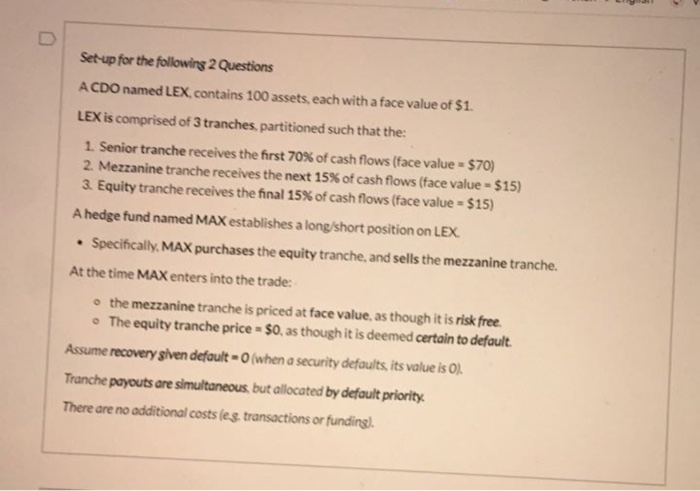

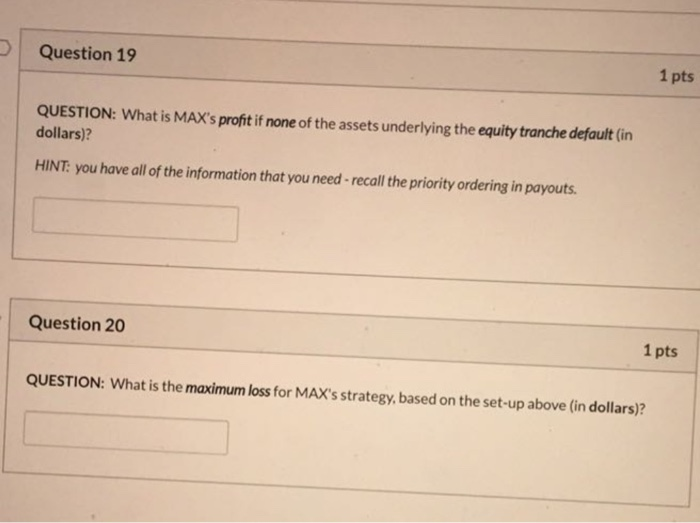

Set-up for the following 2 Questions A CDO named LEX contains 100 assets, each with a face value of $1. LEX is comprised of 3 tranches, partitioned such that the: 1. Senior tranche receives the first 70% of cash flows (face value - $70) 2. Mezzanine tranche receives the next 15% of cash flows (face value - $15) 3. Equity tranche receives the final 15% of cash flows (face value - $15) A hedge fund named MAX establishes a long/short position on LEX. Specifically, MAX purchases the equity tranche, and sells the mezzanine tranche. At the time MAX enters into the trade: the mezzanine tranche is priced at face value, as though it is risk free. The equity tranche price = $0, as though it is deemed certain to default. Assume recovery given default - 0 when a security defaults, its value is 0). Tranche payouts are simultaneous, but allocated by default priority, There are no additional costs les transactions or funding. Question 19 1 pts QUESTION: What is MAX's profit if none of the assets underlying the equity tranche default (in dollars)? HINT: you have all of the information that you need - recall the priority ordering in payouts. Question 20 1 pts QUESTION: What is the maximum loss for MAX's strategy, based on the set-up above (in dollars)? Set-up for the following 2 Questions A CDO named LEX contains 100 assets, each with a face value of $1. LEX is comprised of 3 tranches, partitioned such that the: 1. Senior tranche receives the first 70% of cash flows (face value - $70) 2. Mezzanine tranche receives the next 15% of cash flows (face value - $15) 3. Equity tranche receives the final 15% of cash flows (face value - $15) A hedge fund named MAX establishes a long/short position on LEX. Specifically, MAX purchases the equity tranche, and sells the mezzanine tranche. At the time MAX enters into the trade: the mezzanine tranche is priced at face value, as though it is risk free. The equity tranche price = $0, as though it is deemed certain to default. Assume recovery given default - 0 when a security defaults, its value is 0). Tranche payouts are simultaneous, but allocated by default priority, There are no additional costs les transactions or funding. Question 19 1 pts QUESTION: What is MAX's profit if none of the assets underlying the equity tranche default (in dollars)? HINT: you have all of the information that you need - recall the priority ordering in payouts. Question 20 1 pts QUESTION: What is the maximum loss for MAX's strategy, based on the set-up above (in dollars)