Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Share Comme AalthCeDd AaBbCcDdE AaBbCcD AaBbCc AaBb AutbCcDefe AabCcbes AoBCDe AutbCDTe Ngrmal No Sevcing Meadng Haading Heading 2 E = Subrtle Tale sarie Erh tranass

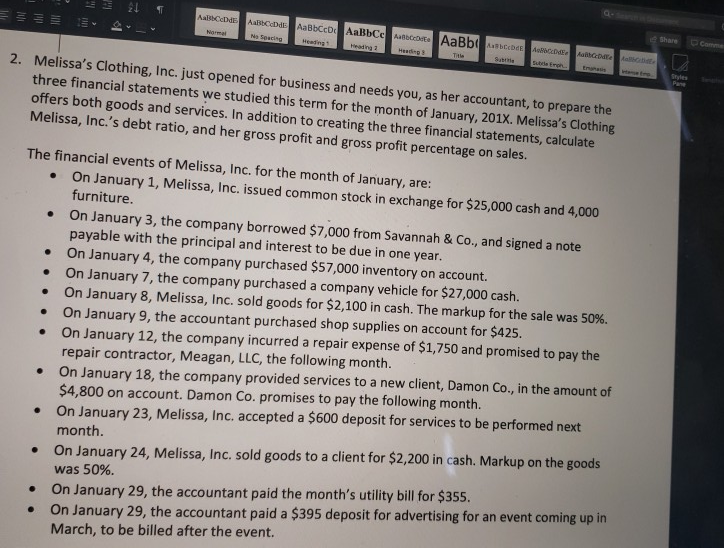

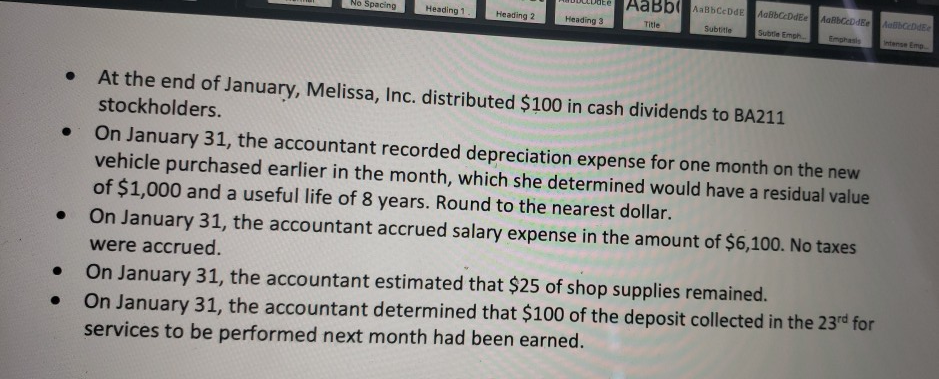

Share Comme AalthCeDd AaBbCcDdE AaBbCcD AaBbCc AaBb AutbCcDefe AabCcbes AoBCDe AutbCDTe Ngrmal No Sevcing Meadng Haading Heading 2 E = Subrtle Tale sarie Erh tranass voee tre Shyles Pane 2. Melissa's Clothing, Inc. just opened for business and needs you, as her accountant, to prepare the three financial statements we studied this term for the month of January, 201X. Melissa's Clothing offers both goods and services. In addition to creating the three financial statements, calculate Melissa, Inc.'s debt ratio, and her gross profit and gross profit percentage on sales. The financial events of Melissa, Inc. for the month of January, are: On January 1, Melissa, Inc. issued common stock in exchange for $25,000 cash and 4,000 furniture. On January 3, the company borrowed $7,000 from Savannah & Co., and signed a note payable with the principal and interest to be due in one year. On January 4, the company purchased $57,000 inventory on account. On January 7, the company purchased a company vehicle for $27,000 cash. On January 8, Melissa, Inc. sold goods for $2,100 in cash. The markup for the sale was 50%. On January 9, the accountant purchased shop supplies on account for $425. On January 12, the company incurred a repair expense of $1,750 and promised to pay the repair contractor, Meagan, LLC, the following month. On January 18, the company provided services to a new client, Damon Co., in the amount of $4,800 On January 23, Melissa, Inc. accepted a $600 deposit for services to be performed next on account. Damon Co. promises to pay the following month. month. the goods On January 24, Melissa, Inc. sold goods to a client for $2,200 in cash. Markup on On January 29, the accountant paid the month's utility bill for $355. On January 29, the accountant paid a $395 deposit for advertising for an event coming up in March, to be billed after the event. was 50%. AaBb AaBbCcDdE AaBbCcDdEe AalbCcDdEe AabCcDdEe No Spacing Heading 1 Heading 2 Heading 3 Ttle Subtitle Subtle Emph Emphasis etense Emp At the end of January, Melissa, Inc. distributed $100 in cash dividends to BA211 stockholders. On January 31, the accountant recorded depreciation expense for one month on the new vehicle purchased earlier in the month, which she determined would have a residual value of $1,000 and a useful life of 8 years. Round to the nearest dollar. On January 31, the accountant accrued salary expense in the amount of $6,100. No taxes were accrued. On January 31, the accountant estimated that $25 of shop supplies remained. On January 31, the accountant determined that $100 of the deposit collected in the 23rd for services to be performed next month had been earned. Debt Ratio: (show formula, and all calculations) Gross Profit on Sales: (show formula, and all calculations) Gross Profit Percentage on Sales: (show formula, and all calculations)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started