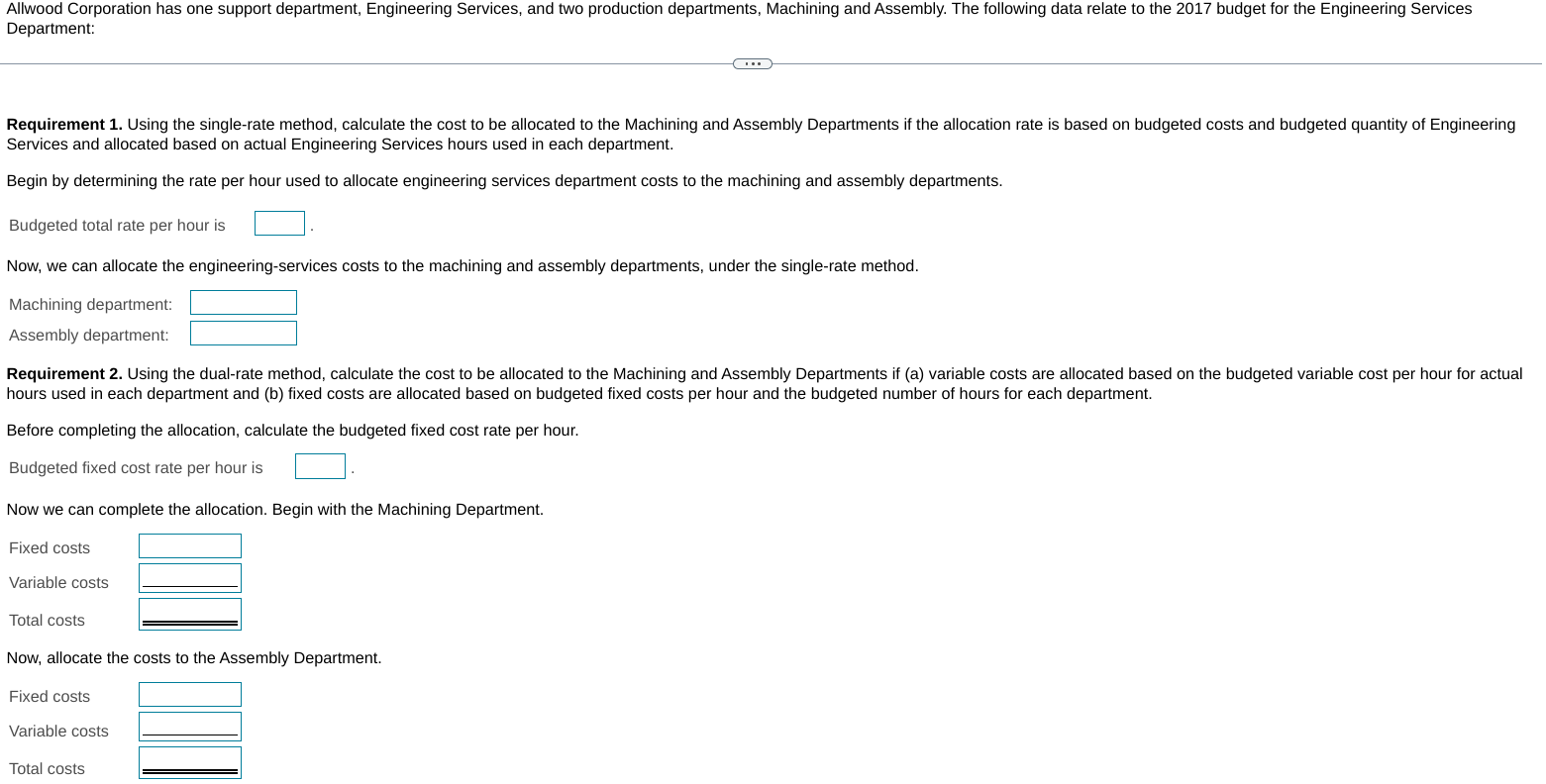

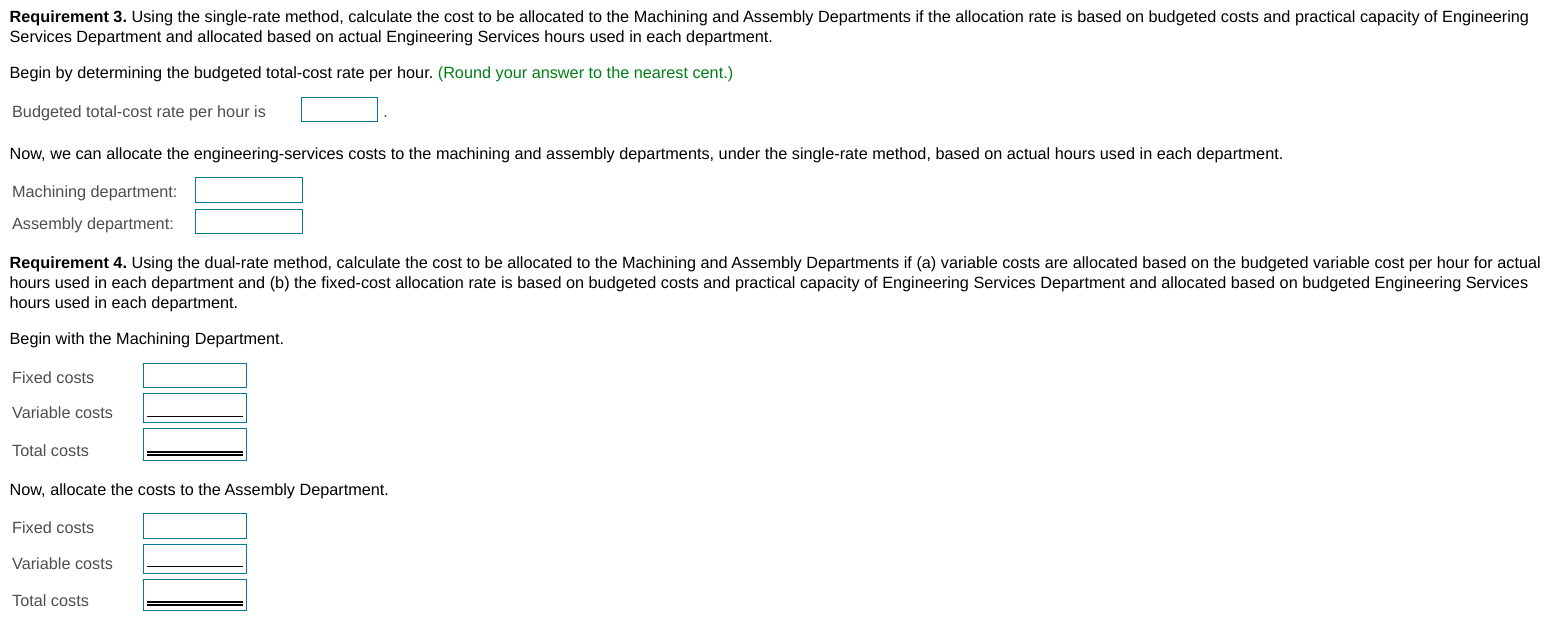

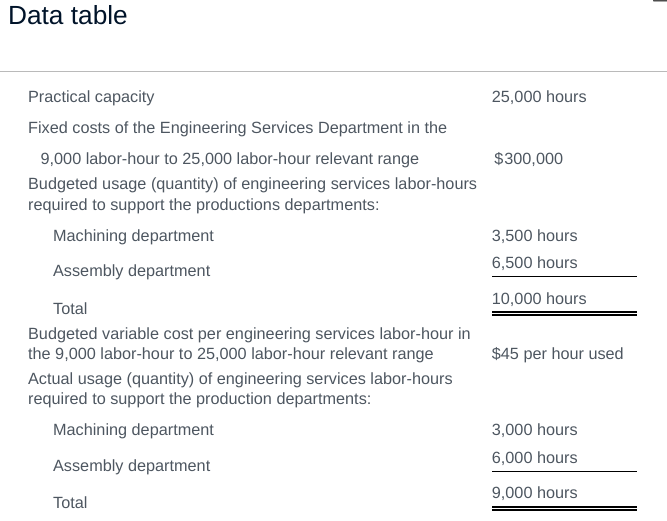

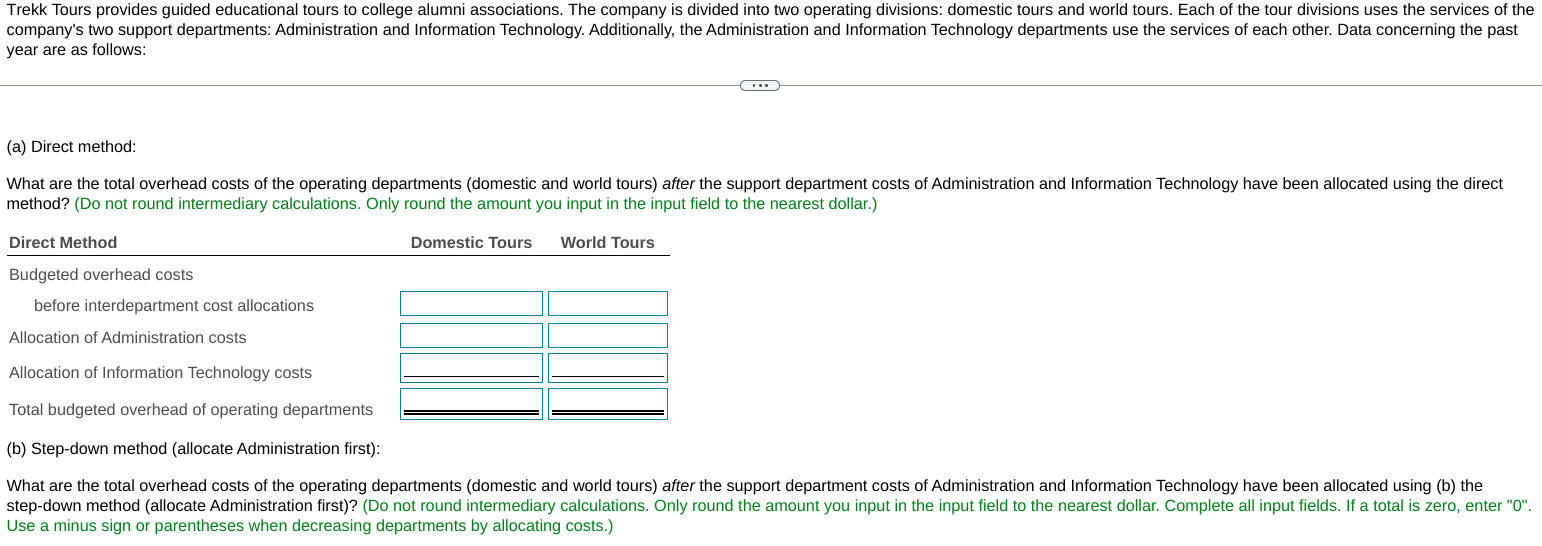

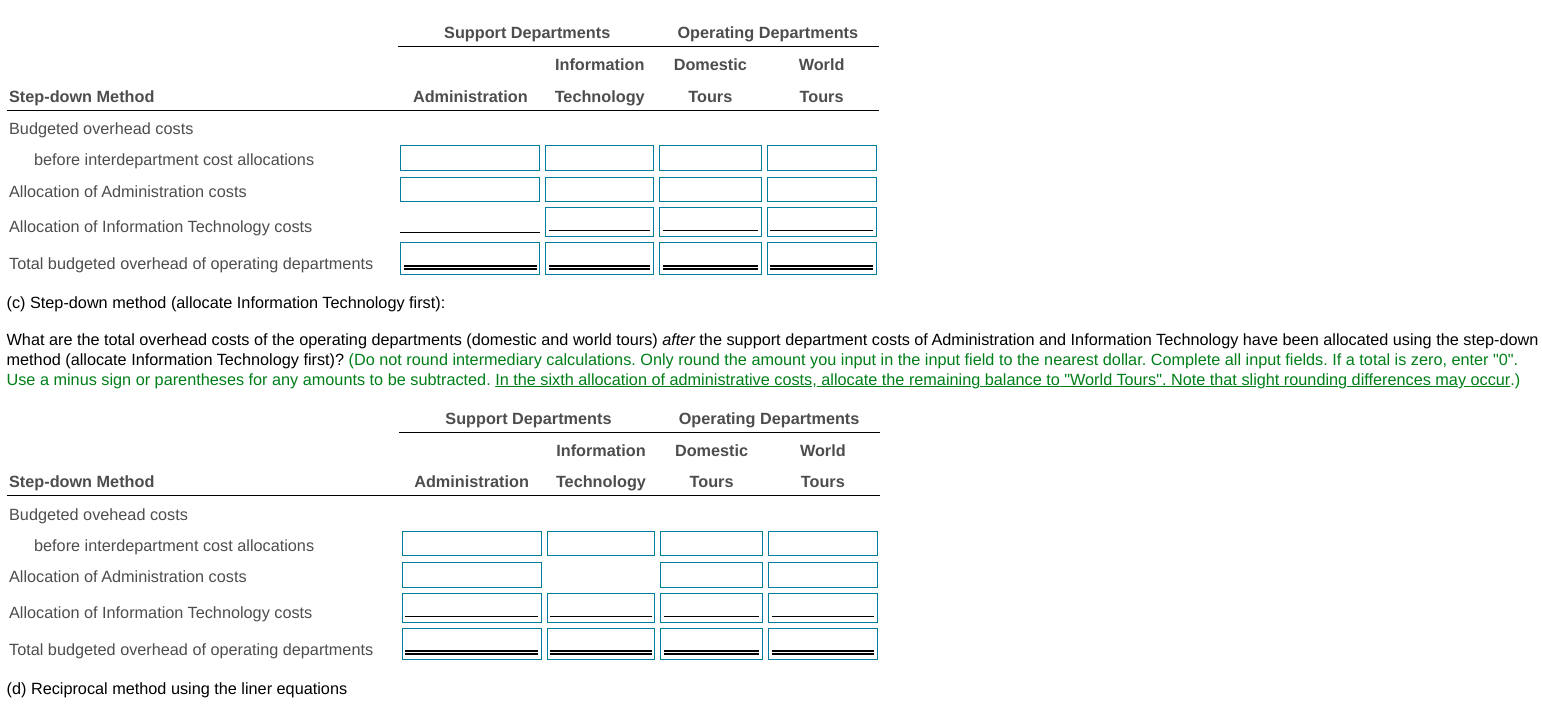

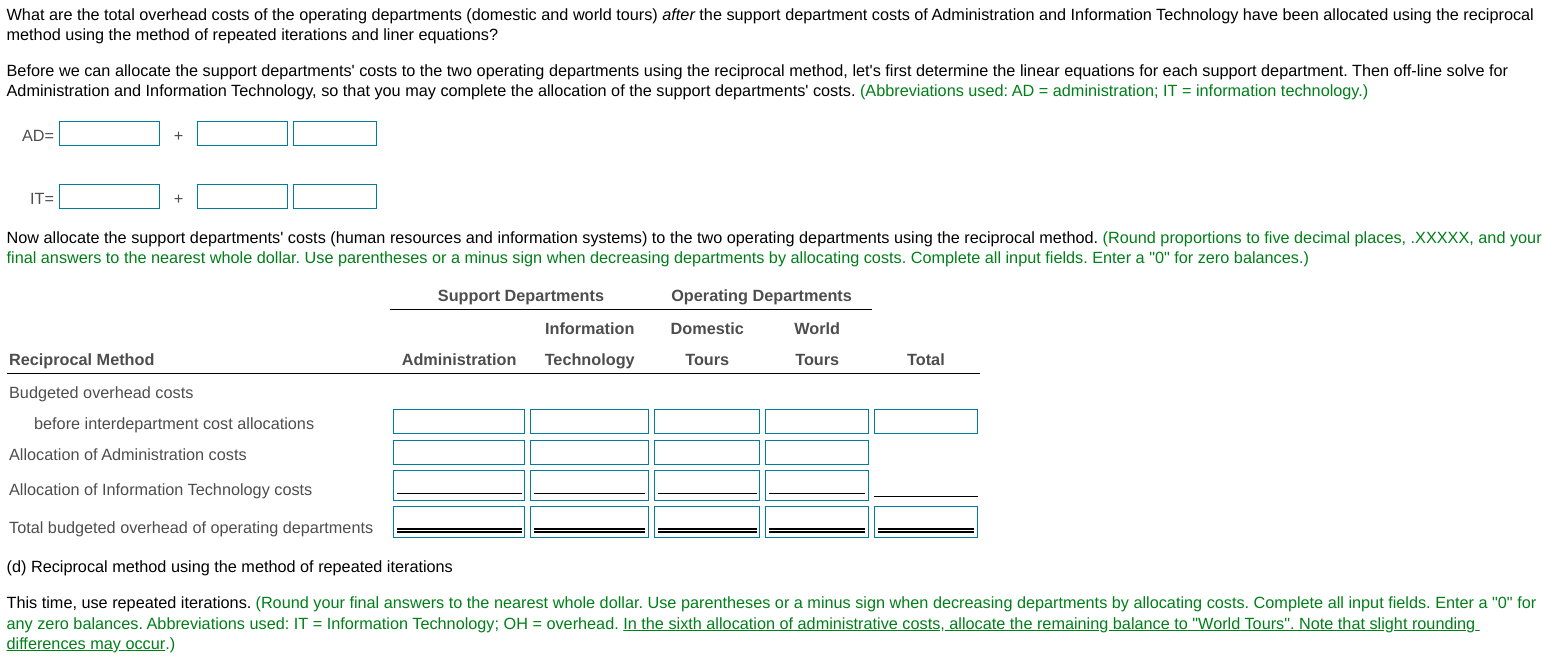

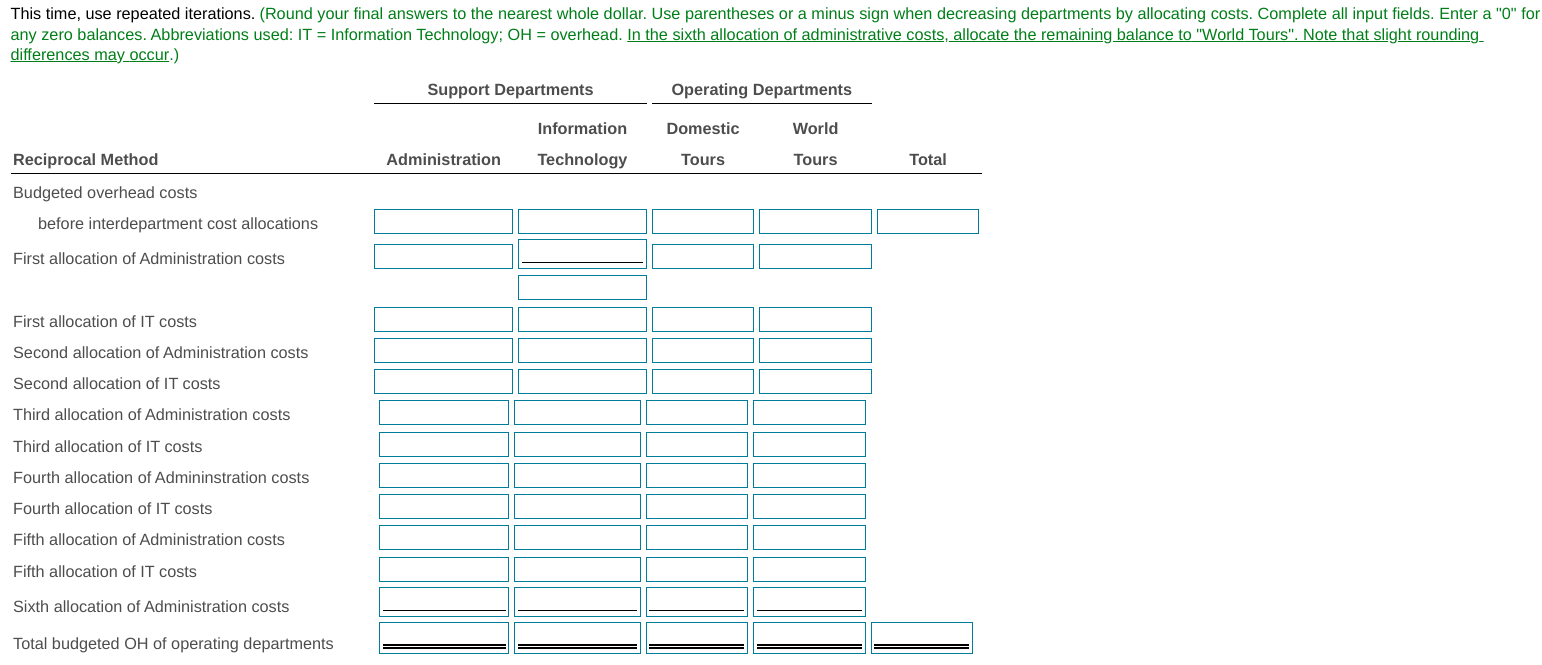

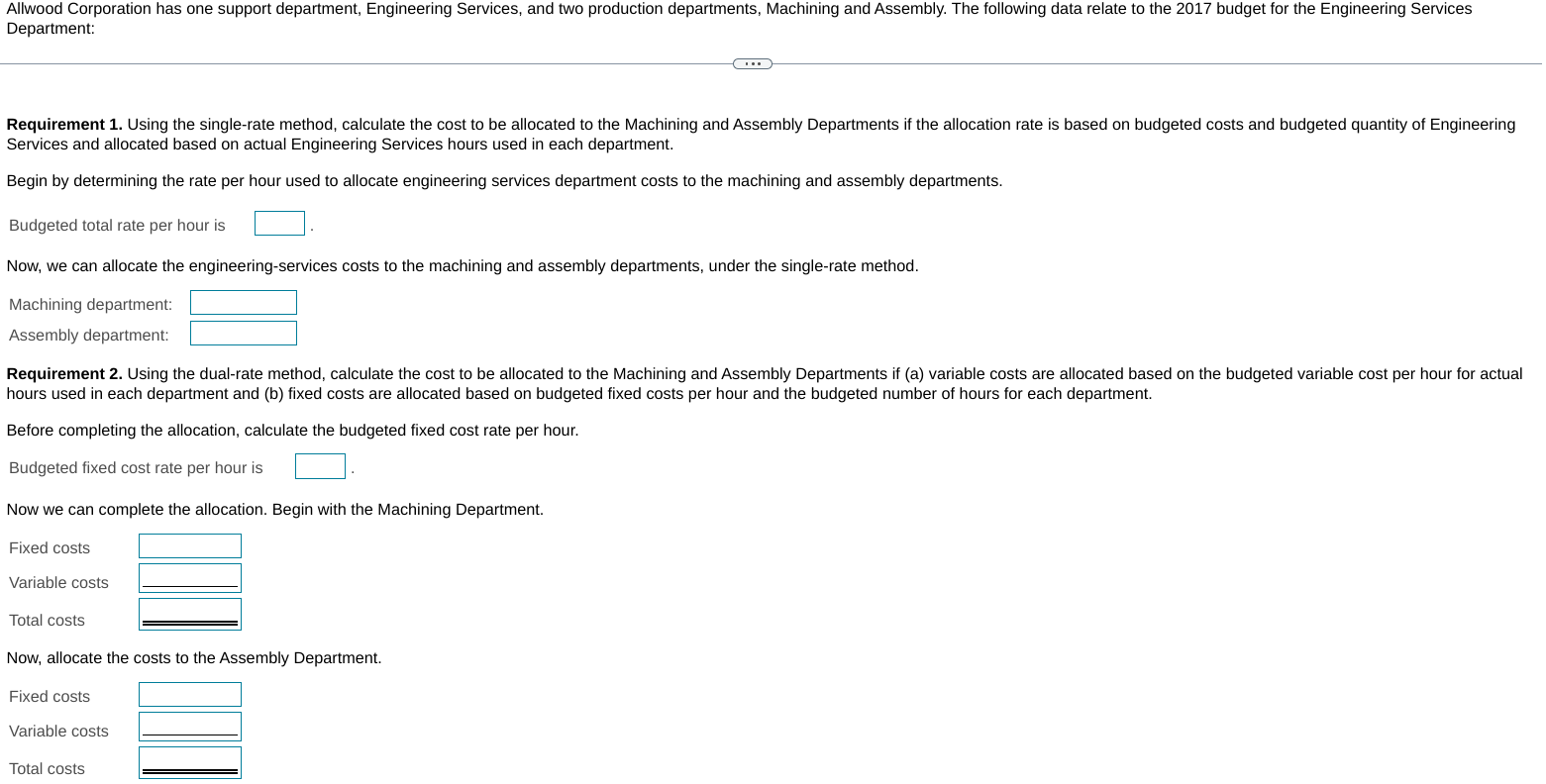

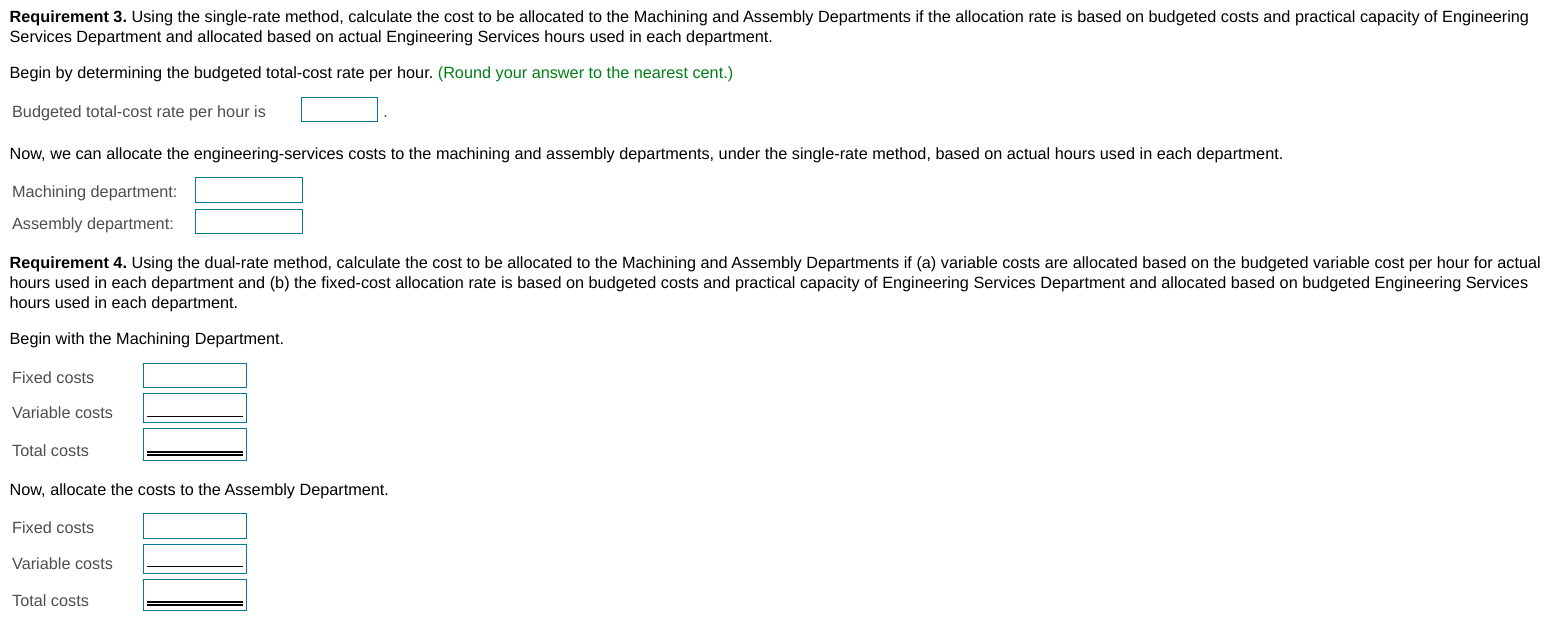

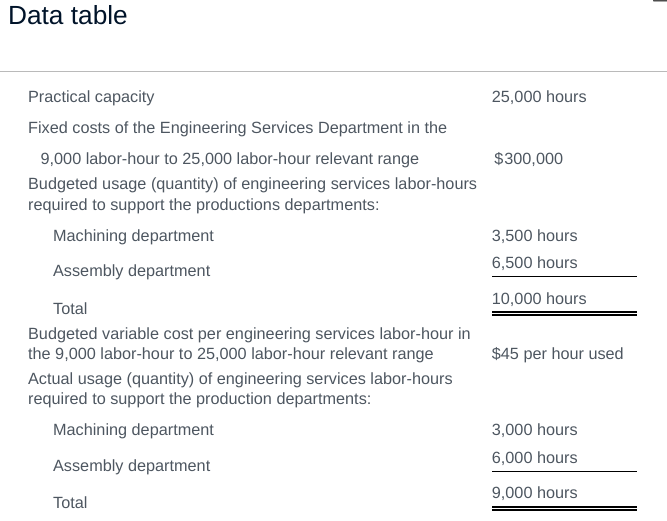

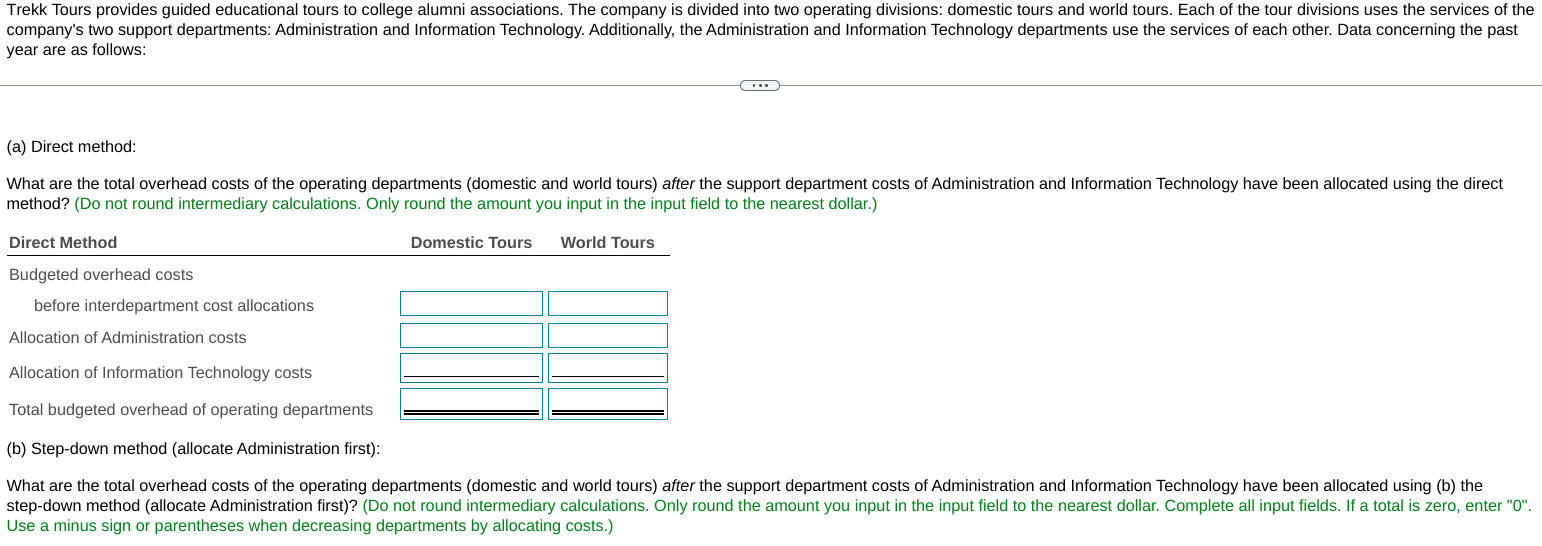

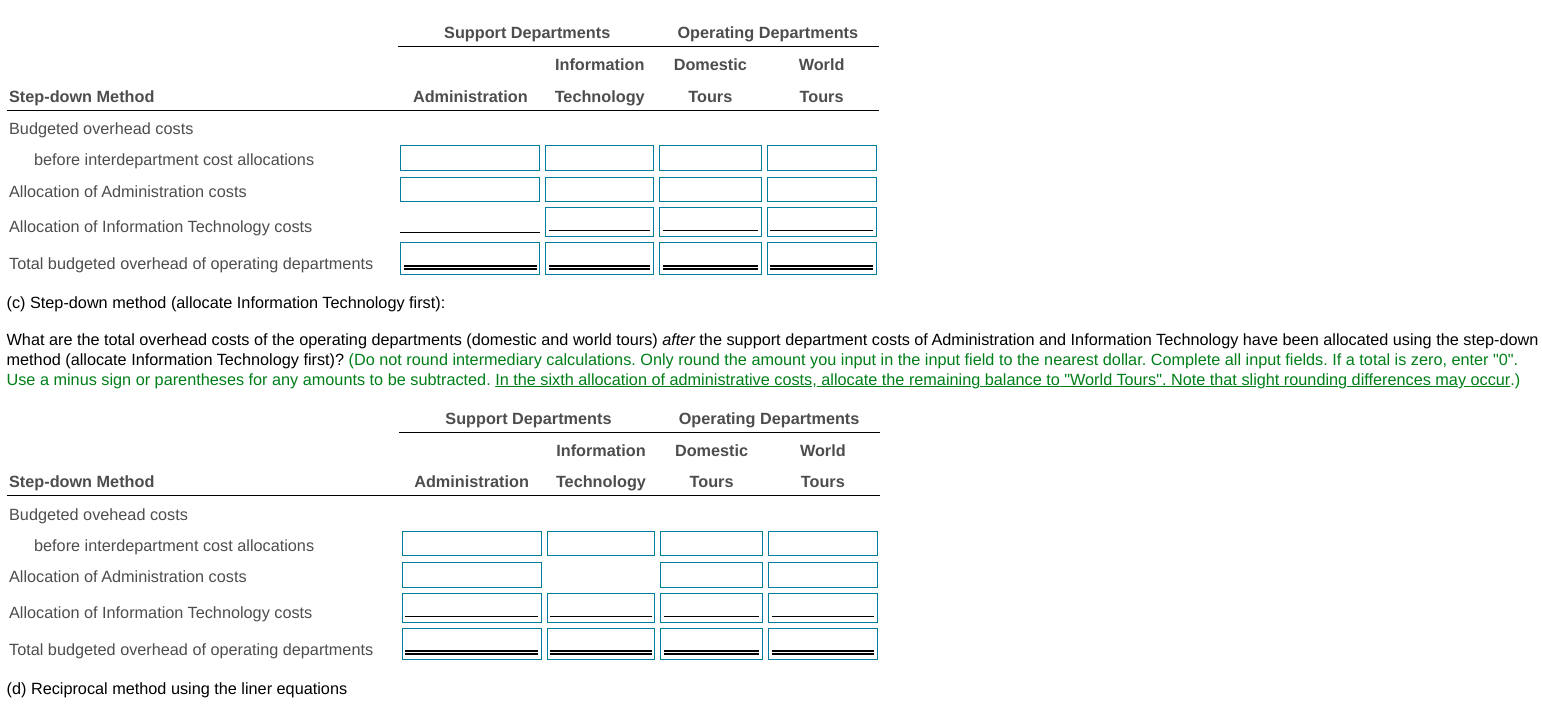

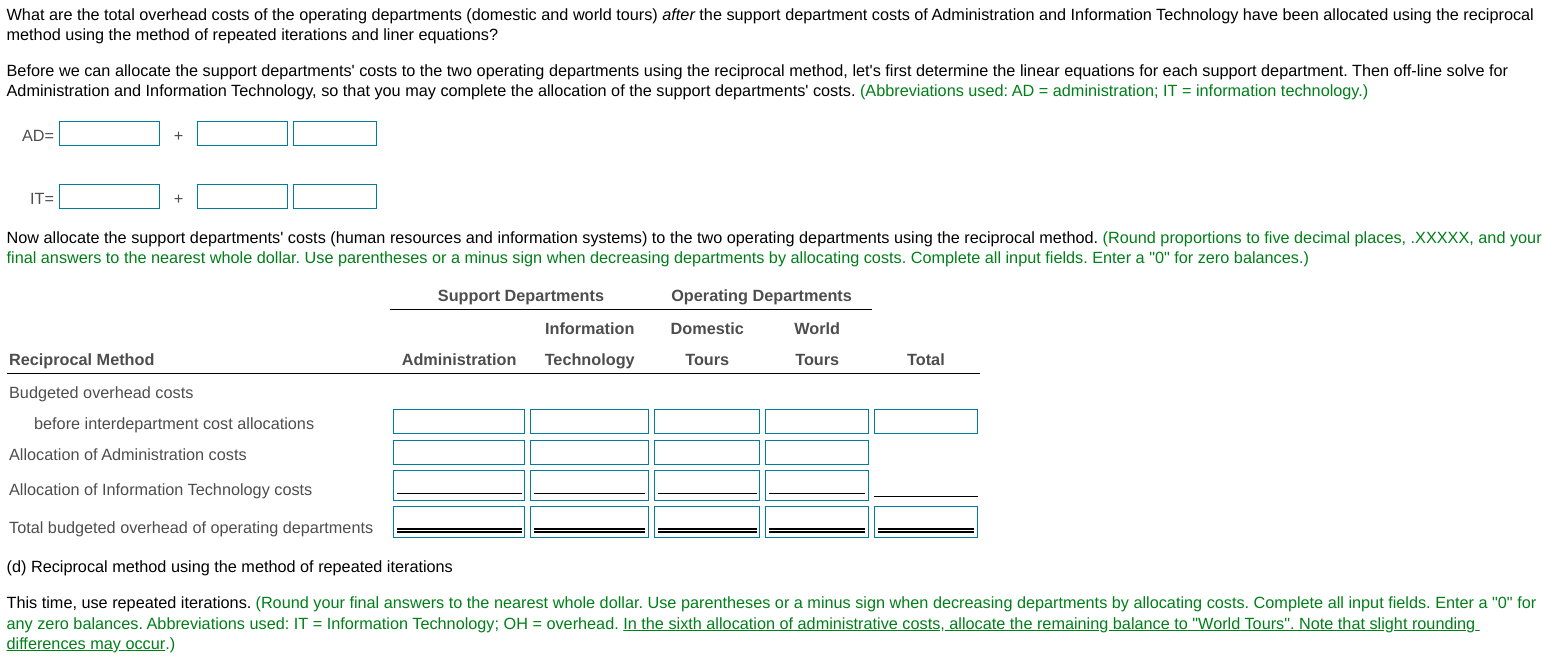

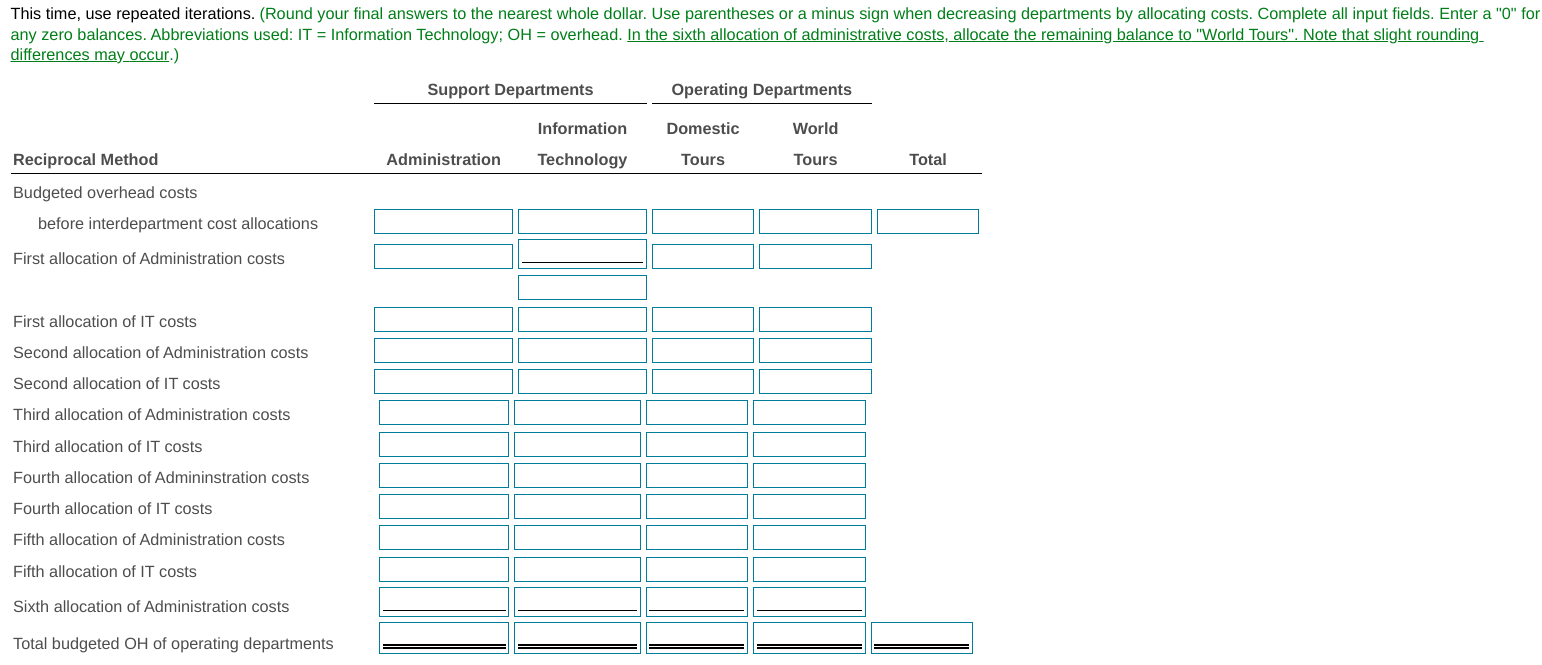

Services and allocated based on actual Engineering Services hours used in each department. Begin by determining the rate per hour used to allocate engineering services department costs to the machining and assembly departments. Budgeted total rate per hour is Now, we can allocate the engineering-services costs to the machining and assembly departments, under the single-rate method. Machining department: