Answered step by step

Verified Expert Solution

Question

1 Approved Answer

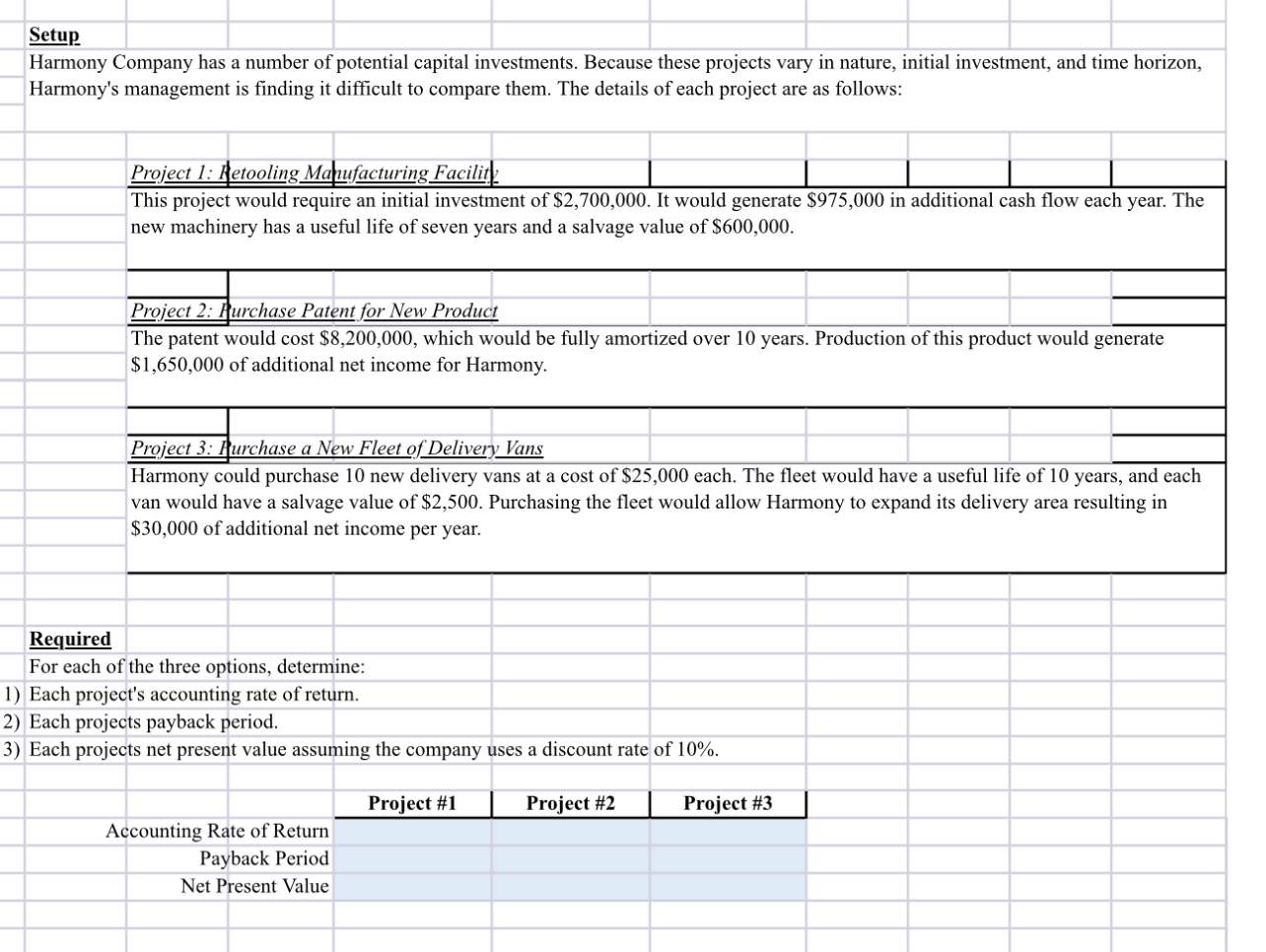

Setup Harmony Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and time horizon, Harmony's management is finding

Setup

Harmony Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and time horizon, Harmony's management is finding it difficult to compare them. The details of each project are as follows:

Project : Retooling Mahufacturing Facilit.

This project would require an initial investment of $ It would generate $ in additional cash flow each year. The new machinery has a useful life of seven years and a salvage value of $

The patent would cost $ which would be fully amortized over years. Production of this product would generate $ of additional net income for Harmony.

tableProject : Purchase a New Fleet of Delivery Vans,Harmony could purchase new delivery vans at a cost of $ each. The fleet would have a useful life of years, and each,van would have a salvage value of $ Purchasing the fleet would allow Harmony to expand its delivery area resulting in$ of additional net income per year.,

Project : Purchase a New Fleet of Delive Harmony could purchase new delivery van would have a salvage value of $ $ of additional net income per year.

Required

For each of the three options, determine:

Each project's accounting rate of return.

Each projects payback period.

Each projects net present value assuming the company uses a discount rate of

Present Value Template for Excel

Insert amounts in columns and RATE or will be calculated in column

Don't type in the blue shaded cells as these contain the formulas.

Setup

Harmony Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and time horizon, Harmony's management is finding it difficult to compare them. The details of each project are as follows:

Project : Retooling Mahufacturing Facilit.

This project would require an initial investment of $ It would generate $ in additional cash flow each year. The new machinery has a useful life of seven years and a salvage value of $

The patent would cost $ which would be fully amortized over years. Production of this product would generate $ of additional net income for Harmony.

tableProject : Purchase a New Fleet of Delivery Vans,Harmony could purchase new delivery vans at a cost of $ each. The fleet would have a useful life of years, and each,van would have a salvage value of $ Purchasing the fleet would allow Harmony to expand its delivery area resulting in$ of additional net income per year.,

Project : Purchase a New Fleet of Delive Harmony could purchase new delivery van would have a salvage value of $ $ of additional net income per year.

Required

For each of the three options, determine:

Each project's accounting rate of return.

Each projects payback period.

Each projects net present value assuming the company uses a discount rate of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started