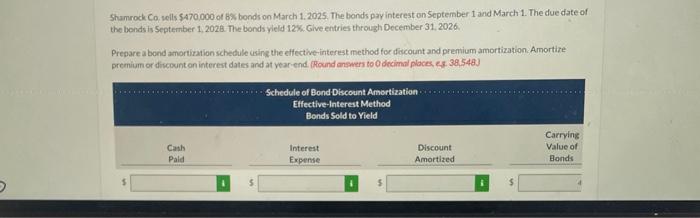

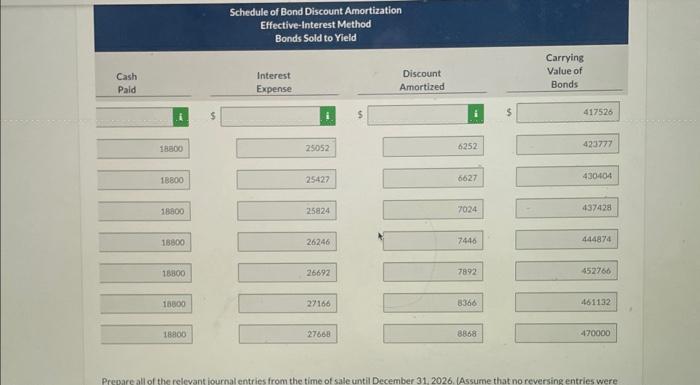

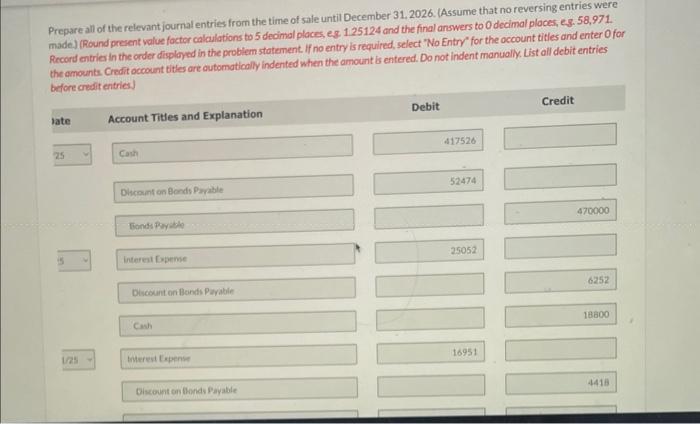

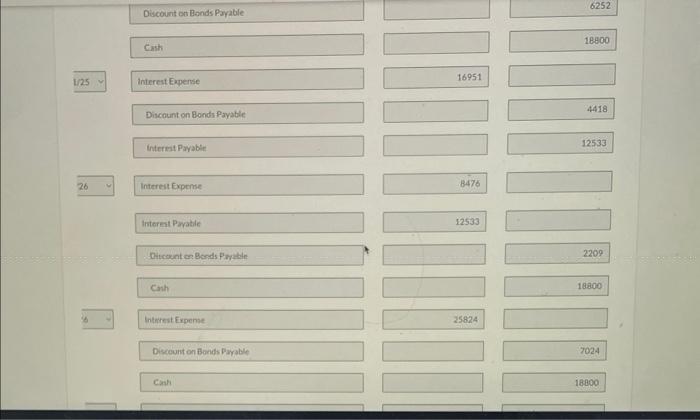

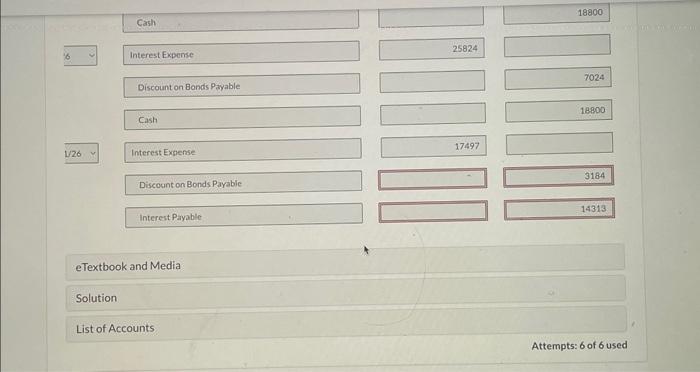

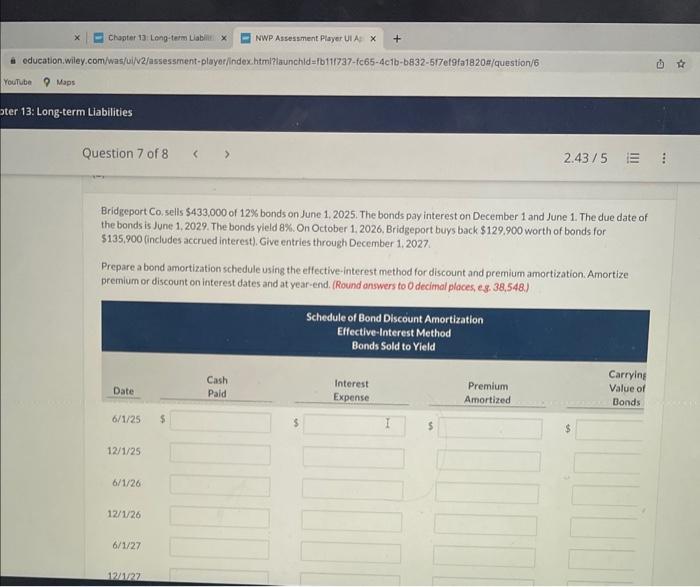

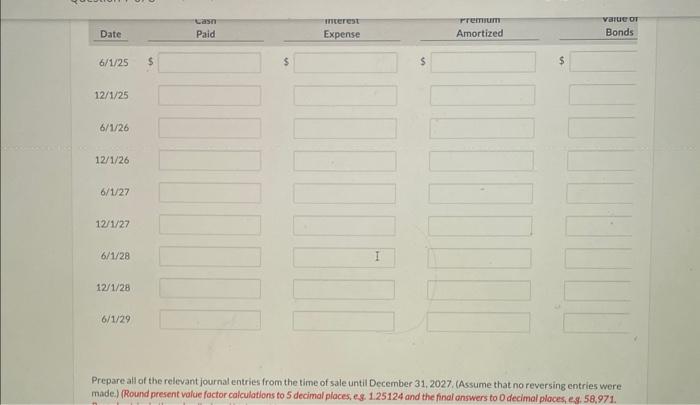

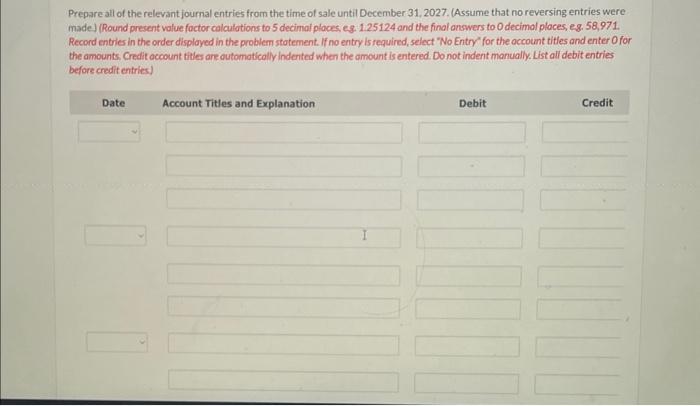

Shamrock Co. selts $470.000 of 6% bonds on March 1.2025, The bonds pay interest on September 1 and March 1. The due date of the bonds is September 1,2028 . The bonds yield 12%. Give entries through December 31,2026. Prepare a bond amortitation schedule usine the effective-interest method for fiscount and premium amortization. Amortire premium or discounton interest dates and at vear end (Pound answers to 0 decimal ploces, es. 38,5483) Preoare all of the relevant iournal entries from the time of sale until December 31. 2026. (Assume that no reversing entries were Prepare all of the relevant journal entries from the time of sale until December 31, 2026. (Assume that no reversing entries were made) (Round present value foctor calaulations to 5 decimal places, es. 1.25124 and the final answers to 0 decimal ploces, eg. 58,971. Recors entrier in the order disployed in the problem statement. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts Credit occount bitles are automatically indented when the amount is entered. Do not indent manualiy. List all debit entries before credit entries) Discount ot Bonds Pxyable Cath interest Expense 16951 Discount