Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Service Revenue Per Hour: $82.25 Sales Revenue Per Unit: $60.25 Cost of Inventory Per Unit: $29.5 Part 2 - General Journal (LO2-4) Post the following

Service Revenue Per Hour: $82.25

Sales Revenue Per Unit: $60.25

Cost of Inventory Per Unit: $29.5

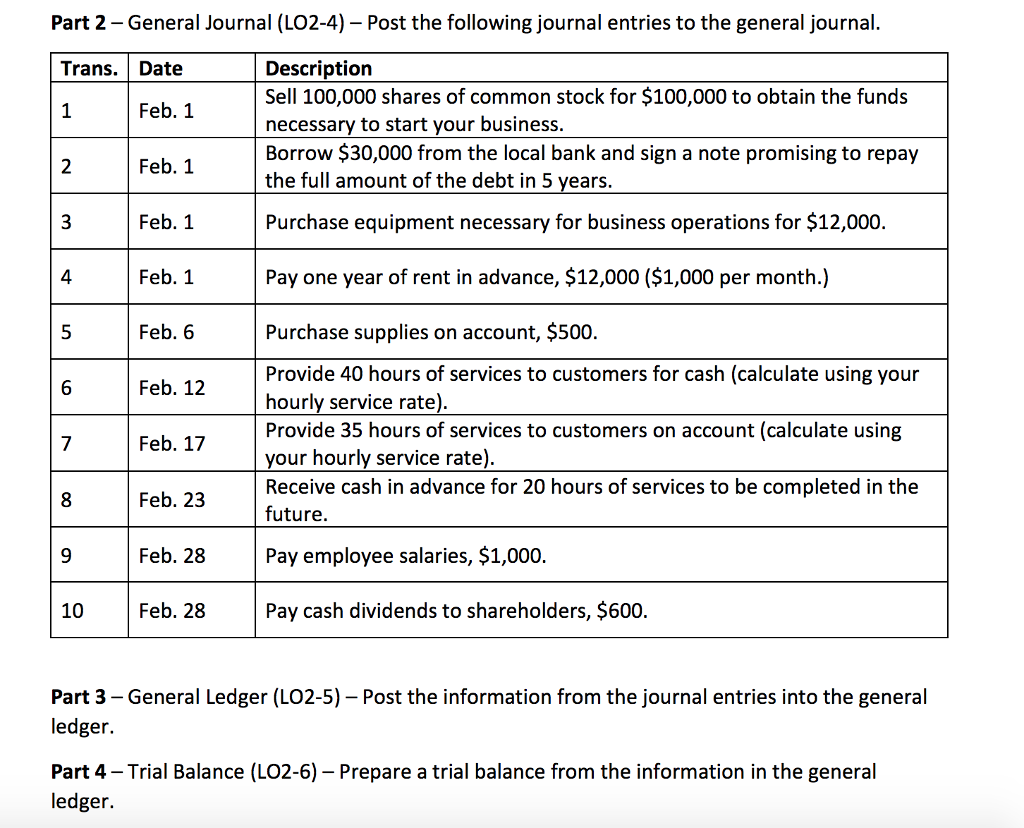

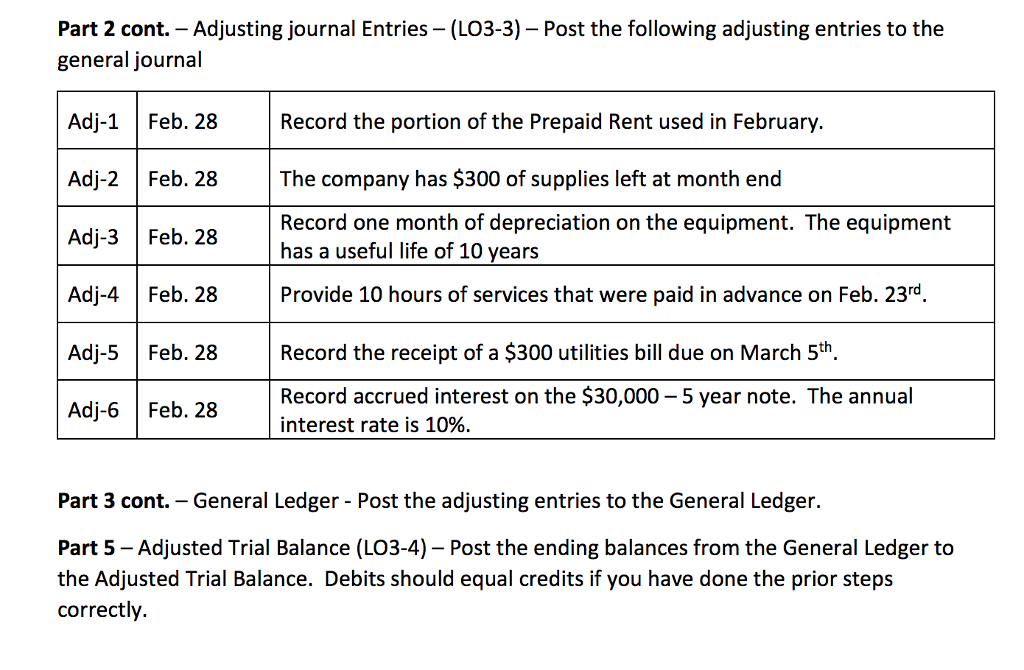

Part 2 - General Journal (LO2-4) Post the following journal entries to the general journal. Trans. Date Feb. 1 Description Sell 100,000 shares of common stock for $100,000 to obtain the funds necessary to start your business. Borrow $30,000 from the local bank and sign a note promising to repay the full amount of the debt in 5 years. N Feb. 1 | Feb. 1 Purchase equipment necessary for business operations for $12,000. Feb. 1 Pay one year of rent in advance, $12,000 ($1,000 per month.) 5 Feb. 6 Purchase supplies on account, $500. Feb. 12 Feb. 17 Provide 40 hours of services to customers for cash (calculate using your hourly service rate). Provide 35 hours of services to customers on account (calculate using your hourly service rate). Receive cash in advance for 20 hours of services to be completed in the future. 8 Feb. 23 Feb. 28 Pay employee salaries, $1,000. Feb. 28 Pay cash dividends to shareholders, $600. Part 3 - General Ledger (LO2-5) - Post the information from the journal entries into the general ledger. Part 4 - Trial Balance (LO2-6) - Prepare a trial balance from the information in the general ledgerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started