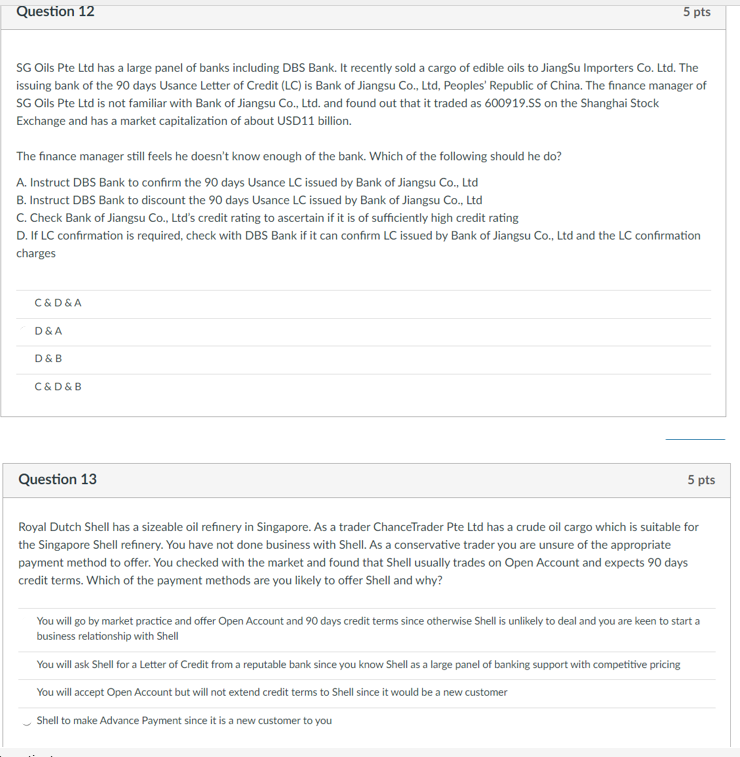

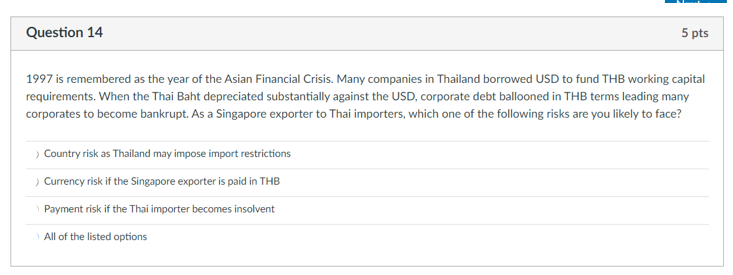

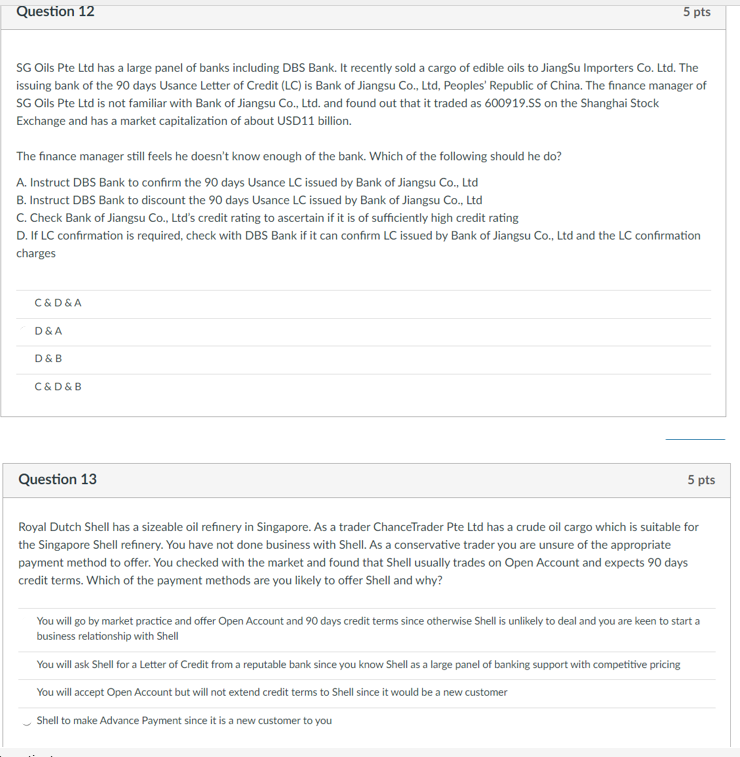

SG Oils Pte Ltd has a large panel of banks including DBS Bank. It recently sold a cargo of edible oils to JiangSu Importers Co. Ltd. The issuing bank of the 90 days Usance Letter of Credit (LC) is Bank of Jiangsu Co., Ltd, Peoples' Republic of China. The finance manager of SG Oils Pte Ltd is not familiar with Bank of Jiangsu Co., Ltd. and found out that it traded as 600919.SS on the Shanghai Stock Exchange and has a market capitalization of about USD11 billion. The finance manager still feels he doesn't know enough of the bank. Which of the following should he do? A. Instruct DBS Bank to confirm the 90 days Usance LC issued by Bank of Jiangsu Co., Ltd B. Instruct DBS Bank to discount the 90 days Usance LC issued by Bank of Jiangsu Co., Ltd C. Check Bank of Jiangsu Co., Ltd's credit rating to ascertain if it is of sufficiently high credit rating D. If LC confirmation is required, check with DBS Bank if it can confirm LC issued by Bank of Jiangsu Co., Ltd and the LC confirmation charges Question 13 Royal Dutch Shell has a sizeable oil refinery in Singapore. As a trader ChanceTrader Pte Ltd has a crude oil cargo which is suitable for the Singapore Shell refinery. You have not done business with Shell. As a conservative trader you are unsure of the appropriate payment method to offer. You checked with the market and found that Shell usually trades on Open Account and expects 90 days credit terms. Which of the payment methods are you likely to offer Shell and why? You will go by market practice and offer Open Account and 90 days credit terms since otherwise Shell is unlikely to deal and you are keen to start a business relationship with Shell You will ask Shell for a Letter of Credit from a reputable bank since you know Shell as a large panel of banking support with competitive pricing You will accept Open Account but will not extend credit terms to Shell since it would be a new customer Shell to make Advance Payment since it is a new customer to you 1997 is remembered as the year of the Asian Financial Crisis. Many companies in Thailand borrowed USD to fund THB working capital requirements. When the Thai Baht depreciated substantially against the USD, corporate debt ballooned in THB terms leading many corporates to become bankrupt. As a Singapore exporter to Thai importers, which one of the following risks are you likely to face? Country risk as Thailand may impose import restrictions Currency risk if the Singapore exporter is paid in THB Payment risk if the Thai importer becomes insolvent All of the listed options