Answered step by step

Verified Expert Solution

Question

1 Approved Answer

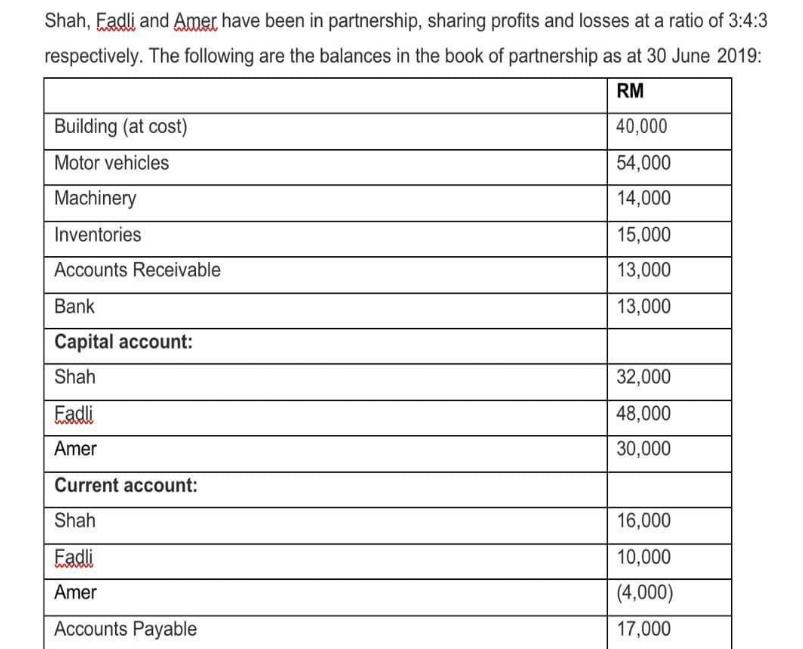

Shah, Fadli and Amer have been in partnership, sharing profits and losses at a ratio of 3:4:3 respectively. The following are the balances in

