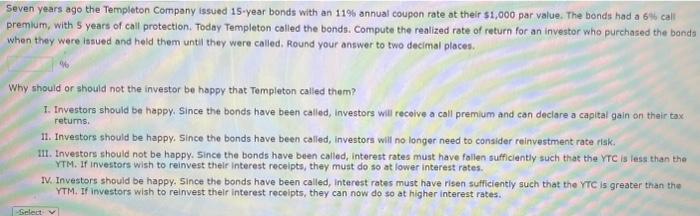

Seven years ago the Templeton Company issued 15 -year bonds with an 11% annual coupon rate at their $1,000 par value. The bonds had a 6 . call premium, with 5 years of call protection. Today Templeton colled the bonds. Compute the realized rate of return for an investor who purchased the bands when they were issued and held them until they were called, Round your answer to two decimal places. Why should or should not the investor be hoppy that Templeton called them? 1. Investors should be happy. Since the bonds have been called, investors will recoive a call premium and can deciare a capital gain on their tax retums, 11. Investors should be happy. Since the bonds have been called, investors will no longer need to consider reinvestment rate risk. 1i1. Investors should not be happy. Since the bonds have been called, interest rates must have fallen sufficiently such that the YrC is less than the YTM. If investors wish to reinvest their interest receipts, they must do so at lower interest rates. IV. Investors should be happy. Since the bonds have been called, interest rates must have risen sufficiently such that the ric is greater than the YTM. If investors wish to reinvest their interest recelpts, they can now do so at higher interest rates. Seven years ago the Templeton Company issued 15 -year bonds with an 11% annual coupon rate at their $1,000 par value. The bonds had a 6 . call premium, with 5 years of call protection. Today Templeton colled the bonds. Compute the realized rate of return for an investor who purchased the bands when they were issued and held them until they were called, Round your answer to two decimal places. Why should or should not the investor be hoppy that Templeton called them? 1. Investors should be happy. Since the bonds have been called, investors will recoive a call premium and can deciare a capital gain on their tax retums, 11. Investors should be happy. Since the bonds have been called, investors will no longer need to consider reinvestment rate risk. 1i1. Investors should not be happy. Since the bonds have been called, interest rates must have fallen sufficiently such that the YrC is less than the YTM. If investors wish to reinvest their interest receipts, they must do so at lower interest rates. IV. Investors should be happy. Since the bonds have been called, interest rates must have risen sufficiently such that the ric is greater than the YTM. If investors wish to reinvest their interest recelpts, they can now do so at higher interest rates