Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shady Fabrication Group ( SFG ) manufactures components for manufacturing equipment at several facilities. The company produces two, related, parts at its Park River Plant,

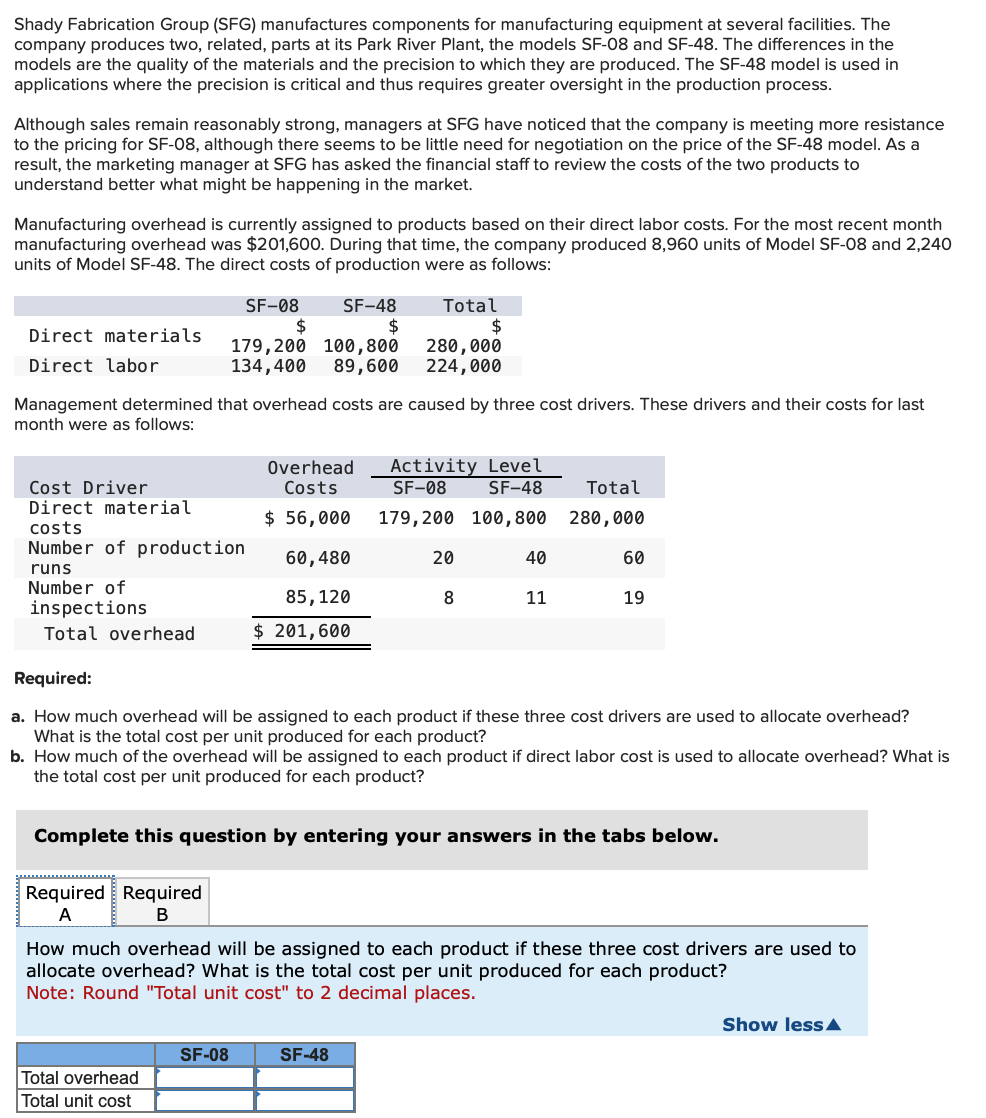

Shady Fabrication Group SFG manufactures components for manufacturing equipment at several facilities. The

company produces two, related, parts at its Park River Plant, the models SF and SF The differences in the

models are the quality of the materials and the precision to which they are produced. The SF model is used in

applications where the precision is critical and thus requires greater oversight in the production process.

Although sales remain reasonably strong, managers at SFG have noticed that the company is meeting more resistance

to the pricing for SF although there seems to be little need for negotiation on the price of the SF model. As a

result, the marketing manager at SFG has asked the financial staff to review the costs of the two products to

understand better what might be happening in the market.

Manufacturing overhead is currently assigned to products based on their direct labor costs. For the most recent month

manufacturing overhead was $ During that time, the company produced units of Model SF and

units of Model SF The direct costs of production were as follows:

Management determined that overhead costs are caused by three cost drivers. These drivers and their costs for last

month were as follows:

Required:

a How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead?

What is the total cost per unit produced for each product?

b How much of the overhead will be assigned to each product if direct labor cost is used to allocate overhead? What is

the total cost per unit produced for each product?

Complete this question by entering your answers in the tabs below.

How much overhead will be assigned to each product if these three cost drivers are used to

allocate overhead? What is the total cost per unit produced for each product?

Note: Round "Total unit cost" to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started