Assembly department: hours used in each department and (b) fixed costs are allocated based on budgeted fixed costs per hour and the budgeted number of hours for each department. Before completing the allocation, calculate the budgeted fixed cost rate per hour. Budgeted fixed cost rate per hour is Now we can complete the allocation. Begin with the Machining Department. Now, allocate the costs to the Assembly Department. Services Department and allocated based on actual Engineering Services hours used in each department. Begin by determining the budgeted total-cost rate per hour. (Round your answer to the nearest cent.) Budgeted total-cost rate per hour is Now, we can allocate the engineering-services costs to the machining and assembly departments, under the single-rate method, based on actual hours used in each department. Machining department: Assembly department: hours used in each department. Nnw allncate the consts tn the Accemhly Department. Data table year are as follows: (a) Direct method: method? (Do not round intermediary calculations. Only round the amount you input in the input field to the nearest dollar.) (b) Step-down method (allocate Administration first): Use a minus sign or parentheses when decreasing departments by allocating costs.) \begin{tabular}{lcccc} & \multicolumn{2}{c}{ Support Departments } & \multicolumn{2}{c}{ Operating Departments } \\ \cline { 2 - 5 } & & Information & Domestic & World \\ Step-down Method & Administration & Technology & Tours & Tours \\ \hline Budgeted overhead costs \\ before interdepartment cost allocations \\ Allocation of Administration costs \\ Allocation of Information Technology costs & & & \end{tabular} (c) Step-down method (allocate Information Technology first): What are the total overhead costs of the operating departments (domestic and world tours) after the support department costs of Administration and Information Technology have been allocated using the step-down method (allocate Information