Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Set forth below is the adjusted trial balance of the Trough Corp. as of 31 March 20X2: Account Debit Credit Cash $ 24,900 Accounts receivable

Set forth below is the adjusted trial balance of the Trough Corp. as of 31 March 20X2:

| Account | Debit | Credit | ||||

| Cash | $ | 24,900 | ||||

| Accounts receivable | 72,500 | |||||

| Merchandise inventory | 87,800 | |||||

| Prepaid rent | 8,500 | |||||

| Equipment | 41,720 | |||||

| Accumulated depreciation | $ | 7,700 | ||||

| Accounts payable | 47,500 | |||||

| Note payable | 45,300 | |||||

| Accrued interest payable | 1,300 | |||||

| Capital stock | 16,250 | |||||

| Retained earnings | 117,370 | |||||

| $ | 235,420 | $ | 235,420 | |||

The following information describes the companys April transactions and provides the data required for month-end adjustments:

- Cash sales were $86,400.

- Sales on account were $79,000.

- Repaid $10,500 of note payable principal on 1 April.

- Operating expenses of $26,250 were paid in cash.

- Collected $43,050 in cash from customers on account.

- Wrote off $2,100 of accounts receivable as uncollectible. No other accounts receivable are in doubt of collection.

- Shareholders invested $20,500 in the business in exchange for 1,000 common shares.

- Bought $82,500 of merchandise on account.

- Ending merchandise inventory was $53,900.

- Paid suppliers $37,500 on account.

- Spent $5,500 for advertising to take place in May 20X2.

- Paid $14,800 in cash for wages, and still owed $3,000 for wages at month-end.

- The rent had previously been paid in advance to 31 July 20X2.

- The equipment has a total useful life of 10 years, and salvage of $4,520. These estimates have not changed since the asset was first acquired.

- The note payable bears an interest rate of 6% per year, and interest is due on 1 May.

Required:

1. Journalize the April transactions and adjusting journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations.)

- Record the cash sales.

- Record the sales on account.

- Record the notes payable.

- Record the operating expenses.

- Record the cash received towards accounts receivable.

- Record the bad debt expense.

- Record the issuance of common shares.

- Record the purchase of goods on account.

- Record the cost of goods sold.

- Record the cash paid against goods purchased on account.

- Record the advertising expenses paid in advance.

- Record the wages expense.

- Record the rent paid in advance.

- Record the depreciation expense.

- Record the interest expense.

