Question

Shaikha is your sister. She has done so well in FIN 2003 and obtained an A+ grade. She wants to celebrate her success by buying

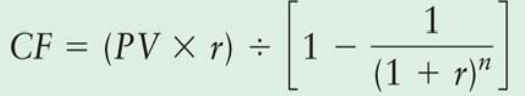

Shaikha is your sister. She has done so well in FIN 2003 and obtained an A+ grade. She wants to celebrate her success by buying a nice car. Shaikha has set her eyes on the 2020 Bugatti la Voiture Noire. However, she does not have enough money for the car and will have to borrow additional funds from the bank for her chosen 2020 Bugatti La Voiture Noire priced at AED2,000,000. Shaikha has the 20% deposit for the Bugatti La Voiture Noire price in her with EmiratesNBD High Saver Savings Account and ADCB Smart-Saver Savings Account. Let us assume we choose an ADCB auto loan. We chose the auto loan because auto loans are by their nature cheaper than personal loans. Further, the souqalmal website indicates that ADCB offers the lowest interest rate for Emiratis, does not charge any loan arrangement fee or late payment penalties for its customers. ADCB is offering Shaikha the loan at 4% fixed interest rate per annum to be repaid over a 5-year period. ADCB is also offering Shaikha a loan re-payment holiday of up to year in case she temporarily loses her job Shaikha is unsure of a number of things and has asked you the following questions: Required a. How much will she need to borrow in order to buy the Bugatti La Voiture Noire? a) Amortize the loan if annual payments are made for a period of 5-years. [Excel Calculation Below] We need to first determine the annual payment using the formulae below  Some Questions You May Ask a. Change the tenor period to 60 months (5 Years) and generate the monthly spreadsheet. Clue: Divide the annual repayment amount above in the answer to question (b) by 12 to obtain the monthly payments and generate the spreadsheet. b. Do you think Shaikha should borrow on a fixed interest rate or variable interest rate across the entire loan repayment period? Why or why not? c. Why is it advantageous (disadvantageous) at times to borrow on a fixed interest rate? Why is it advantageous (disadvantageous) at times to borrow on a variable interest rate? d. Assuming that Shaikas credit rating is A that is why she was given a loan at 4%. What can Shaikha do to ensure that she obtains a loan from ADCB at a much lower interest rate than 4%?

Some Questions You May Ask a. Change the tenor period to 60 months (5 Years) and generate the monthly spreadsheet. Clue: Divide the annual repayment amount above in the answer to question (b) by 12 to obtain the monthly payments and generate the spreadsheet. b. Do you think Shaikha should borrow on a fixed interest rate or variable interest rate across the entire loan repayment period? Why or why not? c. Why is it advantageous (disadvantageous) at times to borrow on a fixed interest rate? Why is it advantageous (disadvantageous) at times to borrow on a variable interest rate? d. Assuming that Shaikas credit rating is A that is why she was given a loan at 4%. What can Shaikha do to ensure that she obtains a loan from ADCB at a much lower interest rate than 4%?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started