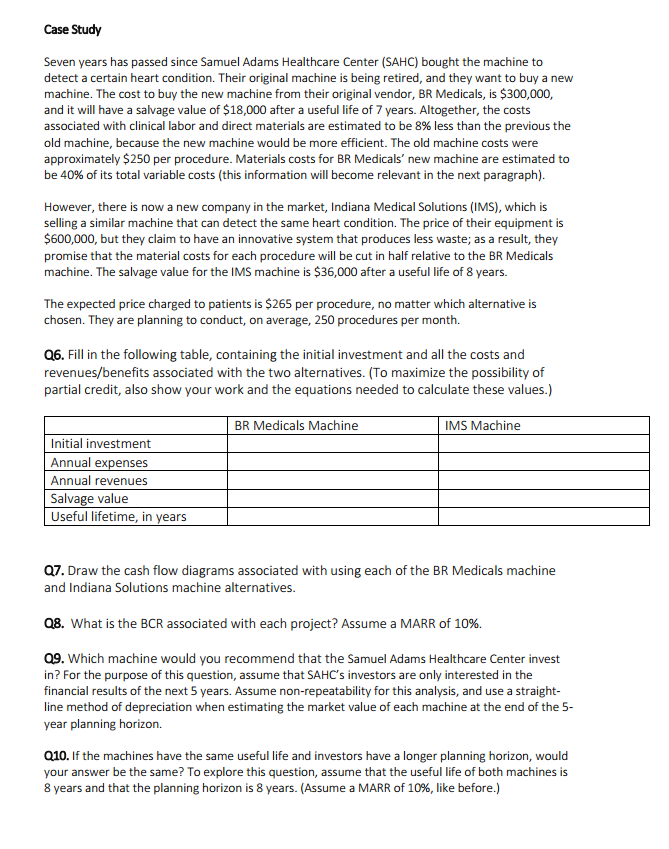

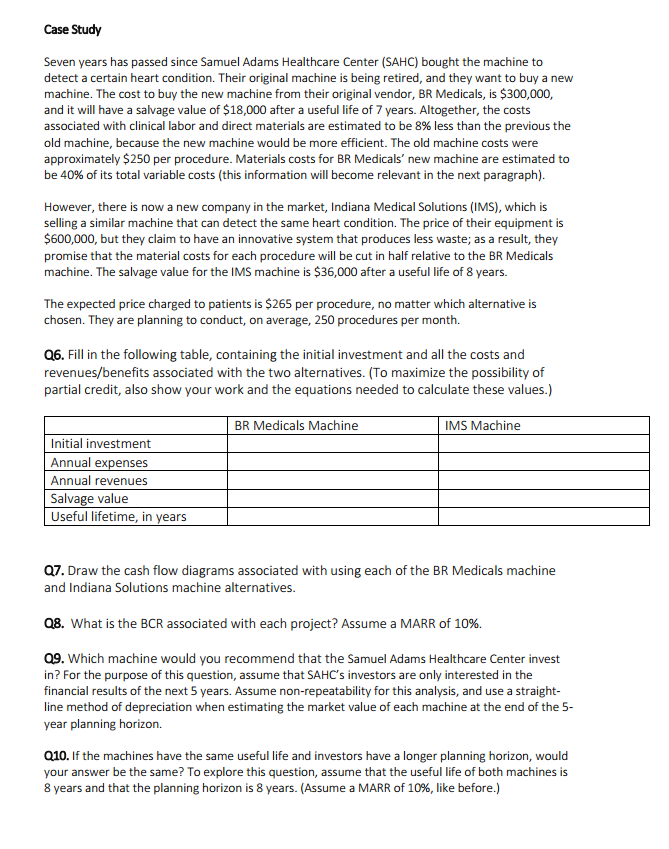

Seven years has passed since Samuel Adams Healthcare Center (SAHC) bought the machine to detect a certain heart condition. Their original machine is being retired, and they want to buy a new machine. The cost to buy the new machine from their original vendor, BR Medicals, is $300,000, and it will have a salvage value of $18,000 after a useful life of 7 years. Altogether, the costs associated with clinical labor and direct materials are estimated to be 8% less than the previous the old machine, because the new machine would be more efficient. The old machine costs were approximately $250 per procedure. Materials costs for BR Medicals' new machine are estimated to be 40% of its total variable costs (this information will become relevant in the next paragraph). However, there is now a new company in the market, Indiana Medical Solutions (IMS), which is selling a similar machine that can detect the same heart condition. The price of their equipment is $600,000, but they claim to have an innovative system that produces less waste; as a result, they promise that the material costs for each procedure will be cut in half relative to the BR Medicals machine. The salvage value for the IMS machine is $36,000 after a useful life of 8 years. The expected price charged to patients is $265 per procedure, no matter which alternative is chosen. They are planning to conduct, on average, 250 procedures per month. Q6. Fill in the following table, containing the initial investment and all the costs and revenues/benefits associated with the two alternatives. (To maximize the possibility of partial credit, also show your work and the equations needed to calculate these values.) Q7. Draw the cash flow diagrams associated with using each of the BR Medicals machine and Indiana Solutions machine alternatives. What is the BCR associated with each project? Assume a MARR of 10%. Which machine would you recommend that the Samuel Adams Healthcare Center invest in? For the purpose of this question, assume that SAHCs investors are only interested in the financial results of the next 5 years. Assume non-repeatability for this analysis, and use a straight-line method of depreciation when estimating the market value of each machine at the end of the 5-year planning horizon. If the machines have the same useful life and investors have a longer planning horizon, would your answer be the same? To explore this question, assume that the useful life of both machines is 8 years and that the planning horizon is 8 years. (Assume a MARR of 10%, like before.)