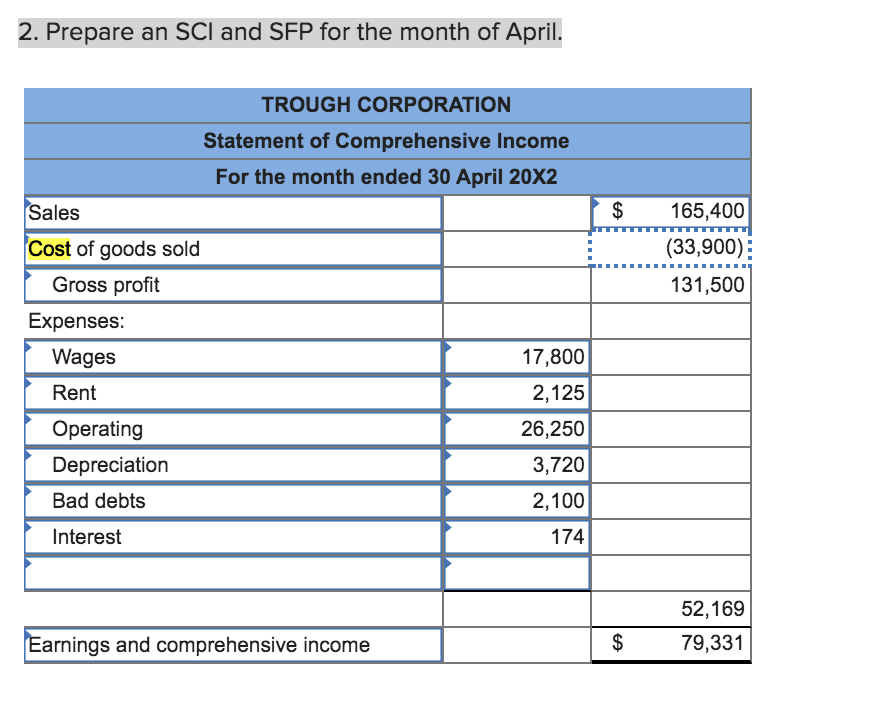

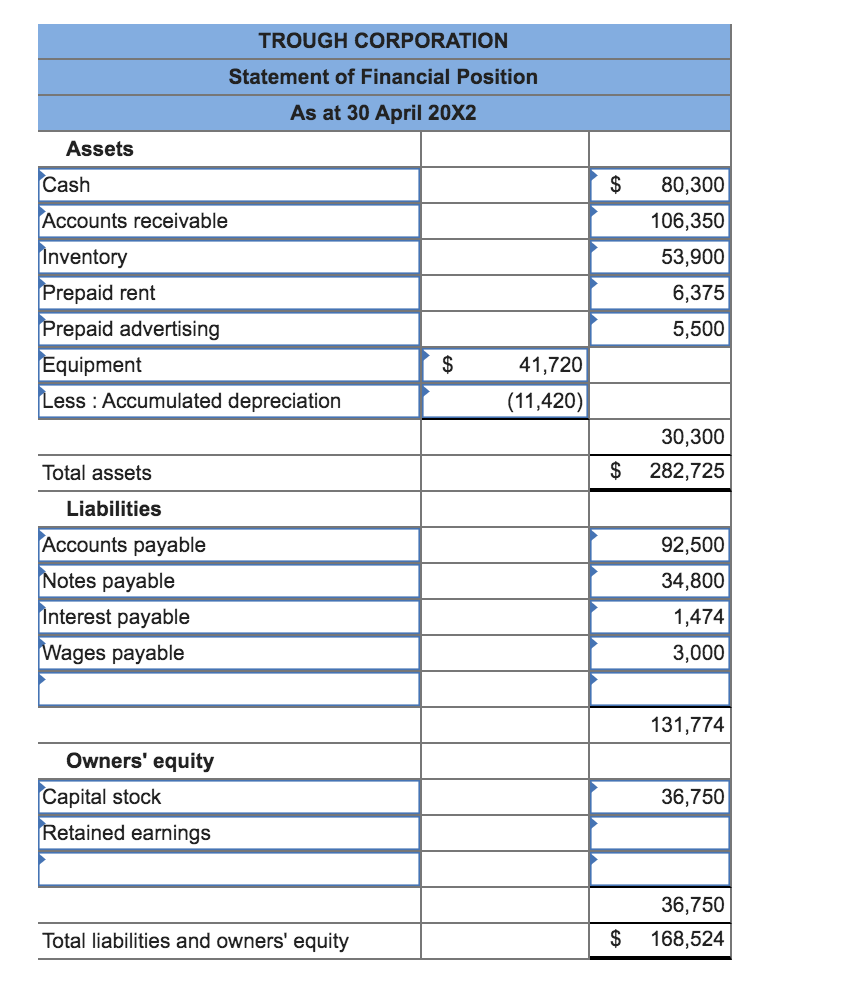

2. Prepare an SCI and SFP for the month of April!

2. Prepare an SCI and SFP for the month of April. $ 165,400 (33,900): 131,500 TROUGH CORPORATION Statement of Comprehensive Income For the month ended 30 April 20X2 Sales Cost of goods sold Gross profit Expenses: Wages 17,800 Rent 2,125 Operating 26,250 Depreciation 3,720 Bad debts 2,100 Interest 174 52,169 79,331 Earnings and comprehensive income $ $ TROUGH CORPORATION Statement of Financial Position As at 30 April 20X2 Assets Cash Accounts receivable Inventory Prepaid rent Prepaid advertising Equipment $ 41,720 Less : Accumulated depreciation (11,420) 80,300 106,350 53,900 6,375 5,500 30,300 282,725 $ Total assets Liabilities Accounts payable Notes payable Interest payable Wages payable 92,500 34,800 1,474 3,000 131,774 Owners' equity Capital stock Retained earnings 36,750 36,750 168,524 Total liabilities and owners' equity $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started