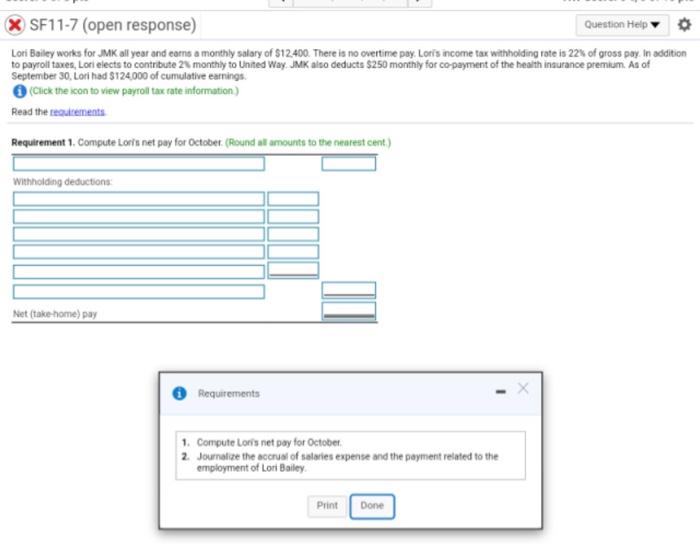

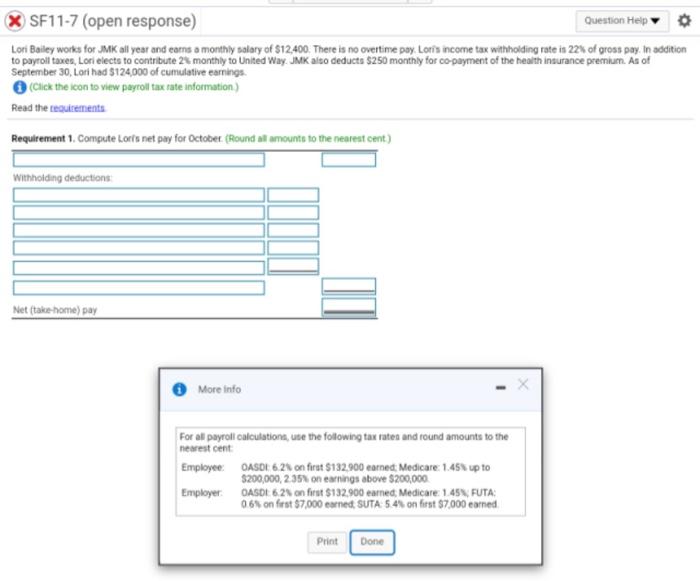

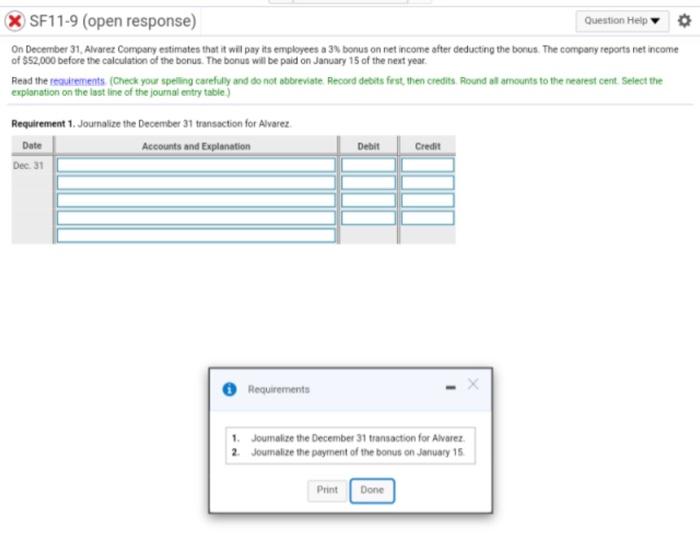

SF11-7 (open response) Question Help Lori Bailey works for JMK all year and carns a monthly salary of $12.400. There is no overtime pay, Loris income tax withholding rate is 22% of gross pay. In addition to payroll taxes, Lori elects to contribute 24 monthly to United Way JMK also deducts $250 monthly for co-payment of the health insurance premium. As of September 30, Lori had $124.000 of cumulative earnings (Click the icon to view payroll tax rate information) Read the requirements Requirement 1. Compute Loris net pay for October (Round all amounts to the nearest cent) Withholding deductions Net (take-home) pay Requirements 1. Compute Lori's net pay for October 2. Journalize the accrual of salaries expense and the payment related to the employment of Lori Bailey Print Done X SF11-7 (open response) Question Help Lori Bailey works for JMK all year and earns a monthly salary of $12,400. There is no overtime pay. Loris income tax withholding rate is 22% of gross pay. In addition to payroll taxes Lori elects to contribute 2 monthly to United Way. JMK also deducts $250 monthly for co-payment of the health insurance premium. As of September 30, Lori had $124,000 of cumulative earnings Click the icon to view payroll tax rate information) Read the requirements Requirement 1. Compute Lois net pay for October (Round al amounts to the nearest cent) Wir holding deductions Net (take home) pay More info For al payroll calculations, use the following tax rates and round amounts to the nearest cent Employee OASDI 6.21 on first $132.900 earned Medicare: 1.45up to $200,000, 2.35% on earnings above $200,000 Employer OASDI 6.2on first $132.900 earned, Medicare: 1.45 FUTA 06 on first $7,000 earned, SUTA 5.41 on first $7.000 earned Print Done SF11-9 (open response) Question Help On December 31. Alvarez Company estimates that it will pay its employees a 3% bonus on net income after deducting the bonus. The company reports niet income of $52,000 before the calculation of the bonus. The bonus will be paid on January 15 of the next year. Read the reautrements (Check your spelling carefully and do not abbreviate. Record debts fest then credits. Round all amounts to the nearest cent Select the explanation on the last line of the journal entry table) Requirement 1. Journalize the December 31 transaction for Alvarez. Date Accounts and Explanation Dec. 31 Debit Credit Requirements 1. Joumalize the December 31 transaction for Alvarez 2 Joumalize the payment of the bonus on January 15 Print Done