Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SESSION A: CHOOSE THE BEST ANSWER The IS curve represents the single level of output where the goods market is in equilibrium. the single level

SESSION A: CHOOSE THE BEST ANSWER

- The IS curve represents

- the single level of output where the goods market is in equilibrium.

- the single level of output where financial markets are in equilibrium.

- the combinations of output and the interest rate where the money market is in equilibrium.

- the combinations of output and the interest rate where the goods market is in equilibrium.

- The IS curve will shift to the right when which of the following occurs?

- an increase in the money supply

- an increase in government spending

- a reduction in the interest rate

- all of the above.

- Which of the following occurs as the economy moves leftward along a given IS curve?

- an increase in the interest rate causes investment spending to decrease

- an increase in the interest rate causes money demand to increase

- an increase in the interest rate causes a reduction in the money supply

- a reduction in government spending causes a reduction in demand for goods

- Which of the following statements is consistent with a given (i.e., fixed) LM curve?

- a reduction in the interest rate causes investment spending to increase

- a reduction in the interest rate causes money demand to decrease

- an increase in output causes money demand to increase

- an increase in output causes an increase in demand for good

- Suppose the economy is currently operating on both the LM curve and the IS curve. Which of the following is true for this economy?

- Production equals demand.

- The money supply equals money demand.

- Financial markets are in equilibrium.

- all of the above

- In H1 2020, the Bank of Zambia pursued expansionary monetary policy. Which of the following will occur as a result of this monetary policy action?

- the LM curve shifts down.

- the LM curve shifts up.

- the IS curve shifts rightward as the interest rate falls.

- the IS curve shifts leftward as the interest rate increases.

- Suppose the Minister of Finance announces measures aimed at fiscal consolidation. Based on the IS-LM model, we know with certainty that the following will occur as a result of this fiscal policy action.

- investment spending will decrease.

- investment spending will increase.

- there will be no change in investment spending.

- investment spending may increase, decrease, or not change.

- Suppose there is a simultaneous fiscal expansion and monetary contraction. We know with certainty that

- output will increase.

- output will decrease.

- the interest rate will increase.

- the interest rate will decrease.

- Consider a very small open economy with a fixed exchange rate and in which there is perfect international capital mobility. Starting from equilibrium in the goods and money markets and in the balance of payments, a sudden increase in income tax will lead to, in the new equilibrium,

- no change in real income and no change in the interest rate

- an increase in both real income and the interest rate

- a reduction in the interest rate and no change in real income

- a reduction in real income and no change in the interest rate.

- Consider the classical macroeconomic model, in this model an expansionary fiscal policy would result in

- reduction in unemployment

- an increase in output

- reduction in economic activity

- none of the above.

- The essential difference between the New Keynesian and New Classical schools of thought is

- in their approach to the formation of expectations

- in their approach to the clearing of markets

- in interest-rate predictions

- none of the above.

- Consider a fixed price model of a closed economy. An increase in savings at each level of disposable income will

- Shift the LM curve down.

- shift the LM curve up.

- shift the IS curve to the left.

- shift the IS curve to the right.

- If capital mobility is imperfect and import demand is completely insensitive to changes in the level of domestic output, which one of the following statements is correct?

- The BP curve is vertical.

- The BP curve is horizontal.

- The BP curve is downward sloping.

- The BP curve is upward sloping if the international rate of interest is greater than the domestic rate of interest.

- Consider the IS-LM-BP model of an open economy with fixed exchange rates and perfect capital mobility. Suppose the economy is initially in a situation of internal and external balance and the government now implements contractionary fiscal policy. Which one of the following statements better describes the changes once the new equilibrium is achieved?

- The exchange rate will appreciate.

- The balance in the current account will deteriorate.

- The money supply will increase.

- The balance of the capital account will deteriorate

- In a fixed exchange rate system with perfect capital mobility, which one of the following statements is correct?

- Expansionary monetary policy is effective in stimulating aggregate expenditure.

- Fiscal expansion is ineffective in stimulating aggregate expenditure.

- Fiscal expansion causes a deficit in the BOP

- None of the above is correct.

