Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Setting is early 1988 Friendly projecting a 20% increase in sales next year and even larger increase in earnings Over 100 companies in industry

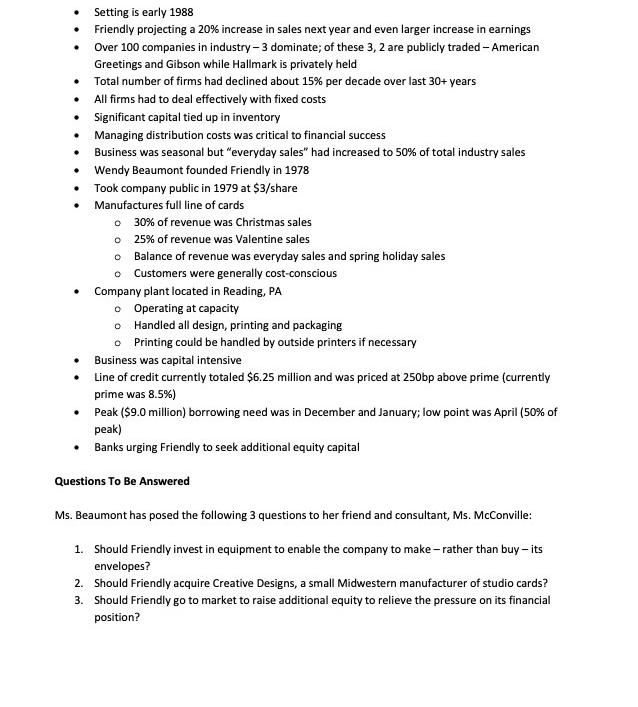

Setting is early 1988 Friendly projecting a 20% increase in sales next year and even larger increase in earnings Over 100 companies in industry - 3 dominate; of these 3, 2 are publicly traded - American Greetings and Gibson while Hallmark is privately held Total number of firms had declined about 15% per decade over last 30+ years All firms had to deal effectively with fixed costs Significant capital tied up in inventory Managing distribution costs was critical to financial success Business was seasonal but "everyday sales" had increased to 50% of total industry sales Wendy Beaumont founded Friendly in 1978 Took company public in 1979 at $3/share Manufactures full line of cards o 30% of revenue was Christmas sales 25% of revenue was Valentine sales O o Balance of revenue was everyday sales and spring holiday sales o Customers were generally cost-conscious Company plant located in Reading, PA o Operating at capacity o Handled all design, printing and packaging o Printing could be handled by outside printers if necessary Business was capital intensive Line of credit currently totaled $6.25 million and was priced at 250bp above prime (currently prime was 8.5%) Peak ($9.0 million) borrowing need was in December and January; low point was April (50% of peak) Banks urging Friendly to seek additional equity capital Questions To Be Answered Ms. Beaumont has posed the following 3 questions to her friend and consultant, Ms. McConville: 1. Should Friendly invest in equipment to enable the company to make- rather than buy-its envelopes? 2. Should Friendly acquire Creative Designs, a small Midwestern manufacturer of studio cards? 3. Should Friendly go to market to raise additional equity to relieve the pressure on its financial position?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets address each of Ms Beaumonts questions 1 Should Friendly invest in equipment to enable the comp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started