Question

Seved Help Seve & Exit Subm On January 2, 2023, Brook Company acquired machinery by issuing a 5%, $324,000 note due in 5 years

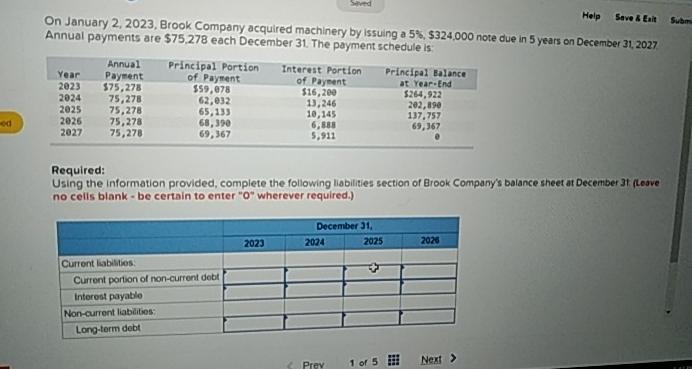

Seved Help Seve & Exit Subm On January 2, 2023, Brook Company acquired machinery by issuing a 5%, $324,000 note due in 5 years on December 31, 2027 Annual payments are $75,278 each December 31. The payment schedule is: Principal Balance Year Annual Payment Principal Portion of Payment Interest Portion of Payment at Year-End 2023 $75,278 $59,078 $16,200 $264,922 2024 75,278 62,032 13,246 202,890 2025 75,278 65,133 10,145 137,757 ed 2026 75,278 68,390 6,888 69,367 2027 75,278 69,367 5,911 Required: Using the information provided, complete the following liabilities section of Brook Company's balance sheet at December 31 (Leave no cells blank - be certain to enter "O" wherever required.) Current liabilities: Current portion of non-current debt Interest payable Non-current liabilities: Long-term debt December 31, 2023 2024 2025 2026 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles Volume 2

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris

17th Canadian Edition

1260881334, 9781260881332

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App