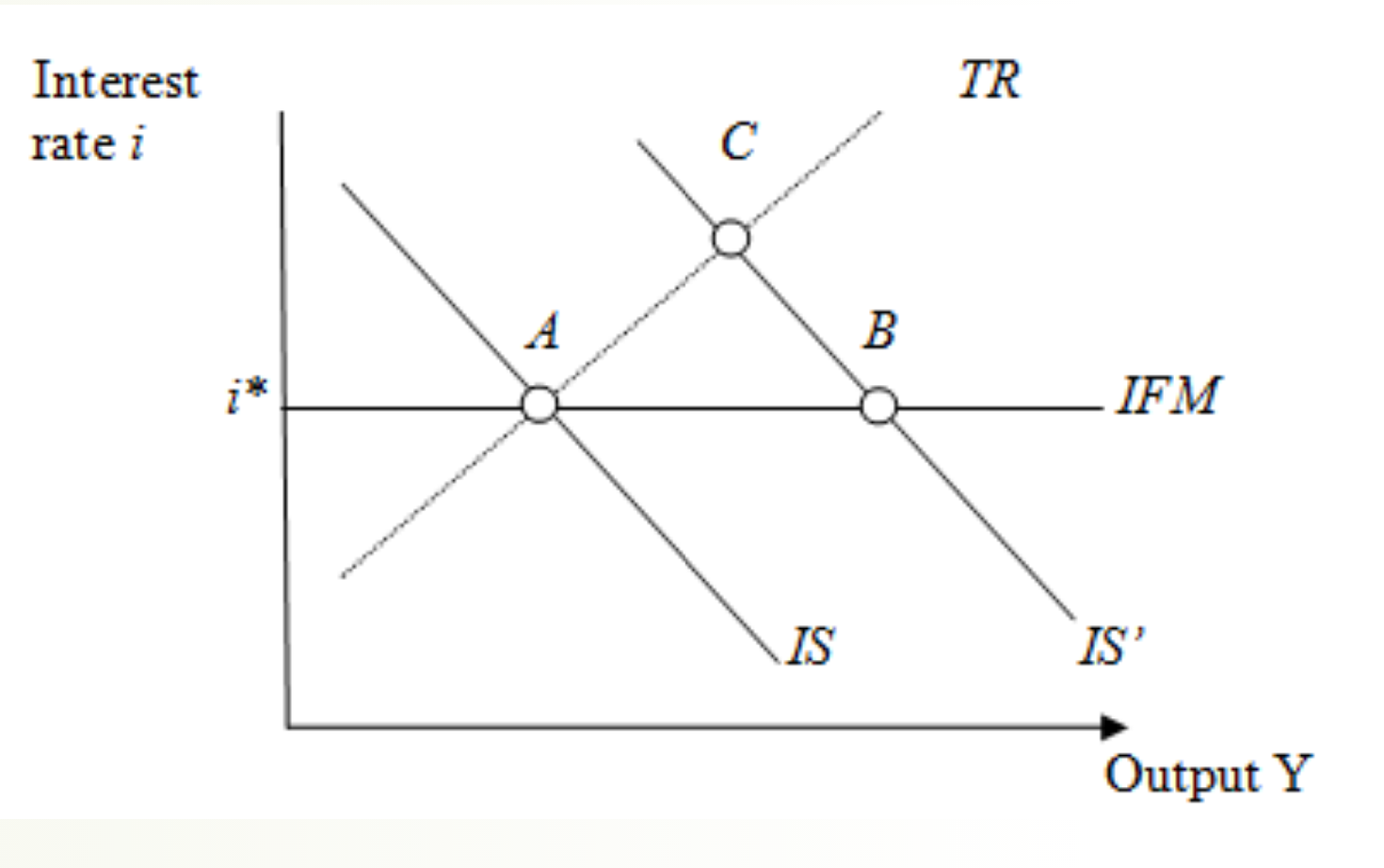

- Assume a small open country under fixed exchanges rate and full capital mobility. Prices are fixed in the short run and equilibrium is given initially at point A. An exogenous increase in public spending shifts the IS curve to IS'. Which of the following statements is true?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started