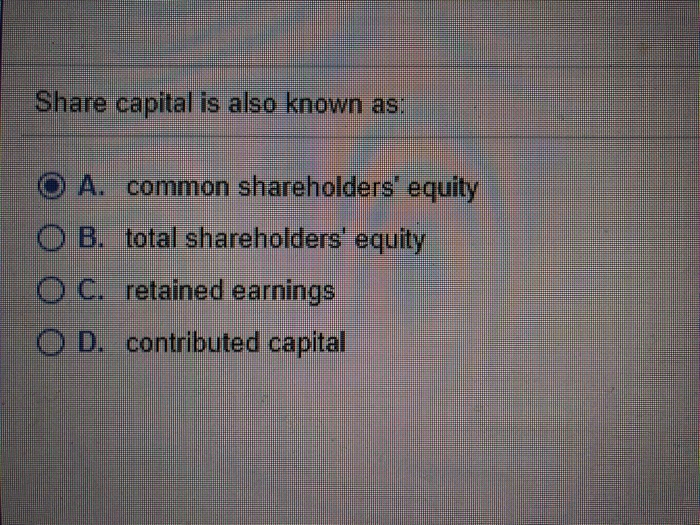

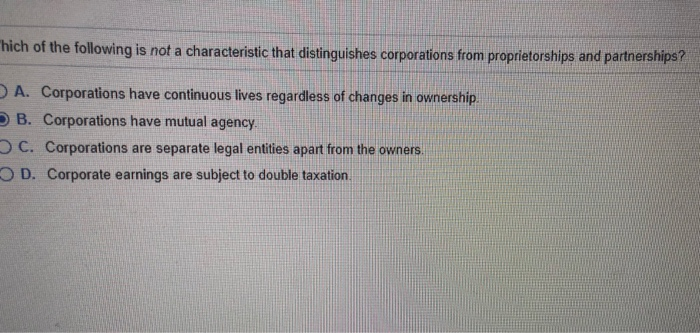

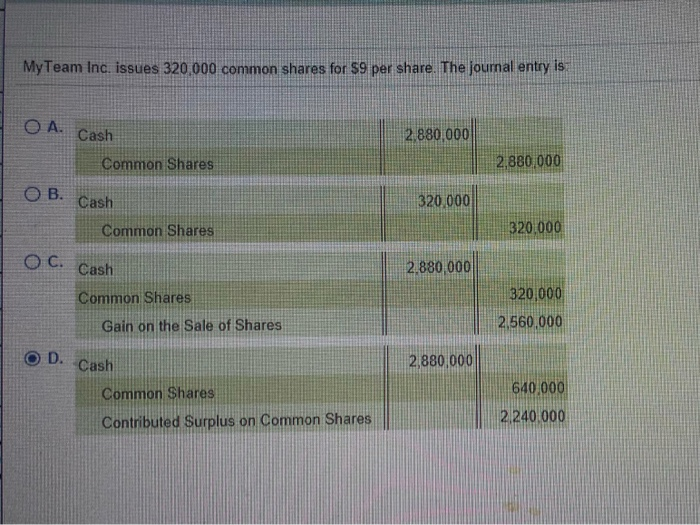

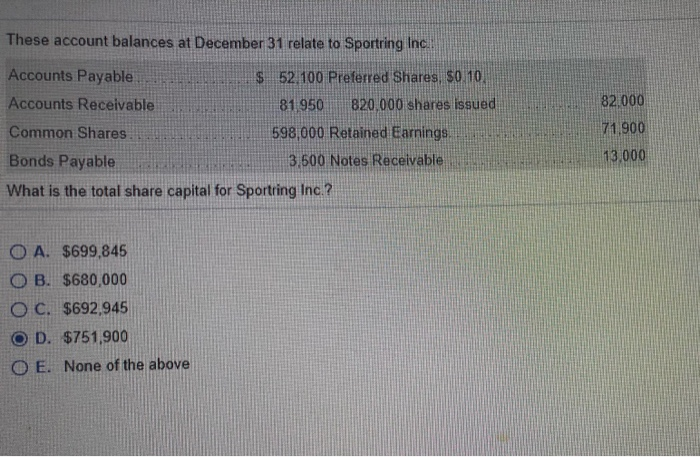

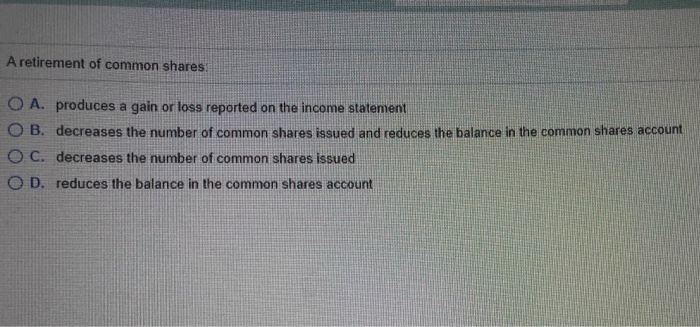

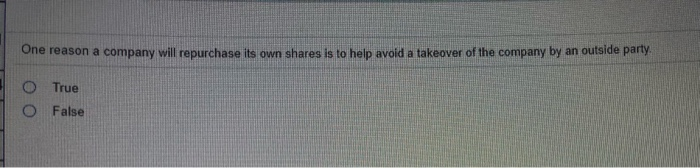

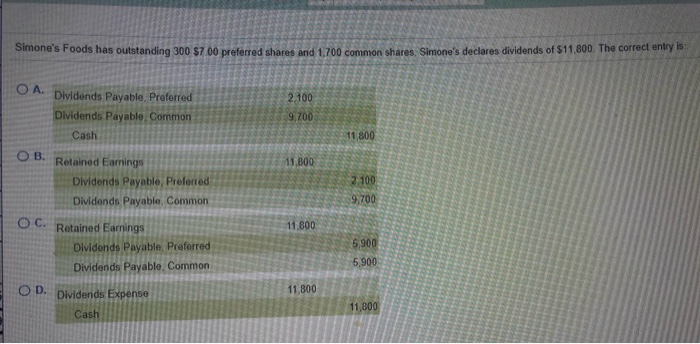

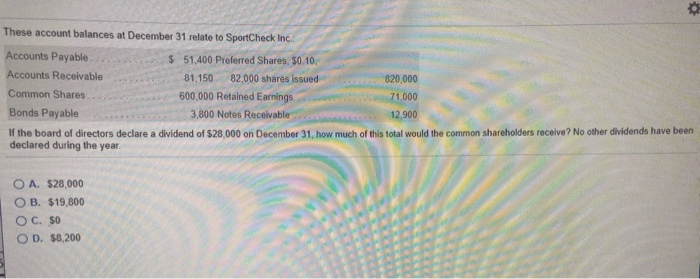

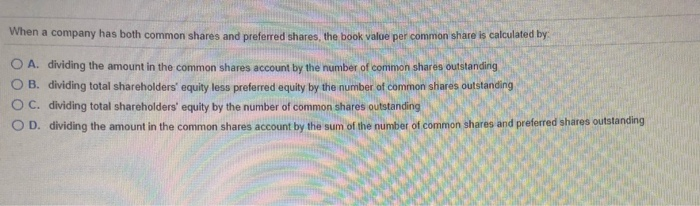

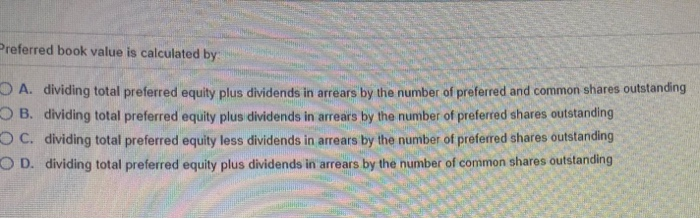

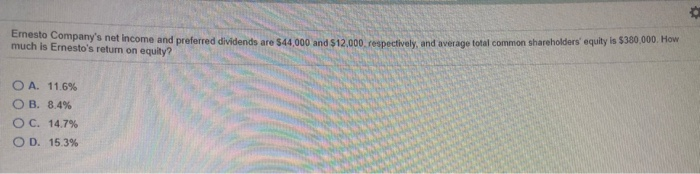

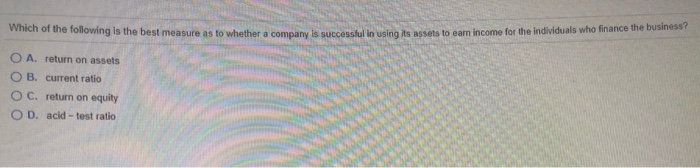

Share capital is also known as: A. common shareholders' equity O B. total shareholders' equity O C. retained earnings O D. contributed capital hich of the following is not a characteristic that distinguishes corporations from proprietorships and partnerships? A. Corporations have continuous lives regardless of changes in ownership B. Corporations have mutual agency. C. Corporations are separate legal entities apart from the owners OD. Corporate earnings are subject to double taxation MyTeam Inc. issues 320,000 common shares for $9 per share. The journal entry is . Cash 2.880,000 Common Shares 2.880 000 . Cash 320 000 Common Shares 320.000 OC. Cash 2.880 000 320,000 Common Shares Gain on the sale of Shares 2.560,000 D. Cash 2,880 000 640.000 Common Shares Contributed Surplus on Common Shares 2.240.000 These account balances at December 31 relate to Sportring Inc Accounts Payable $ 52.100 Preferred Shares $0.10. Accounts Receivable IND 81950 820,000 shares issued Common Shares 598,000 Retained