Technology first)? (Do not round intermediary calculations. Only round the amount you input in the input field to the nearest dollar. Complete all input fields. If a total is zero, enter "0". Use a minus sign or parentheses for any amounts to be subtracted. In the sixth allocation of administrative costs, allocate the remaining balance to "World Tours". Note that slight rounding differences may occur.) \begin{tabular}{lcccc} & \multicolumn{2}{c}{ Support Departments } & \multicolumn{2}{c}{ Operating Departments } \\ \cline { 2 - 5 } & & Information & Domestic & World \\ Step-down Method & Administration & Technology & Tours & Tours \\ \hline Budgeted ovehead costs \\ before interdepartment cost allocations \\ Allocation of Administration costs \\ Allocation of Information Technology costs \\ Total budgeted overhead of operating departments & & & \end{tabular} (d) Reciprocal method using the liner equations method using the method of repeated iterations and liner equations? AD= IT= final answers to the nearest whole dollar. Use parentheses or a minus sign when decreasing departments by allocating costs. Complete all input fields. Enter a "0" for zero balances.) (d) Reciprocal method using the method of repeated iterations differences may_occur.) differences may occur.) Services and allocated based on actual Engineering Services hours used in each department. Begin by determining the rate per hour used to allocate engineering services department costs to the machining and assembly departments. Budgeted total rate per hour is Now, we can allocate the engineering-services costs to the machining and assembly departments, under the single-rate method. Machining department: Assembly department: hours used in each department and (b) fixed costs are allocated based on budgeted fixed costs per hour and the budgeted number of hours for each department. Before completing the allocation, calculate the budgeted fixed cost rate per hour. Budgeted fixed cost rate per hour