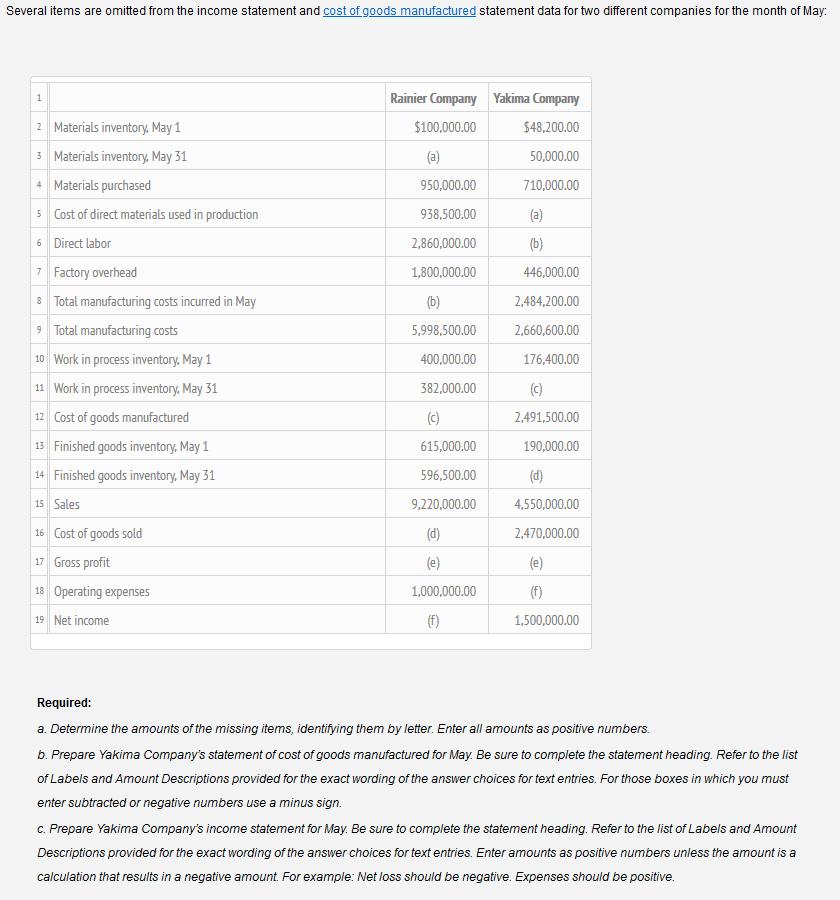

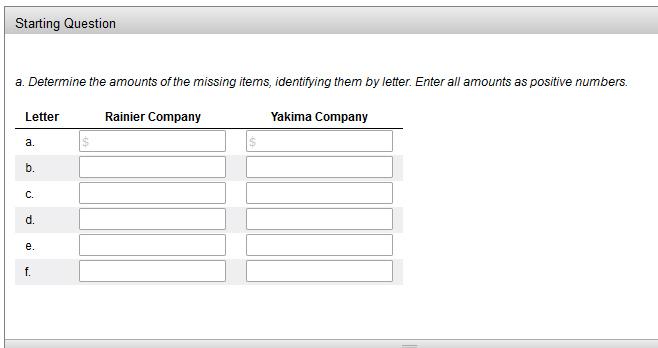

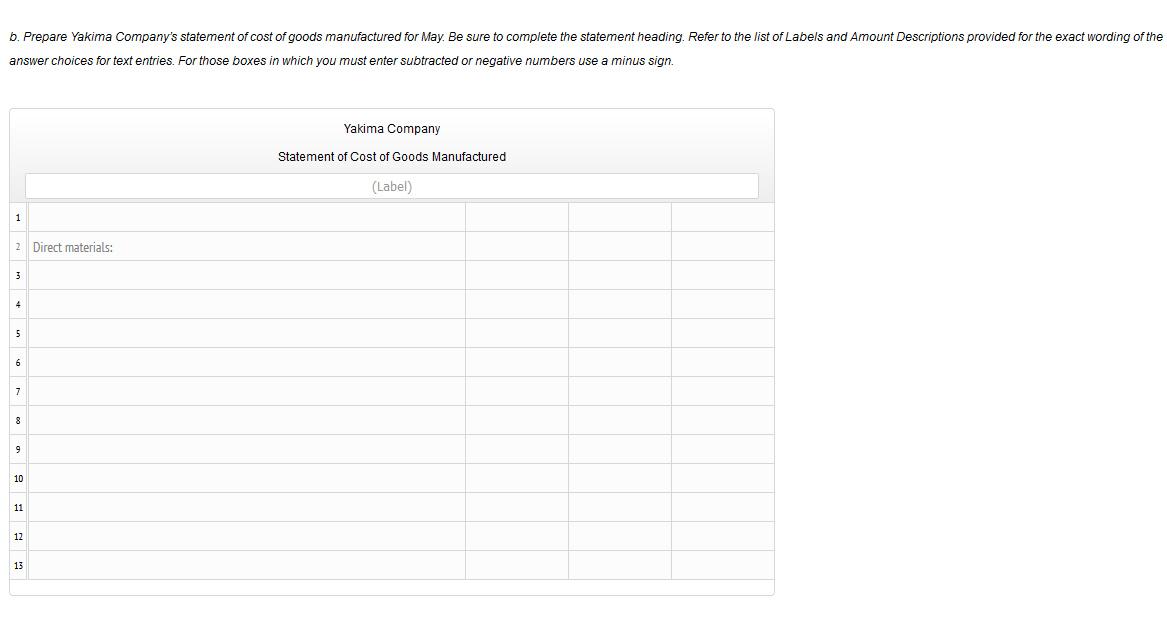

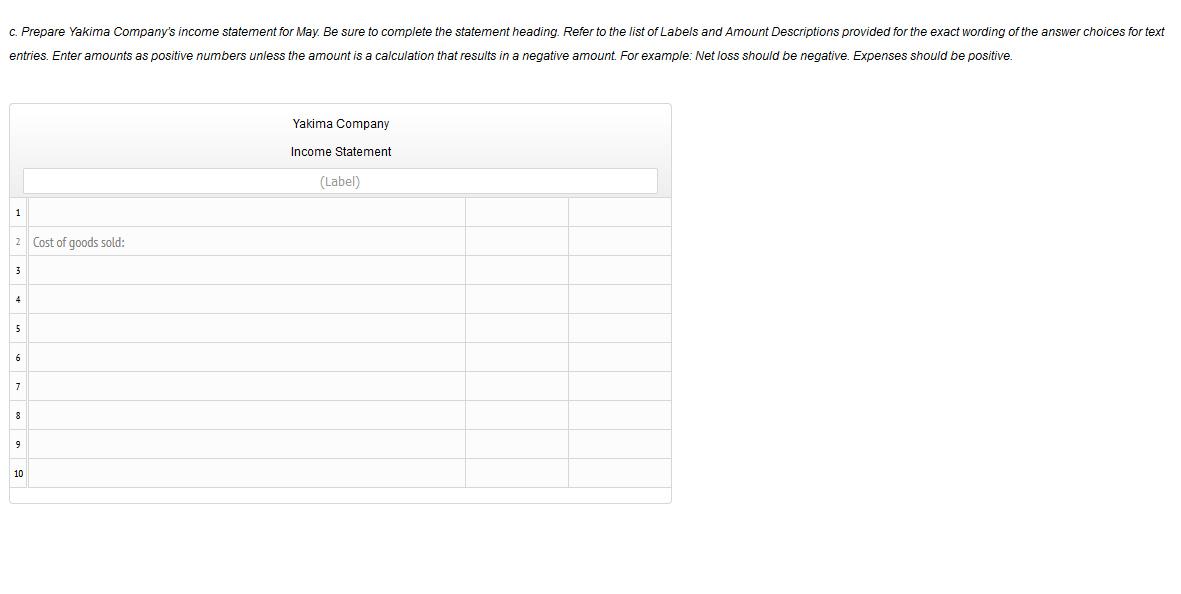

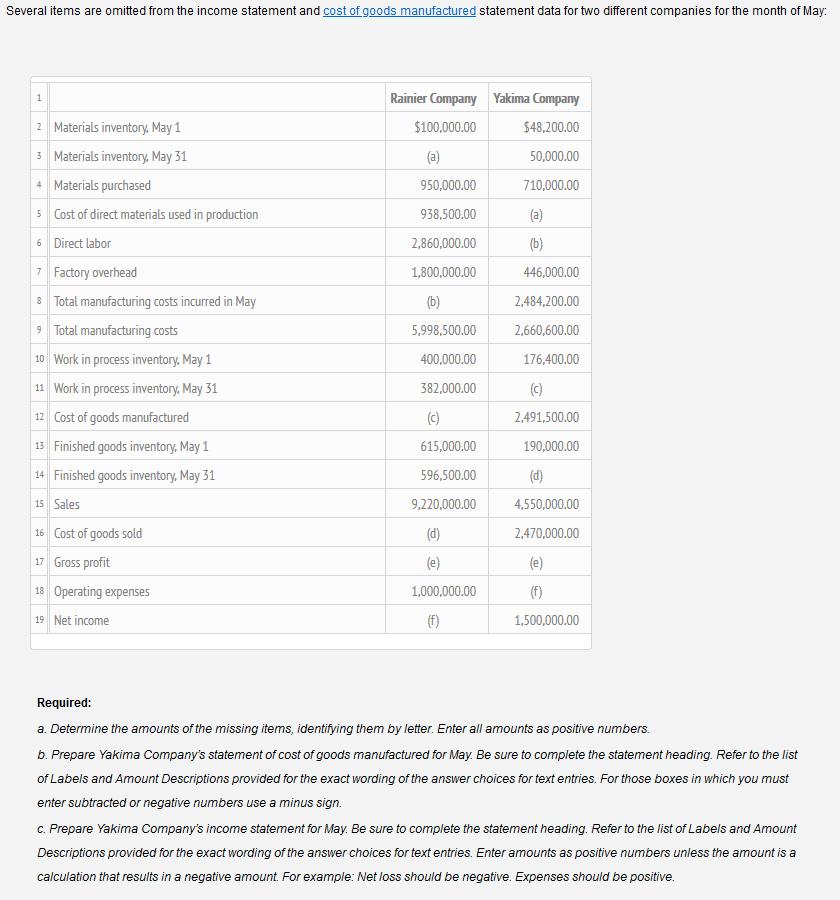

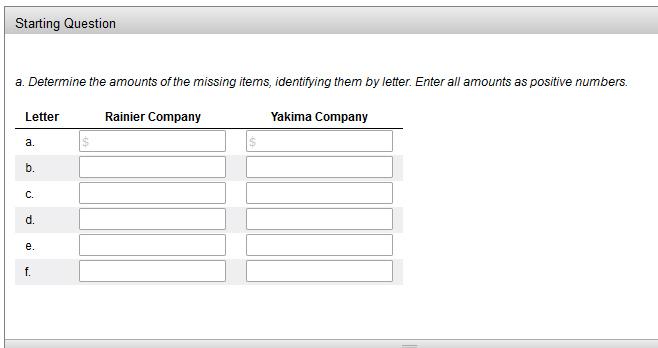

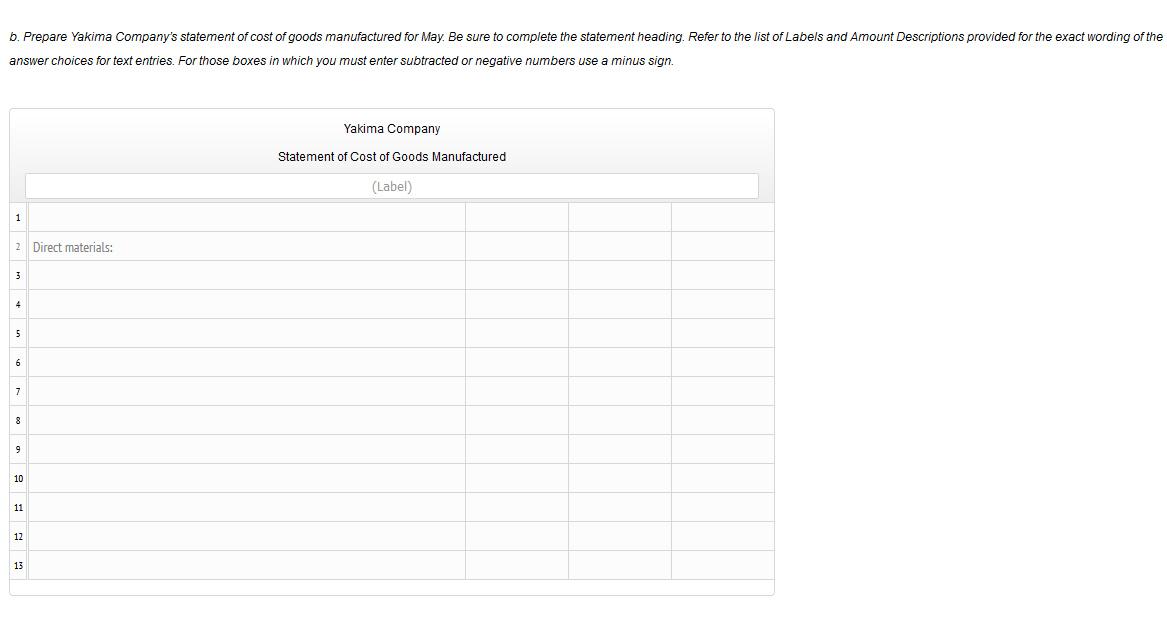

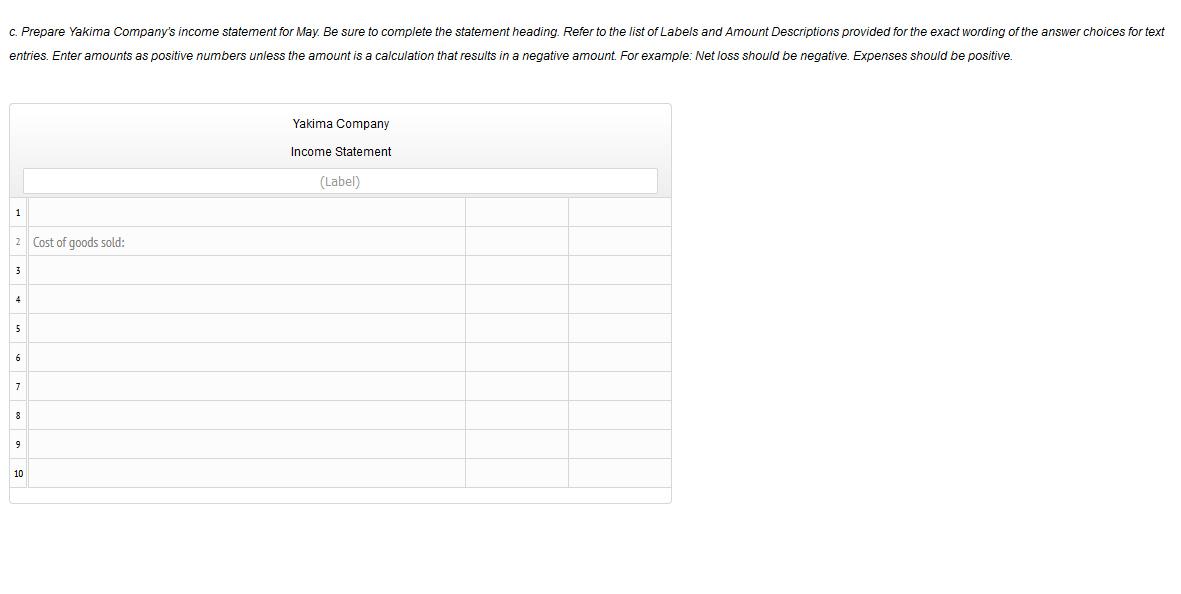

Several items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of May: 1 2. Materials inventory, May 1 3 Materials inventory, May 31 4 Materials purchased 5 Cost of direct materials used in production 6 Direct labor 7 Factory overhead 8 Total manufacturing costs incurred in May 9 Total manufacturing costs 10 Work in process inventory, May 1 11 Work in