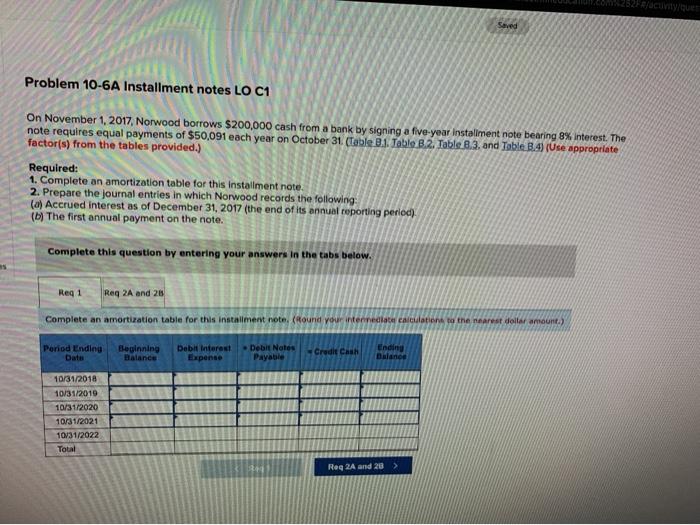

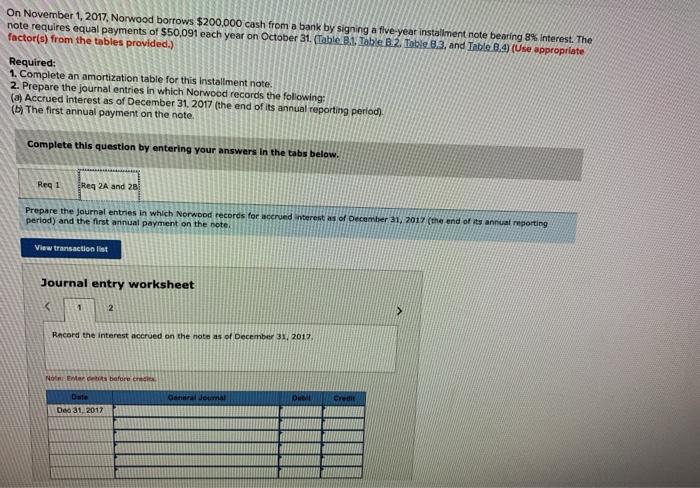

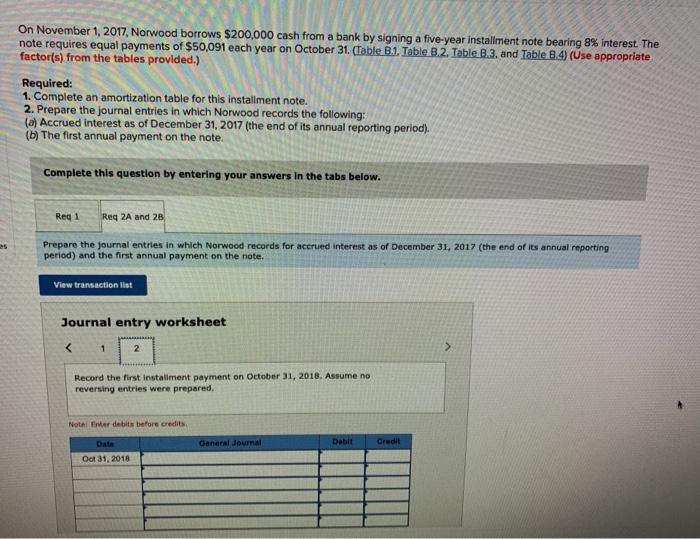

Seved Problem 10-6A Installment notes LO C1 On November 1, 2017 Norwood borrows $200,000 cash from a bank by signing a five-year installment note bearing 8% interest. The note requires equal payments of $50,091 each year on October 31 (Table B.1. Toble B.2. Table 8.3. and Table B.4) (Use appropriate factor(s) from the tables provided.) Required: 1. Complete an amortization table for this installment note. 2. Prepare the journal entries in which Norwood records the following (0) Accrued interest as of December 31, 2017 (the end of its annual reporting perlod) (6) The first annual payment on the note. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 28 Complete an amortization table for this installment note. (Hound your internealace calculation to the nearest dollar amount.) Period Ending Date Beginning Balance Debli interest Expense Debit Notes Payable Credit CASH Ending Balance 10/31/2018 10/31/2019 10/31/2020 10/31/2021 10/31/2022 Total Req2A and 28 > On November 1, 2017 Norwood borrows $200,000 cash from a bank by signing a five-year installment note bearing 8% Interest. The note requires equal payments of $50,091 each year on October 31. (Table B.1. Table B.2. Table 8.3, and Table 8.4) (Use appropriate factor(s) from the tables provided.) Required: 1. Complete an amortization table for this installment note. 2. Prepare the journal entries in which Norwood records the following: (a) Accrued interest as of December 31, 2017 (the end of its annual reporting period), (6) The first annual payment on the note Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A and 28 Prepare the journal entries in which Norwood records for accrued nterest as of December 31, 2017 (the end of its annual reporting period) and the first annual payment on the note View transaction list Journal entry worksheet 2 Racord the interest accrued on the note as of December 31, 2012 Not Erdebits before credo General Journal Dell Credit Dec 31, 2017 On November 1, 2017, Norwood borrows $200,000 cash from a bank by signing a five-year installment note bearing 8% Interest . The note requires equal payments of $50,091 each year on October 31. (Table B.1. Table 8.2. Table 8.3. and Table 8.4) (Use appropriate factor(s) from the tables provided.) Required: 1. Complete an amortization table for this installment note. 2. Prepare the journal entries in which Norwood records the following: (a) Accrued interest as of December 31, 2017 (the end of its annual reporting period). (b) The first annual payment on the note. Complete this question by entering your answers in the tabs below. Req1 Req 2A and 28 25 Prepare the journal entries in which Norwood records for accrued interest as of December 31, 2017 (the end of its annual reporting period) and the first annual payment on the note. View transaction list Journal entry worksheet