Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sessions Manufacturing Company needs to expand their existing facility and needs to secure $35 million in financing to fund the expansion. Ben Bates, the

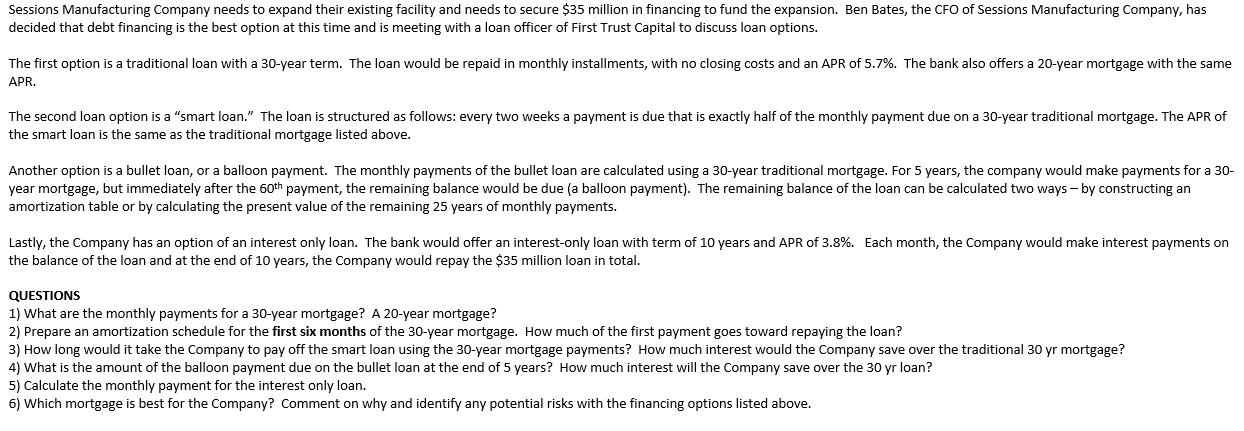

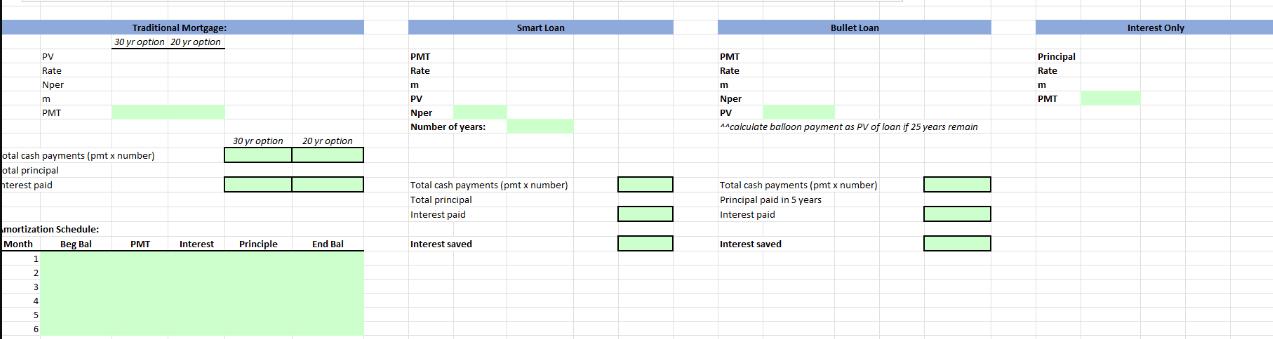

Sessions Manufacturing Company needs to expand their existing facility and needs to secure $35 million in financing to fund the expansion. Ben Bates, the CFO of Sessions Manufacturing Company, has decided that debt financing is the best option at this time and is meeting with a loan officer of First Trust Capital to discuss loan options. The first option is a traditional loan with a 30-year term. The loan would be repaid in monthly installments, with no closing costs and an APR of 5.7%. The bank also offers a 20-year mortgage with the same APR. The second loan option is a "smart loan." The loan is structured as follows: every two weeks a payment is due that is exactly half of the monthly payment due on a 30-year traditional mortgage. The APR of the smart loan is the same as the traditional mortgage listed above. Another option is a bullet loan, or a balloon payment. The monthly payments of the bullet loan are calculated using a 30-year traditional mortgage. For 5 years, the company would make payments for a 30- year mortgage, but immediately after the 60th payment, the remaining balance would be due (a balloon payment). The remaining balance of the loan can be calculated two ways - by constructing an amortization table or by calculating the present value of the remaining 25 years of monthly payments. Lastly, the Company has an option of an interest only loan. The bank would offer an interest-only loan with term of 10 years and APR of 3.8%. Each month, the Company would make interest payments on the balance of the loan and at the end of 10 years, the Company would repay the $35 million loan in total. QUESTIONS 1) What are the monthly payments for a 30-year mortgage? A 20-year mortgage? 2) Prepare an amortization schedule for the first six months of the 30-year mortgage. How much of the first payment goes toward repaying the loan? 3) How long would it take the Company to pay off the smart loan using the 30-year mortgage payments? How much interest would the Company save over the traditional 30 yr mortgage? 4) What is the amount of the balloon payment due on the bullet loan at the end of 5 years? How much interest will the Company save over the 30 yr loan? 5) Calculate the monthly payment for the interest only loan. 6) Which mortgage is best for the Company? Comment on why and identify any potential risks with the financing options listed above. PV Rate Nper m PMT otal cash payments (pmt x number) otal principal nterest paid mortization Schedule: Month Beg Bal 1 2 3 4 5 6 Traditional Mortgage: 30 yr option 20 yr option PMT 30 yr option 20 yr option Interest Principle End Bal PMT Rate m PV Nper Number of years: Smart Loan Total cash payments (pmt x number) Total principal Interest paid Interest saved 000 PMT Rate Bullet Loan m Nper PV ^^ calculate balloon payment as PV of loan if 25 years remain Total cash payments (pmt x number) Principal paid in 5 years Interest paid Interest saved 000 Principal Rate m PMT Interest Only

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions 1 Monthly payments for a 30year mortgage at 57 APR on 35 milli...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started