Question

(a) From the following information, compute Debt-Equity Ratio: Long Term Borrowings - 2,00,000 Long Term Provisions - 1,00,000 Current Liabilities - 50,000 Non-current-Assets -

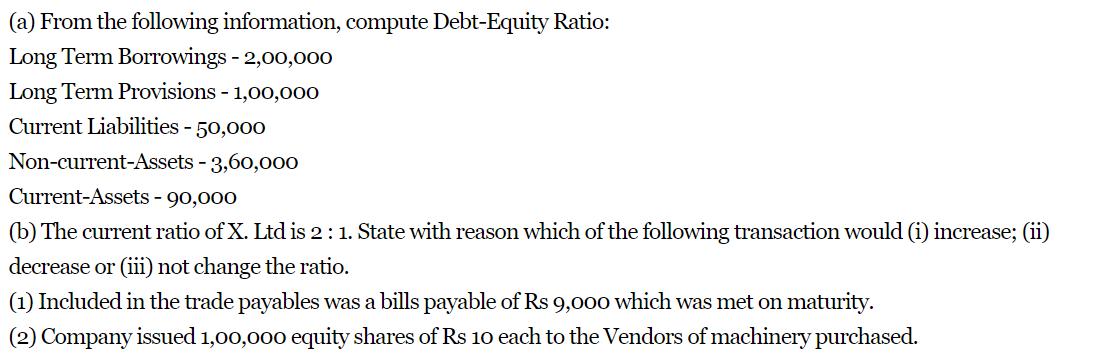

(a) From the following information, compute Debt-Equity Ratio: Long Term Borrowings - 2,00,000 Long Term Provisions - 1,00,000 Current Liabilities - 50,000 Non-current-Assets - 3,60,000 Current-Assets - 90,000 (b) The current ratio of X. Ltd is 2 : 1. State with reason which of the following transaction would (i) increase; (ii) decrease or (iii) not change the ratio. (1) Included in the trade payables was a bills payable of Rs 9,000 which was met on maturity. (2) Company issued 1,00,000 equity shares of Rs 10 each to the Vendors of machinery purchased.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Debt Equity Ratio ShareholdersFundsLongTermDebt Total Assets Total Liabilities Shareholders Funds To...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Auditing An Introduction to International Standards on Auditing

Authors: Rick Hayes, Philip Wallage, Hans Gortemaker

3rd edition

273768174, 978-0273768173

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App