Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shara, a citizen of Lebanon, receives substantial income from oil holdings in Yemen. She had never visited the United States before her 2 1 st

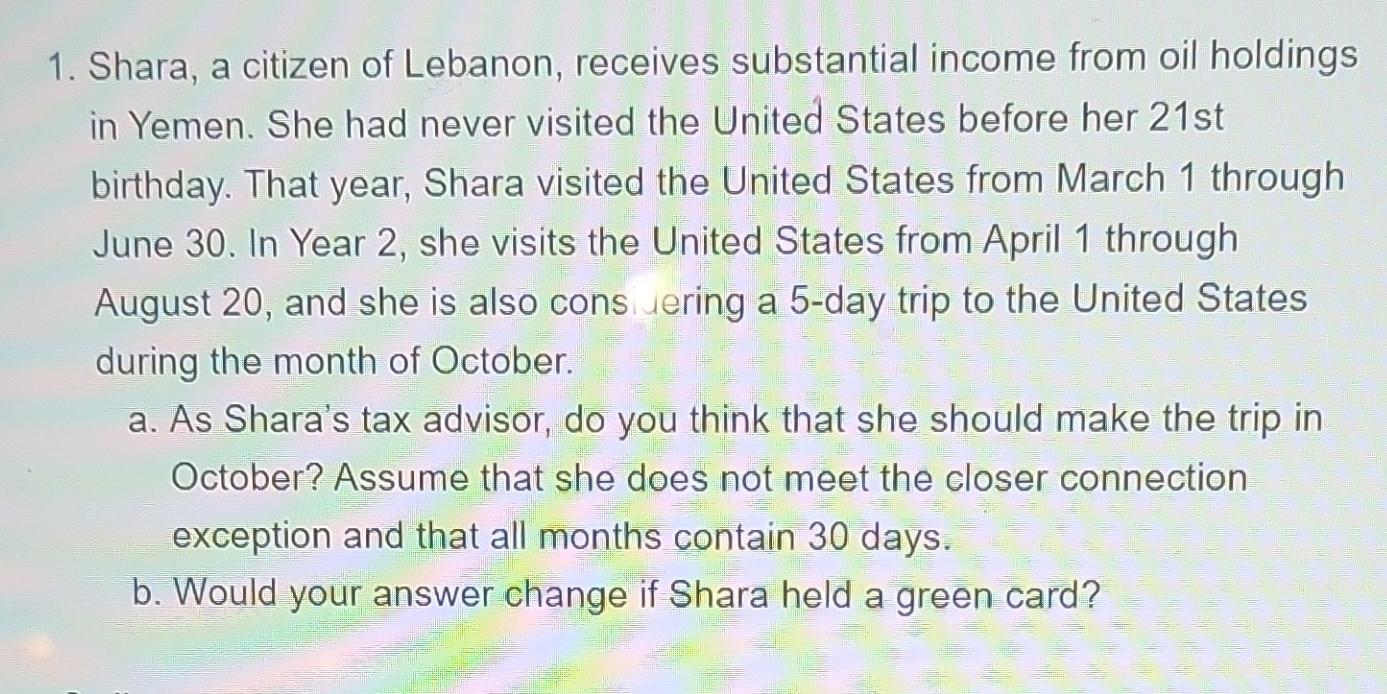

Shara, a citizen of Lebanon, receives substantial income from oil holdings in Yemen. She had never visited the United States before her st birthday. That year, Shara visited the United States from March through June In Year she visits the United States from April through August and she is also cons uering a day trip to the United States during the month of October.

a As Shara's tax advisor, do you think that she should make the trip in October? Assume that she does not meet the closer connection exception and that all months contain days.

b Would your answer change if Shara held a green card?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started