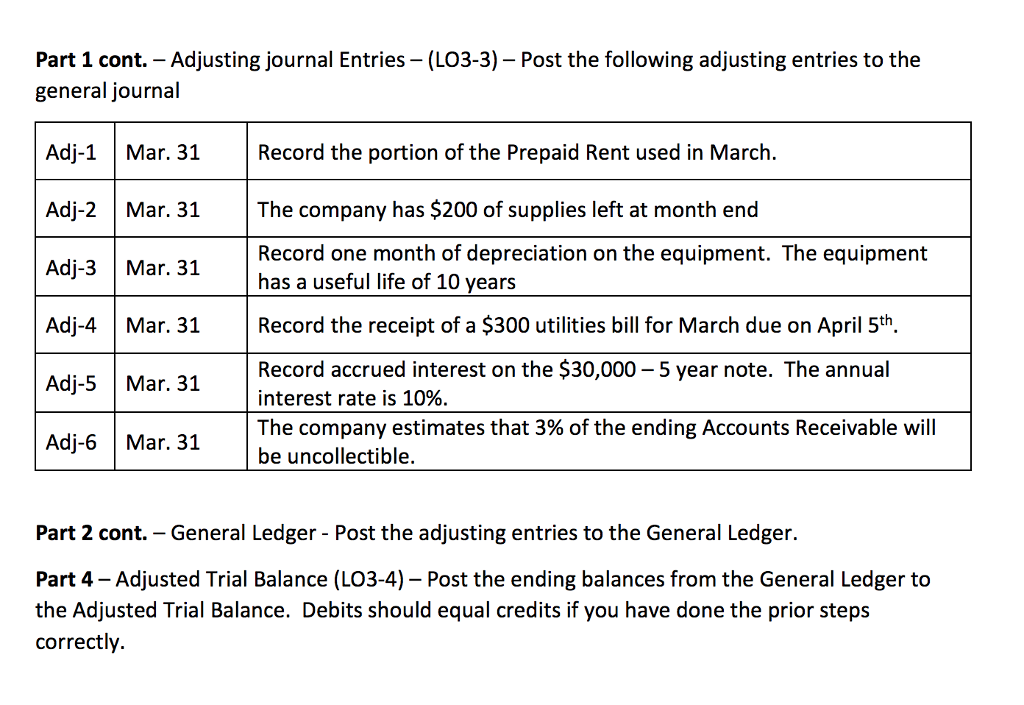

Part 1-General Journal (LO5-1- LO5-8)- Post the tollowing journal entries to the general journal. Inventory transactions should be recorded using the perpetual method. Trans. Date Description Mar. 1 Purchase 200 units of inventory with cash. Provide 45 hours of services to customers on account (calculate using your hourly service rate). Mar. 3 Pay the $300 utility bill received Feb. 28th. Provide 30 hours of services to customers for cash with a 10% trade discount. Due to a customer complaint book a sales allowance for 5 hours of the Mar. 3rd sales on account Mar. 5 4 Mar. 10 5 Mar. 12 Mar. 18 Sell 100 units of inventory on account. (Perpetual method) Sell 50 units of inventory to a customer on account with a sales discount of 2/10, n/30. 7 Mar. 20 Mar. 23 Purchase an additional 300 units of inventory on account. The customer who purchased product on Mar. 20th pays the amount due (within discount period) Provide the remaining 10 hours of services that were paid in advance on Feb. 23rd Sell 200 units of inventory to a customer who signs a 6 month promissory note at 10% interest for the balance due. Mar. 27 10 Mar. 29 Mar. 31 12 Mar. 31 Pay employee salaries of $1,200 Part 2 - General Ledger (LO2-5) Post the information from the above journal entries into the general ledger. Use the ending balances from section 1 as your beginning balances for section 2. Part 3 - Trial Balance (LO2-6) - Prepare a trial balance from the information in the general ledger. Part 1-General Journal (LO5-1- LO5-8)- Post the tollowing journal entries to the general journal. Inventory transactions should be recorded using the perpetual method. Trans. Date Description Mar. 1 Purchase 200 units of inventory with cash. Provide 45 hours of services to customers on account (calculate using your hourly service rate). Mar. 3 Pay the $300 utility bill received Feb. 28th. Provide 30 hours of services to customers for cash with a 10% trade discount. Due to a customer complaint book a sales allowance for 5 hours of the Mar. 3rd sales on account Mar. 5 4 Mar. 10 5 Mar. 12 Mar. 18 Sell 100 units of inventory on account. (Perpetual method) Sell 50 units of inventory to a customer on account with a sales discount of 2/10, n/30. 7 Mar. 20 Mar. 23 Purchase an additional 300 units of inventory on account. The customer who purchased product on Mar. 20th pays the amount due (within discount period) Provide the remaining 10 hours of services that were paid in advance on Feb. 23rd Sell 200 units of inventory to a customer who signs a 6 month promissory note at 10% interest for the balance due. Mar. 27 10 Mar. 29 Mar. 31 12 Mar. 31 Pay employee salaries of $1,200 Part 2 - General Ledger (LO2-5) Post the information from the above journal entries into the general ledger. Use the ending balances from section 1 as your beginning balances for section 2. Part 3 - Trial Balance (LO2-6) - Prepare a trial balance from the information in the general ledger