on Bondi Payable interest Poyabie Intereit Expeme 8476 Intereat Pyatic Bitcoent on Bonds Pryale Canh Intnrest Erpeme Discount on Bonds Payble Interest Expense 25824 Discount on Bonds Payable 7024 Cash Interest Expterse 17497 Discount on Bonds Payabic eTextbook and Media Solution List of Accounts Attempts: 6 of 6 used Bridgeport Co.sells $433,000 of 12% bonds on June 1.2025. The bonds pay interest on December 1 and June 1 . The due date of the bonds is June 1, 2029. The bonds yield 8\%. On October 1, 2026. Bridgeport buys back $129,900 worth of bonds for 5135,900 (includes accrued interest). Give entries through December 1,2027 Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round onswers to O decimal places, es. 38,548.) Prepare all of the relevant journal entries from the time of sale until December 31, 2027. (Assume that no reversing entries were made.) (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answers to 0 decimal places, es. 58,971. Prepare all of the relevant journal entries from the time of sale until December 31, 2027. (Assume that no reversing entries were made) (Round present value foctor calculations to 5 decimal places, eg. 1.25124 and the final onswers to 0 decimol places, eg. 58 , 971. Record entries in the order displayed in the problem stotement. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts, Credit occount tibles are outomotically indented when the amount is entered. Do not indent manually: List all debit entries before credit entries)