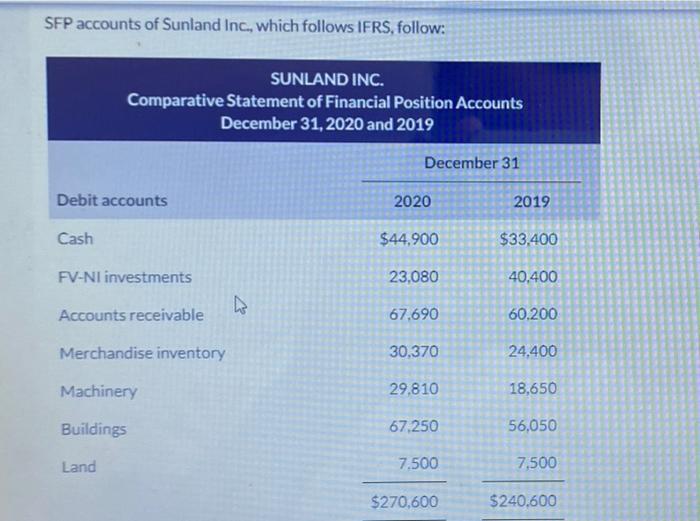

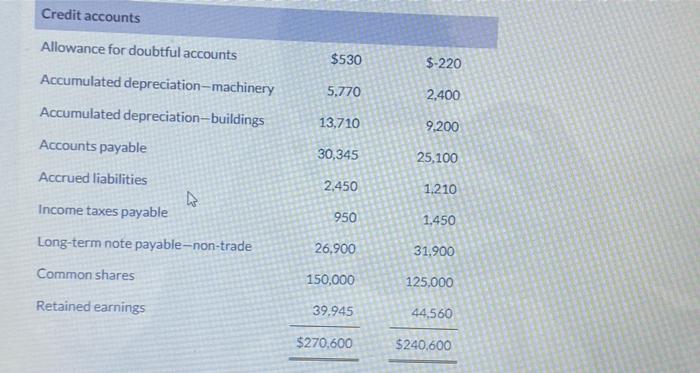

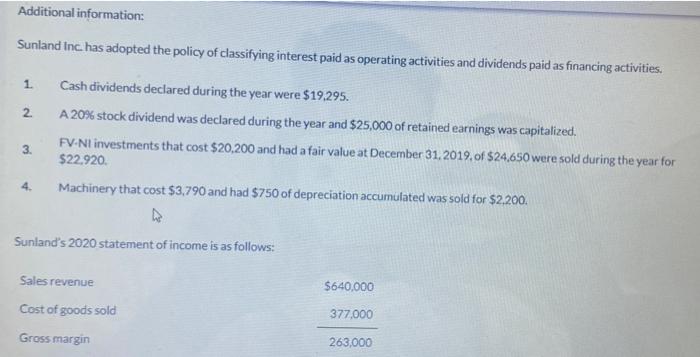

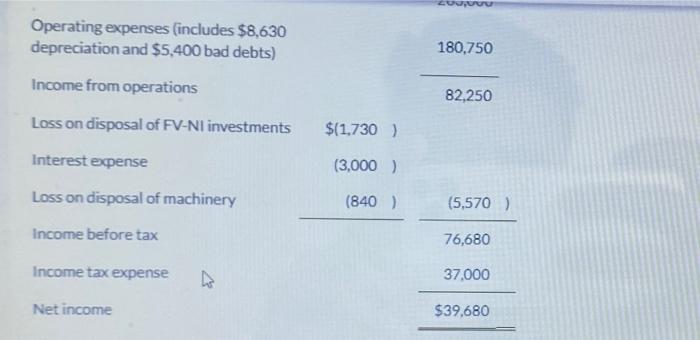

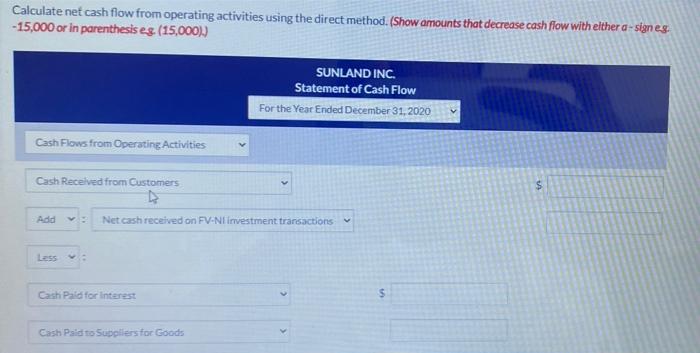

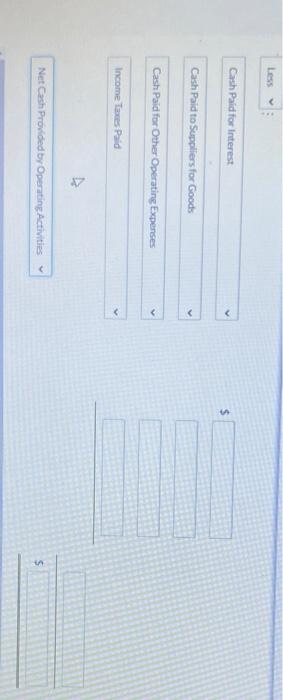

SFP accounts of Sunland Inc., which follows IFRS, follow: SUNLAND INC. Comparative Statement of Financial Position Accounts December 31, 2020 and 2019 December 31 Debit accounts 2020 2019 Cash $44,900 $33,400 FV-NI investments 23,080 40,400 Accounts receivable 67,690 60.200 Merchandise inventory 30,370 24,400 Machinery 29.810 18,650 Buildings 67.250 56,050 Land 7.500 7,500 $270,600 $240,600 Credit accounts Allowance for doubtful accounts $530 $-220 Accumulated depreciation-machinery Accumulated depreciation-buildings 5.770 2.400 13,710 9.200 Accounts payable 30,345 25,100 Accrued liabilities 2,450 1.210 Income taxes payable 950 1.450 Long-term note payable-non-trade 26,900 31.900 Common shares 150,000 125,000 Retained earnings 39.945 44,560 $270,600 $240,600 Additional information: Sunland Inc has adopted the policy of classifying interest paid as operating activities and dividends paid as financing activities. 1 2. Cash dividends declared during the year were $19,295. A 20% stock dividend was declared during the year and $25,000 of retained earnings was capitalized. FV.Nl investments that cost $20,200 and had a fair value at December 31, 2019, of $24,650 were sold during the year for $22.920 Machinery that cost $3,790 and had $750 of depreciation accumulated was sold for $2.200. 3. 4. Sunland's 2020 statement of income is as follows: Sales revenue $640,000 Cost of goods sold 377,000 Gross margin 263,000 Operating expenses (includes $8,630 depreciation and $5,400 bad debts) 180,750 Income from operations 82,250 Loss on disposal of FV-Nl investments $(1.730) Interest expense (3,000) Loss on disposal of machinery (840) (5,570) Income before tax 76,680 Income tax expense . 37,000 Net income $39,680 Calculate net cash flow from operating activities using the direct method. (Show amounts that decrease cash flow with elthera - signes -15,000 or in parenthesis es (15,0001) SUNLAND INC. Statement of Cash Flow For the Year Ended December 31, 2020 Cash Flows from Operating Activities Cash Received from Customers $ Add Net cash received on FV.N investment transactions Less Cash Paid for interest $ Cash Paid to Suppliers for Goods Less Cash Paid for interest $ Cash Paid to Suppliers for Goods V Cash Paid for Other Operating Expenses Income Tas Paid A Net Cash Provided by Operating Activities $