Question

Shantunu International is considering the accuisition of an equipment costing Taka 150,000. The equipment has an economic life of 5 years. The company can purchase

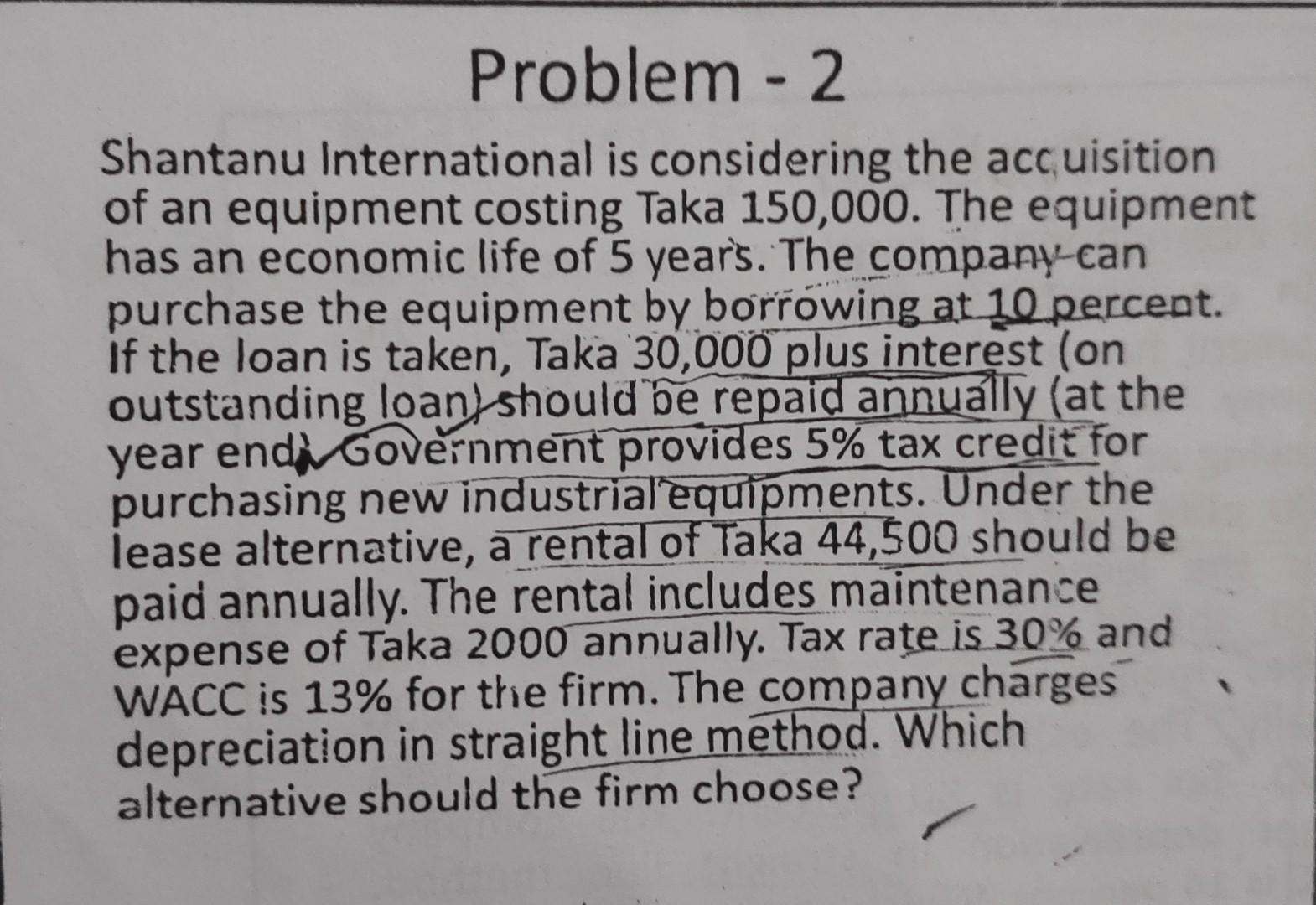

Shantunu International is considering the accuisition of an equipment costing Taka 150,000. The equipment has an economic life of 5 years. The company can purchase the equipment by borrowing at 10 percent. If the loan is taken, Taka 30,000 plus interest (on outstanding loan) should be repaid annually (at the year end) Government provides 5% tax credit for purchasing new industrial equipments. Under the lease alternative, a rental of Taka 44,500 should be paid annually.

The rental includes maintenance expense of Taka 2000 annually. Tax rate is 30% and WACC is 13% for the firm. The company charges depreciation in straight line method. 1. Which alternative should the firm choose? 2. What if the lease rental includes a maintenance expense of Taka 5000 annually.

Problem - 2 Shantanu International is considering the accuisition of an equipment costing Taka 150,000. The equipment has an economic life of 5 years. The company can purchase the equipment by borrowing at 10 percent. If the loan is taken, Taka 30,000 plus interest (on outstanding loan) should be repaid annually (at the year endi Government provides 5% tax credit for purchasing new industrial equipments. Under the lease alternative, a rental of Taka 44,500 should be paid annually. The rental includes maintenance expense of Taka 2000 annually. Tax rate is 30% and WACC is 13% for the firm. The company charges depreciation in straight line method. Which alternative should the firm chooseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started