Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Share answer as a pdf Part 1: Solve the following questions based on Perpetuity and Deferred Annuity: Question 1 The dean of the School of

Share answer as a pdf

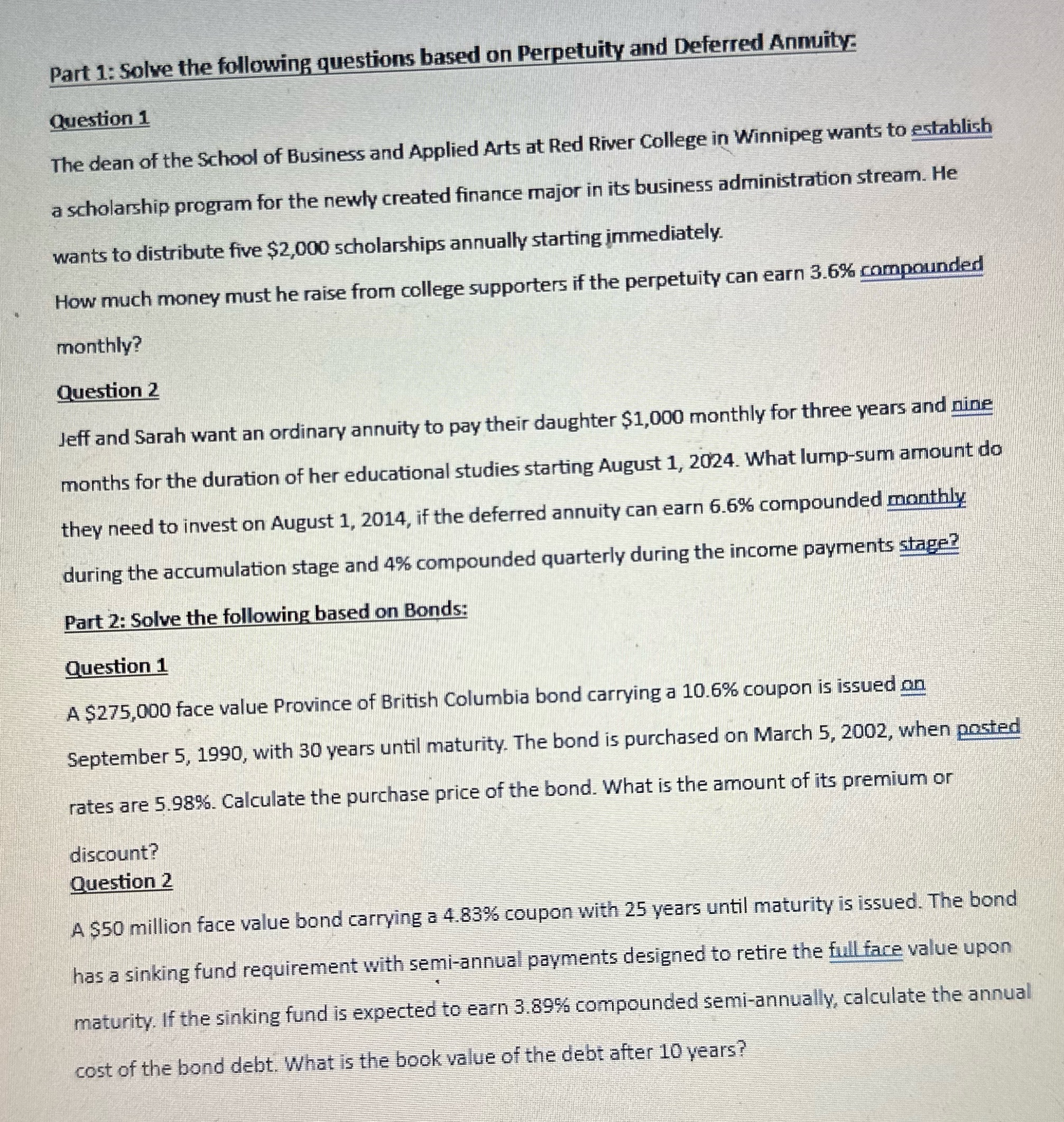

Part 1: Solve the following questions based on Perpetuity and Deferred Annuity: Question 1 The dean of the School of Business and Applied Arts at Red River College in Winnipeg wants to establish a scholarship program for the newly created finance major in its business administration stream. He wants to distribute five $2,000 scholarships annually starting immediately. How much money must he raise from college supporters if the perpetuity can earn 3.6% compounded monthly? Question 2 Jeff and Sarah want an ordinary annuity to pay their daughter $1,000 monthly for three years and nine months for the duration of her educational studies starting August 1, 2024. What lump-sum amount do they need to invest on August 1, 2014, if the deferred annuity can earn 6.6% compounded monthly during the accumulation stage and 4% compounded quarterly during the income payments stage? Part 2: Solve the following based on Bonds: Question 1 A $275,000 face value Province of British Columbia bond carrying a 10.6% coupon is issued on September 5, 1990, with 30 years until maturity. The bond is purchased on March 5, 2002, when posted rates are 5.98%. Calculate the purchase price of the bond. What is the amount of its premium or discount? Question 2 A $50 million face value bond carrying a 4.83% coupon with 25 years until maturity is issued. The bond has a sinking fund requirement with semi-annual payments designed to retire the full face value upon maturity. If the sinking fund is expected to earn 3.89% compounded semi-annually, calculate the annual cost of the bond debt. What is the book value of the debt after 10 years?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started