Answered step by step

Verified Expert Solution

Question

1 Approved Answer

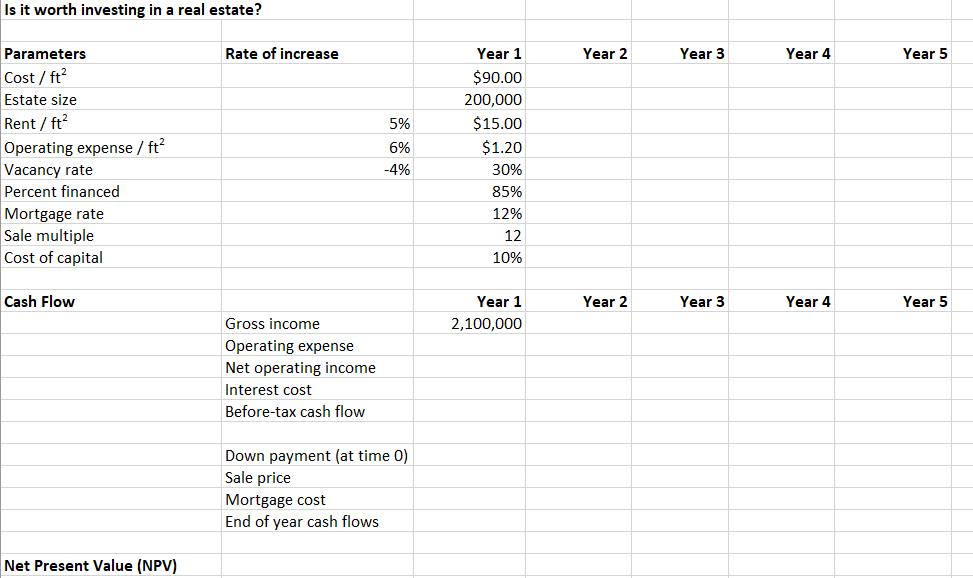

1. Fill in each of the parameters with a Rate of increase along the years. 2. Calculate the Cash Flow items over the years. 3.

1. Fill in each of the parameters with a “Rate of increase” along the years.

2. Calculate the Cash Flow items over the years.

3. Obtain the Net Present Value (NPV).

Is it worth investing in a real estate? Parameters Rate of increase Year 1 Year 2 Year 3 Year 4 Year 5 Cost / ft? Estate size Rent / ft $90.00 200,000 5% $15.00 Operating expense / ft? Vacancy rate Percent financed Mortgage rate Sale multiple Cost of capital 6% $1.20 -4% 30% 85% 12% 12 10% Cash Flow Year 1 Year 2 Year 3 Year 4 Year 5 Gross income 2,100,000 Operating expense Net operating income Interest cost Before-tax cash flow Down payment (at time 0) Sale price Mortgage cost End of year cash flows Net Present Value (NPV)

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Rent operating expenses and vacancy rate are calculated for each year is calculated by the given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started