is Now we can complete the allocation. Begin with the Machining Department. Now, allocate the costs to the Assembly Department. Services Department and allocated based on actual Engineering Services hours used in each department. Begin by determining the budgeted total-cost rate per hour. (Round your answer to the nearest cent.) Budgeted total-cost rate per hour is Now, we can allocate the engineering-services costs to the machining and assembly departments, under the single-rate method, based on actual hours used in each department. Machining department: Assembly department: hours used in each department. Nnw allncate the consts tn the Accemhly Department. Data table year are as follows: (a) Direct method: method? (Do not round intermediary calculations. Only round the amount you input in the input field to the nearest dollar.) (b) Step-down method (allocate Administration first): Use a minus sign or parentheses when decreasing departments by allocating costs.) \begin{tabular}{lcccc} & \multicolumn{2}{c}{ Support Departments } & \multicolumn{2}{c}{ Operating Departments } \\ \cline { 2 - 5 } & & Information & Domestic & World \\ Step-down Method & Administration & Technology & Tours & Tours \\ \hline Budgeted overhead costs \\ before interdepartment cost allocations \\ Allocation of Administration costs \\ Allocation of Information Technology costs & & & \end{tabular} (c) Step-down method (allocate Information Technology first): What are the total overhead costs of the operating departments (domestic and world tours) after the support department costs of Administration and Information Technology have been allocated using the step-down method (allocate Information Technology first)? (Do not round intermediary calculations. Only round the amount you input in the input field to the nearest dollar. Complete all input fields. If a total is zero, enter "0". Use a minus sign or parentheses for any amounts to be subtracted. In the sixth allocation of administrative costs, allocate the remaining balance to "World Tours". Note that slight rounding differences may occur.) \begin{tabular}{lcccc} & \multicolumn{2}{c}{ Support Departments } & \multicolumn{2}{c}{ Operating Departments } \\ \cline { 2 - 5 } & & Information & Domestic & World \\ Step-down Method & Administration & Technology & Tours & Tours \\ \hline Budgeted ovehead costs \\ before interdepartment cost allocations \\ Allocation of Administration costs \\ Allocation of Information Technology costs \\ Total budgeted overhead of operating departments & & & \end{tabular} (d) Reciprocal method using the liner equations method using the method of repeated iterations and liner equations? AD= IT= final answers to the nearest whole dollar. Use parentheses or a minus sign when decreasing departments by allocating costs. Complete all input fields. Enter a "0" for zero balances.) (d) Reciprocal method using the method of repeated iterations differences may_occur.) differences may occur.)