Earnings. Bonds Payable 3,500 Notes Receivable What is the total share capital for Sportring Inc.? 82.000 71,900 13,000 O A. $699,845 O B. $680,000 OC. $692,945 OD. $751,900 O E. None of the above A retirement of common shares: O A. produces a gain or loss reported on the income statement OB. decreases the number of common shares issued and reduces the balance in the common shares account O C. decreases the number of common shares issued O D. reduces the balance in the common shares account One reason a company will repurchase its own shares is to help avoid a takeover of the company by an outside party True O False Simone's Foods has outstanding 300 $7.00 preferred shares and 1.700 common shares, Simone's declares dividends of 511,800. The correct entry is . 2.100 Dividends Payable Preferred Dividends Payable Common Cash 9,700 11,800 OB 11,000 Retained Eamings Dividends Payable, Preferred Dividends Payable, Common 2.100 9,700 OC. 11,800 Retained Earnings Dividends Payable, Preferred Dividends Payable. Common 5.900 5,900 OD. Dividends Expense 11,800 11,800 Cash 0 These account balances at December 31 relate to SportCheck Inc. Accounts Payable $ 51,400 Preferred Shares, 50.10. Accounts Receivable 81,150 82,000 shares issued 820,000 Common Shares 600,000 Retained Earnings 71,000 Bonds Payable 3,800 Notes Receivable 12,900 If the board of directors declare a dividend of $28,000 on December 31, how much of this total would the common shareholders receive? No other dividends have been declared during the year O A. $28,000 O B. $19,800 O C. SO OD. $8,200 When a company has both common shares and preferred shares, the book valve per common share is calculated by O A. dividing the amount in the common shares account by the number of common shares outstanding O B. dividing total shareholders' equity less preferred equity by the number of common shares outstanding O C. dividing total shareholders' equity by the number of common shares outstanding OD. dividing the amount in the common shares account by the sum of the number of common shares and preferred shares outstanding Preferred book value is calculated by A. dividing total preferred equity plus dividends in arrears by the number of preferred and common shares outstanding O B. dividing total preferred equity plus dividends in arrears by the number of preferred shares outstanding C. dividing total preferred equity less dividends in arrears by the number of preferred shares outstanding OD. dividing total preferred equity plus dividends in arrears by the number of common shares outstanding Emesto Company's net income and preferred dividends are $44,000 and $12,000 respectively, and average total common shareholders' equity is $380,000. How much is Ernesto's return on equity? O A 11.6% OB. 8.4% O C. 14.7% OD. 15.3% Which of the following is the best measure as to whether a company is successful in using its assets to earn income for the individuals who finance the business? O A return on assets B. Current ratio OC. return on equity OD. acid-test ratio