Answered step by step

Verified Expert Solution

Question

1 Approved Answer

sful (B Time Value of Money Part 2 MrMiddle Tennessee State Uni Logout Successful Unit 2 Homework - 3 at X e/content/7564070/viewContent/59373147/View Question 11 (0.2

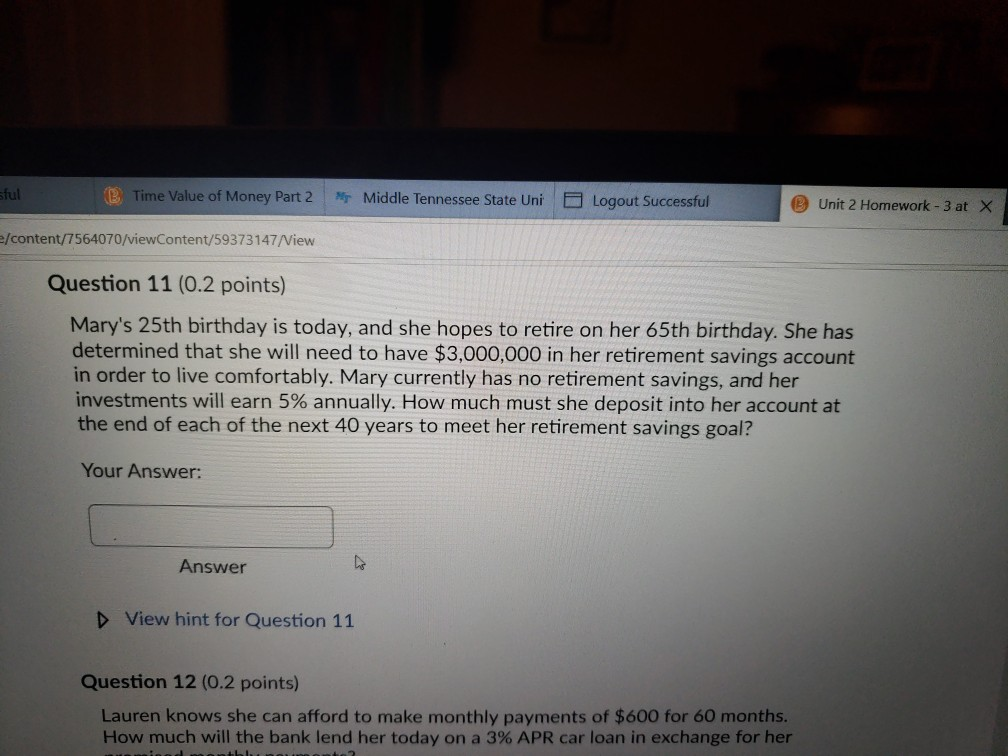

sful (B Time Value of Money Part 2 MrMiddle Tennessee State Uni Logout Successful Unit 2 Homework - 3 at X e/content/7564070/viewContent/59373147/View Question 11 (0.2 points) Mary's 25th birthday is today, and she hopes to retire on her 65th birthday. She has determined that she will need to have $3,000,000 in her retirement savings account in order to live comfortably. Mary currently has no retirement savings, and her investments will earn 5% annually. How much must she deposit into her account at the end of each of the next 40 years to meet her retirement savings goal? Your Answer: Answer D View hint for Question 11 Question 12 (0.2 points) Lauren knows she can afford to make monthly payments of $600 for 60 months. How much will the bank lend her today on a 3% APR car loan in exchange for her

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started