Answered step by step

Verified Expert Solution

Question

1 Approved Answer

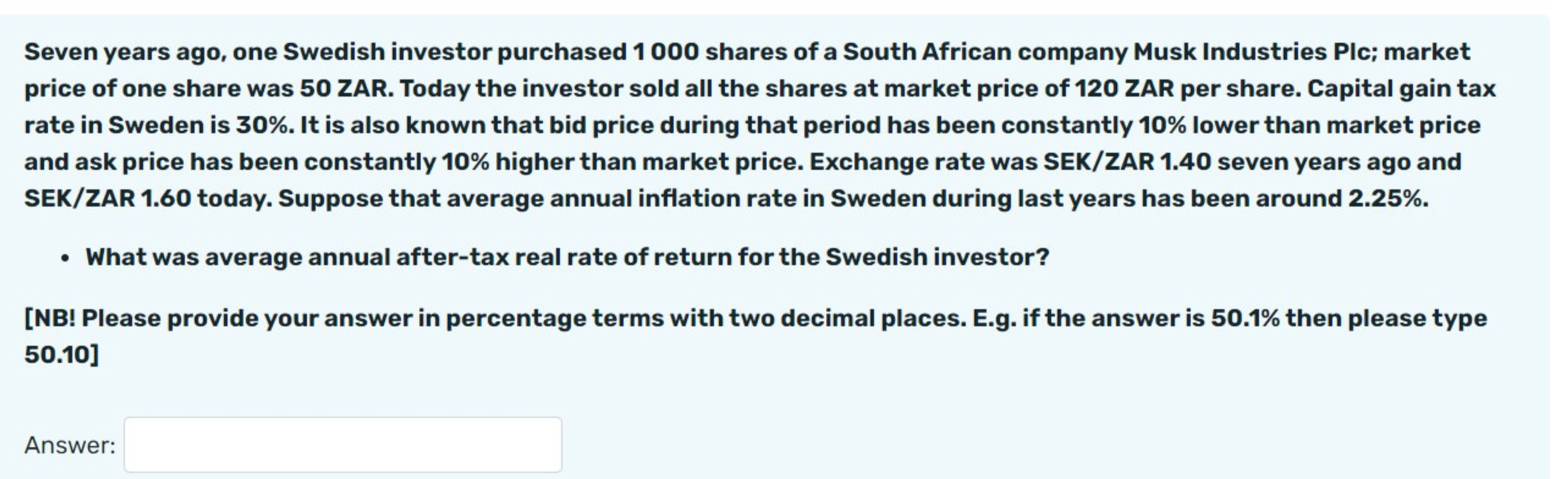

Seven years ago, one Swedish investor purchased 1 0 0 0 shares of a South African company Musk Industries Plc; market price of one share

Seven years ago, one Swedish investor purchased shares of a South African company Musk Industries Plc; market

price of one share was ZAR. Today the investor sold all the shares at market price of ZAR per share. Capital gain tax

rate in Sweden is It is also known that bid price during that period has been constantly lower than market price

and ask price has been constantly higher than market price. Exchange rate was SEKZAR seven years ago and

SEKZAR today. Suppose that average annual inflation rate in Sweden during last years has been around

What was average annual aftertax real rate of return for the Swedish investor?

NB Please provide your answer in percentage terms with two decimal places. Eg if the answer is then please type

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started