Question

Seth and Alexandra Moore of Elk Grove Village, Illinois have an annual income of $105,000 and want to buy a home. Currently, mortgage rates are

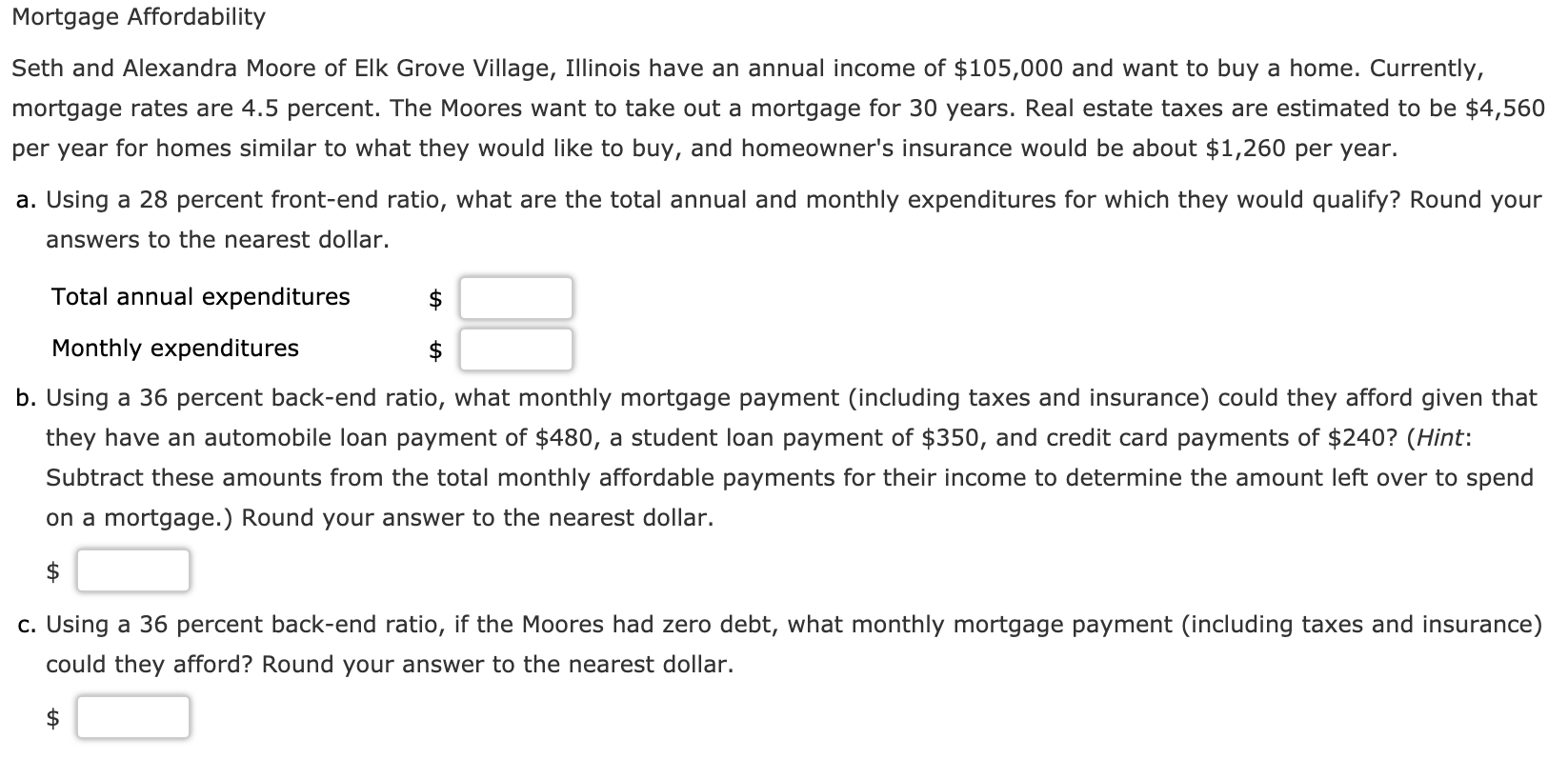

Seth and Alexandra Moore of Elk Grove Village, Illinois have an annual income of $105,000 and want to buy a home. Currently, mortgage rates are 4.5 percent. The Moores want to take out a mortgage for 30 years. Real estate taxes are estimated to be $4,560 per year for homes similar to what they would like to buy, and homeowner's insurance would be about $1,260 per year.

-

Using a 28 percent front-end ratio, what are the total annual and monthly expenditures for which they would qualify? Round your answers to the nearest dollar.

Total annual expenditures $ Monthly expenditures $ -

Using a 36 percent back-end ratio, what monthly mortgage payment (including taxes and insurance) could they afford given that they have an automobile loan payment of $480, a student loan payment of $350, and credit card payments of $240? (Hint: Subtract these amounts from the total monthly affordable payments for their income to determine the amount left over to spend on a mortgage.) Round your answer to the nearest dollar.

$

-

Using a 36 percent back-end ratio, if the Moores had zero debt, what monthly mortgage payment (including taxes and insurance) could they afford? Round your answer to the nearest dollar.

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started