Question

Setting: It is early January 2015. As the chief financial officer of TM Toys Inc., you are evaluating a strategic acquisition of Toy Co. Inc.

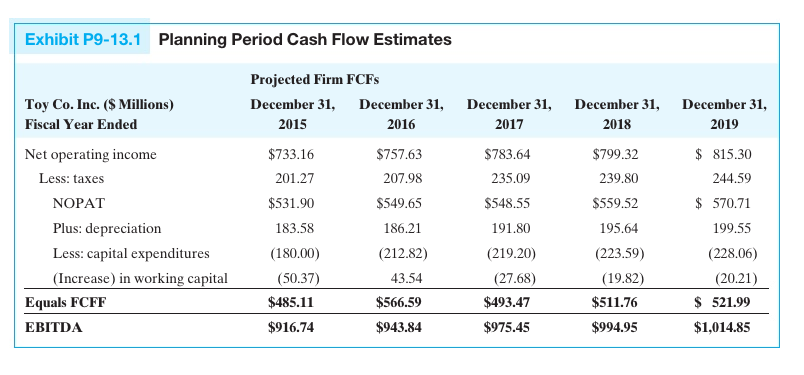

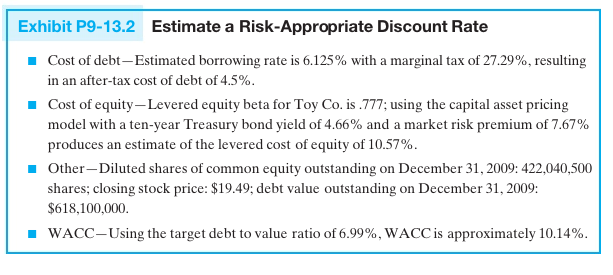

Setting: It is early January 2015. As the chief financial officer of TM Toys Inc., you are evaluating a strategic acquisition of Toy Co. Inc. (the target). Industry Overview: The toys-and-games industry consists of a select group of global players. The $60 billion industry (excluding videos) is dominated by two US toymakers: Mattel (Barbie, Hot Wheels, Fisher-Price) and Hasbro (G.I. Joe, Tonka, Playskool). International players include Japans Bandai Co. (Digimon) and Sanrio (Hello Kitty), as well as Denmarks LEGO Holding. Success in this industry depends on creating cross-culturally appealing brands backed by successful marketing strategies. Toy com-panies achieve success through scoring the next big hit with their target consumers and unveiling must-have toys. Historically, we have seen significant merger and acquisition activity and consolidation among brands in this industry. Target Company Description: Toy Co. Inc. is a multibrand company that designs and markets a broad range of toys and consumer products. The product cat-egories include: Action Figures, Art Activity Kits, Stationery, Writing Instruments,Performance Kites, Water Toys, Sports Activity Toys, Vehicles, Infant/Pre-School, Plush, Construction Toys, Electronics, Dolls, Dress-Up, Role Play, and Pet Toys and Accessories. The products are sold under various brand names. The target designs, manufactures, and markets a variety of toy products worldwide through sales to re-tailers and wholesalers, and directly to consumers. Its stock price closed on 12/31/14 at $19.49 per share. Valuation Assignment: Your task is to estimate the intrinsic value of Toy Co. Inc.s equity (on a per share basis) on December 31, 2014, using the enterprise DCF model; this will assist you with determining what per-share offer to make to Toy Co. Inc.s shareholders. Treat all of the results and forecasts for the fiscal years ended 2015 to 2019 as projections. Your research on various historical merger and acquisition transac-tions suggests that comparable toy companies have been acquired at enterprise value/EBITDA multiples of 10.5 * to 11.5 * . This is your assumption for a terminal-value exit multiple at the end of the forecast period, 2019. Exhibit P9-13.1 includes the targets planning period cash flow estimates, and Exhibit P9-13.2 provides market and other data for calculation of WACC for a discount rate

Exhibit P9-13.1 Planning Period Cash Flow Estimates Projected Firm FCFs Toy Co. Inc. Millions) December 31, December 31, December 3i, December 31, December 31, 2019 2015 2016 2017 Fiscal Year Ended 2018 $757.63 8783.64 $799.32 815.30 $733.16 Net operating income 207.98 Less: taxes 201.27 235.09 239.80 244.59 570.71 NOPAT $531.90 $549.65 $548.55 $559.52 183.58 195.64 186.21 Plus: depreciation 191.80 199.55 (223.59) (228.06) Less: capital expenditures (180.00) (212.82) (219.20) (50.37) (27.68) (20.21) (Increase in working capital 43.54 $485.11 521.99 $566.59 $493.47 $511.76 Equals FCFF $916.74 $943.84 $994.95 EBITDA $975.45 $1,014.85

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started