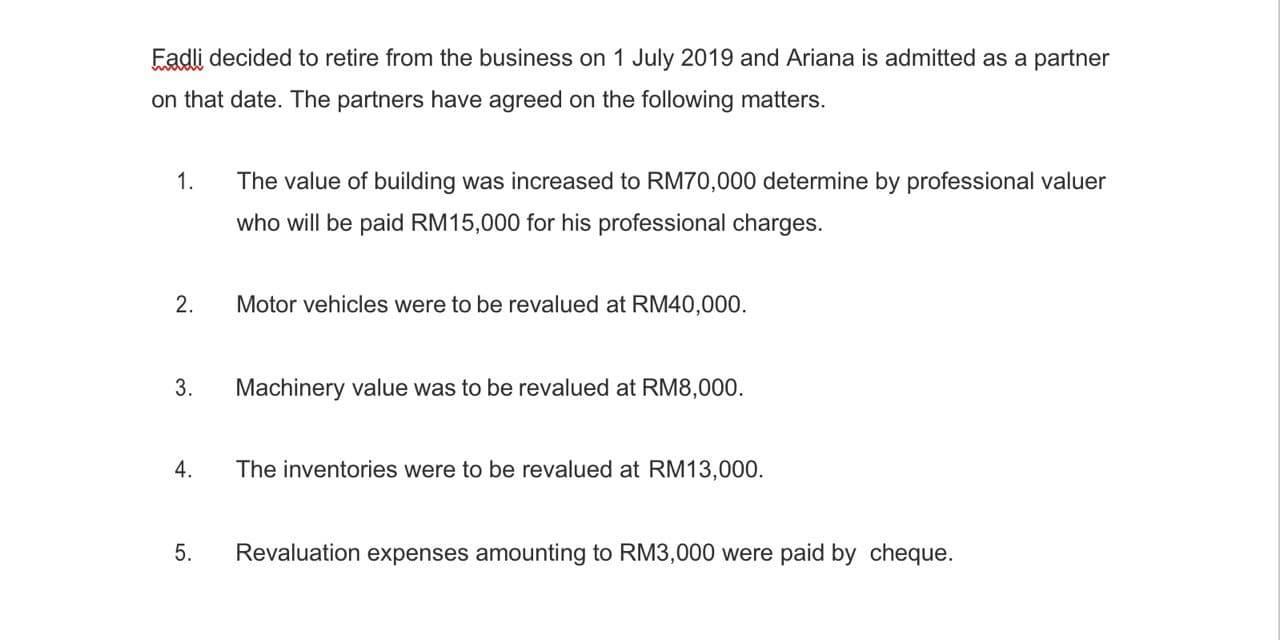

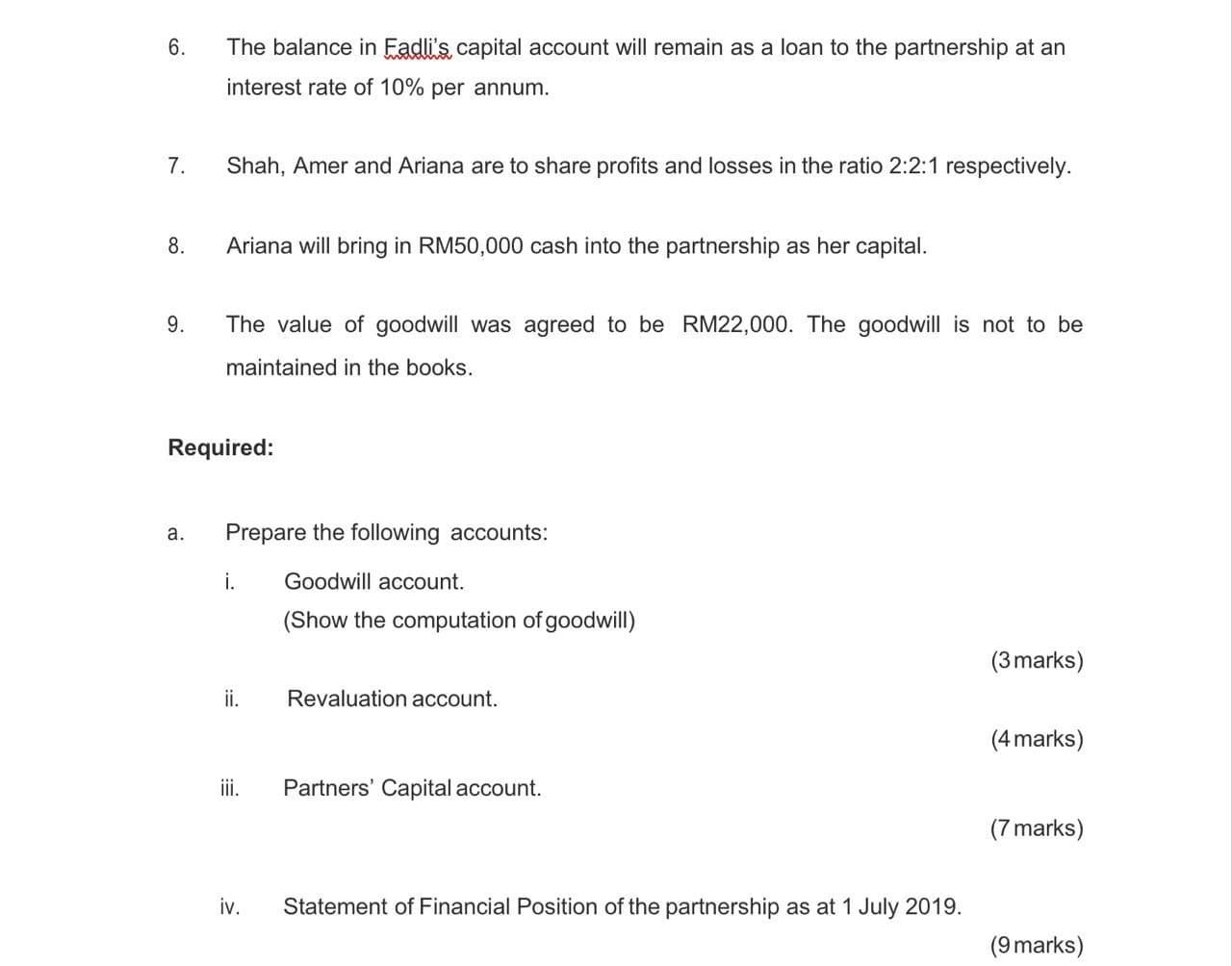

Shah, Fadli and Amer have been in partnership, sharing profits and losses at a ratio of 3:4:3 respectively. The following are the balances in the book of partnership as at 30 June 2019: RM Building (at cost) 40,000 Motor vehicles 54,000 Machinery 14,000 Inventories 15,000 Accounts Receivable 13,000 Bank 13,000 Capital account: Shah 32,000 Fadli 48,000 Amer 30,000 Current account: Shah 16,000 Eadli 10,000 Amer (4,000) Accounts Payable 17,000 Fadli decided to retire from the business on 1 July 2019 and Ariana is admitted as a partner on that date. The partners have agreed on the following matters. 1. The value of building was increased to RM70,000 determine by professional valuer who will be paid RM15,000 for his professional charges. 2. Motor vehicles were to be revalued at RM40,000. 3. Machinery value was to be revalued at RM8,000. 4. The inventories were to be revalued at RM13,000. 5. Revaluation expenses amounting to RM3,000 were paid by cheque. 6. The balance in Fadli's capital account will remain as a loan to the partnership at an interest rate of 10% per annum. 7. Shah, Amer and Ariana are to share profits and losses in the ratio 2:2:1 respectively. 8. Ariana will bring in RM50,000 cash into the partnership as her capital. 9. The value of goodwill was agreed to be RM22,000. The goodwill is not to be maintained in the books. Required: a. Prepare the following accounts: i. Goodwill account. (Show the computation of goodwill) (3 marks) ii. Revaluation account. (4 marks) ii. Partners' Capital account. (7 marks) iv. Statement of Financial Position of the partnership as at 1 July 2019. (9 marks)

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The answer is as follows The retirement in partnership firm occurs when a partner voluntarily leaves the partnership business At the time of retirement the retiring partners capital account is adjuste...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started