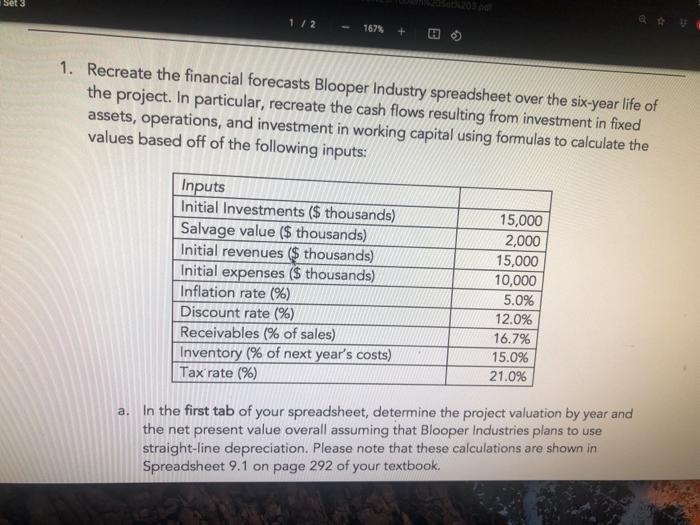

Set 3 1/2 167% + 1. Recreate the financial forecasts Blooper Industry spreadsheet over the six-year life of the project. In particular, recreate the cash flows resulting from investment in fixed assets, operations, and investment in working capital using formulas to calculate the values based off of the following inputs: Inputs Initial Investments ($ thousands) Salvage value ($ thousands) Initial revenues ($ thousands) Initial expenses ($ thousands) Inflation rate (%) Discount rate (%) Receivables (% of sales) Inventory (% of next year's costs) Tax rate (%) 15,000 2,000 15,000 10,000 5.0% 12.0% 16.7% 15.0% 21.0% a. In the first tab of your spreadsheet, determine the project valuation by year and the net present value overall assuming that Blooper Industries plans to use straight-line depreciation. Please note that these calculations are shown in Spreadsheet 9.1 on page 292 of your textbook. 1 / 2 167% + Spreadsheet on page 272 01 your textbook b. In the second tab of your spreadsheet, determine the impact of using the double-declining-balance method of depreciation on project valuation. More specifically, assume that Blooper depreciates 40% of the remaining written down value for each of the first three years or the project and then splits the remaining written down value over the final two years. I C. The executives of Blooper Industries have been following the news about President Biden's proposed American Jobs Plan and its associated increase in 1 C. The executives of Blooper Industries have been following the news about President Biden's proposed American Jobs Plan and its associated increase in the corporate tax rate from 21.0% to 28.0%. In the third tab of your spreadsheet, recreate the financial forecasts assuming straight-line depreciation and President Biden's proposed 28.0% corporate tax rate. Set 3 1/2 167% + 1. Recreate the financial forecasts Blooper Industry spreadsheet over the six-year life of the project. In particular, recreate the cash flows resulting from investment in fixed assets, operations, and investment in working capital using formulas to calculate the values based off of the following inputs: Inputs Initial Investments ($ thousands) Salvage value ($ thousands) Initial revenues ($ thousands) Initial expenses ($ thousands) Inflation rate (%) Discount rate (%) Receivables (% of sales) Inventory (% of next year's costs) Tax rate (%) 15,000 2,000 15,000 10,000 5.0% 12.0% 16.7% 15.0% 21.0% a. In the first tab of your spreadsheet, determine the project valuation by year and the net present value overall assuming that Blooper Industries plans to use straight-line depreciation. Please note that these calculations are shown in Spreadsheet 9.1 on page 292 of your textbook. 1 / 2 167% + Spreadsheet on page 272 01 your textbook b. In the second tab of your spreadsheet, determine the impact of using the double-declining-balance method of depreciation on project valuation. More specifically, assume that Blooper depreciates 40% of the remaining written down value for each of the first three years or the project and then splits the remaining written down value over the final two years. I C. The executives of Blooper Industries have been following the news about President Biden's proposed American Jobs Plan and its associated increase in 1 C. The executives of Blooper Industries have been following the news about President Biden's proposed American Jobs Plan and its associated increase in the corporate tax rate from 21.0% to 28.0%. In the third tab of your spreadsheet, recreate the financial forecasts assuming straight-line depreciation and President Biden's proposed 28.0% corporate tax rate