process inventory, May 31 12 Cost of goods manufactured 13 Finished goods inventory, May 1 14 Finished goods inventory, May 31 15 Sales 16 Cost of goods sold 17 Gross profit 13 Operating expenses 19 Net income Rainier Company Yakima Company $100.000.00 $48,200.00 (a) 50,000.00 950,000.00 710,000.00 938,500.00 (a) 2,860,000.00 (b) 1,800,000.00 446,000.00 (b) 2.484.200.00 5,998,500.00 2,660.600.00 400.000.00 176,400.00 382,000.00 (0) 2,491,500.00 615,000.00 190,000.00 596,500.00 (d) 9,220,000.00 4,550,000.00 (d) 2.470,000.00 (e) le) 1,000,000.00 (f) (1) 1,500,000.00 Required: a. Determine the amounts of the missing items, identifying them by letter. Enter all amounts as positive numbers. b. Prepare Yakima Company's statement of cost of goods manufactured for May. Be sure to complete the statement heading. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. c. Prepare Yakima Company's income statement for May. Be sure to complete the statement heading. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. Enter amounts as positive numbers unless the amount is a calculation that results in a negative amount. For example: Net loss should be negative. Expenses should be positive. Starting Question a. Determine the amounts of the missing items, identifying them by letter. Enter all amounts as positive numbers. Letter Rainier Company Yakima Company a. . b. C. d. d. e. e. f. b. Prepare Yakima Company's statement of cost of goods manufactured for May. Be sure to complete the statement heading. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Yakima Company Statement of Cost of Goods Manufactured (Label) 1 2 Direct materials: 3 4 5 6 7 8 9 10 11 12 13 C. Prepare Yakima Company's income statement for May. Be sure to complete the statement heading. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. Enter amounts as positive numbers unless the amount is a calculation that results in a negative amount. For example: Net loss should be negative. Expenses should be positive Yakima Company Income Statement (Label) 1 2 Cost of goods sold: 3 4 5 6 7 8 9 10