Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Share Home e Insert Draw Page Layout Formulas Data View Review Help Insert Calibri AP ' 11 ce Custom 2X Delete Sensil te B I

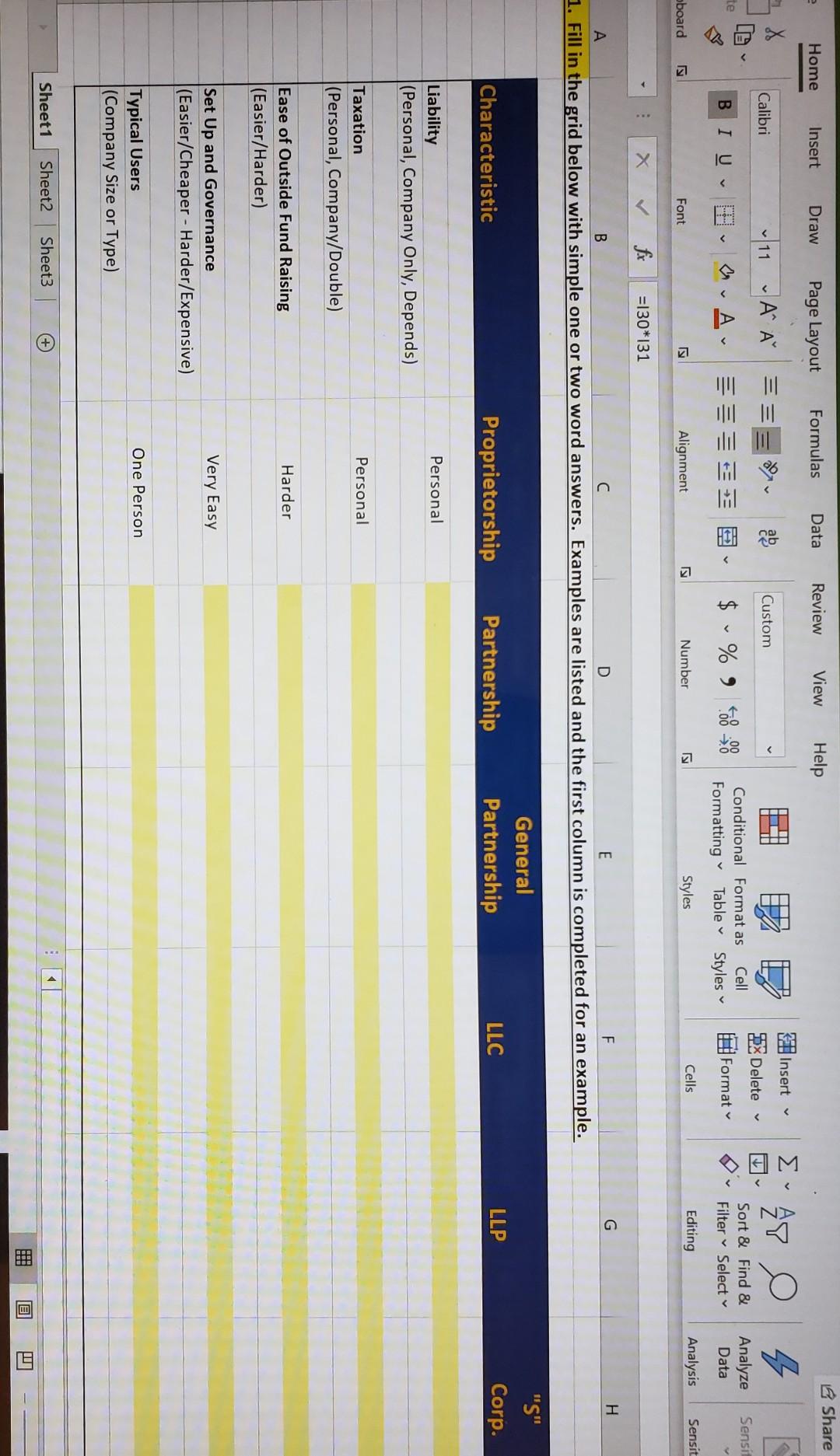

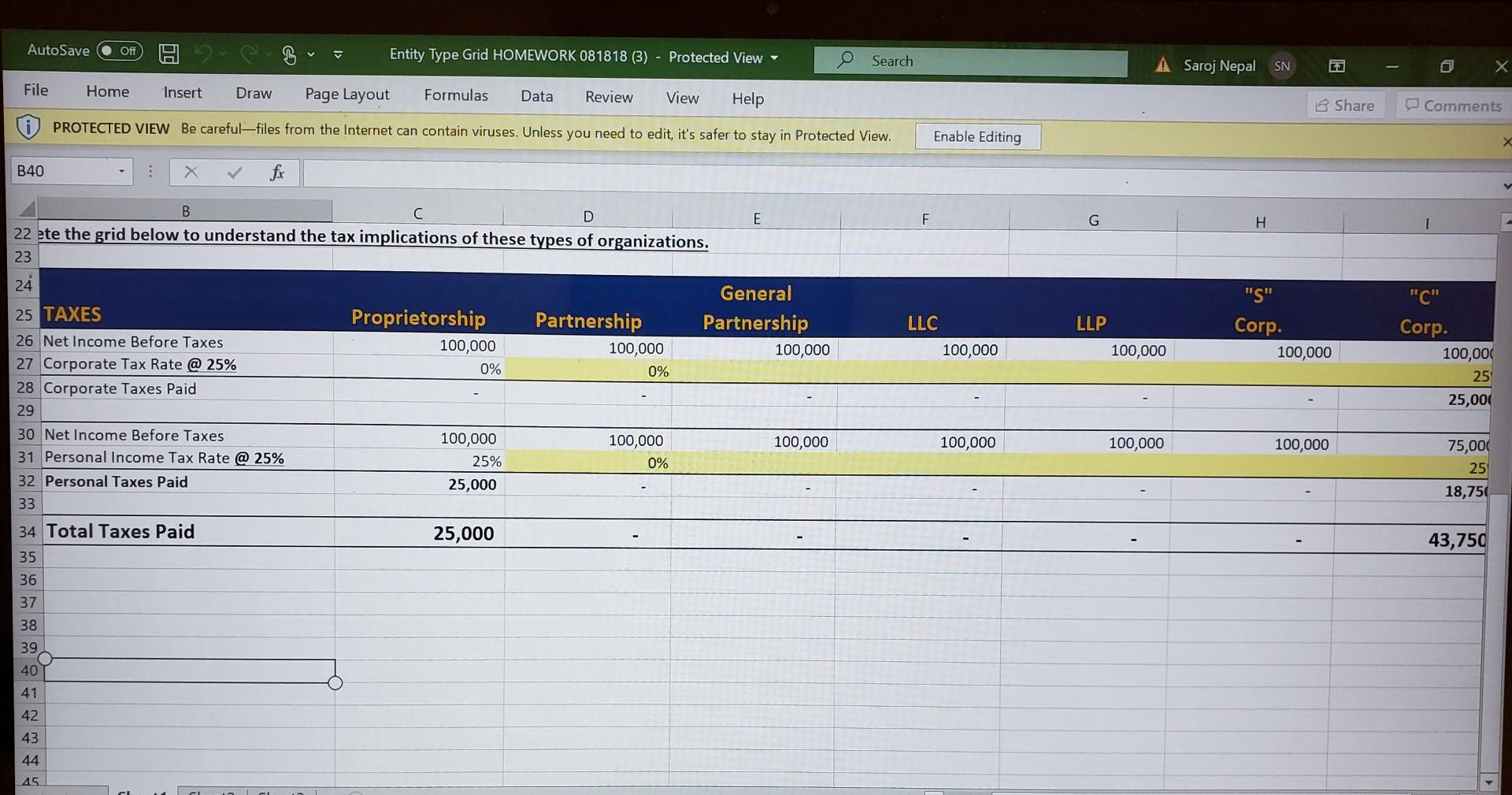

Share Home e Insert Draw Page Layout Formulas Data View Review Help Insert Calibri AP ' 11 ce Custom 2X Delete Sensil te B I U $ % 9 Conditional Format as Cell Formatting Table Styles Analyze Data Sort & Find & Filter Select Format Sensit Cells Number Alignment board Analysis Editing Styles Font is =130*131 G H D B E F 1. Fill in the grid below with simple one or two word answers. Examples are listed and the first column is completed for an example. General Partnership "S" Corp. Characteristic Partnership Proprietorship LLP LLC Personal Liability (Personal, Company Only, Depends) Personal Taxation (Personal, Company/Double) Harder Ease of Outside Fund Raising (Easier/Harder) Very Easy Set Up and Governance (Easier/Cheaper - Harder/Expensive) One Person Typical Users (Company Size or Type) Sheet1 Sheet2 Sheet3 (+ O AutoSave Off Entity Type Grid HOMEWORK 081818 (3) Protected View Search Saroj Nepal SN File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing x B40 X fr E F H B C D 22 ete the grid below to understand the tax implications of these types of organizations. 23 24 Proprietorship 100,000 0% LLP General Partnership 100,000 Partnership 100,000 0% LLC 100,000 "S" Corp. 100,000 100,000 25 TAXES 26 Net Income Before Taxes 27 Corporate Tax Rate @ 25% 28 Corporate Taxes Paid 29 30 Net Income Before Taxes 31 Personal Income Tax Rate @ 25% 32 Personal Taxes Paid 33 "C" Corp. 100,000 25 25,000 100,000 100,000 0% 100,000 100,000 100,000 25% 25,000 100,000 75,000 25 18,750 34 Total Taxes Paid 25,000 43,750 35 36 37 38 39 40 41 42 43 44 45 Share Home e Insert Draw Page Layout Formulas Data View Review Help Insert Calibri AP ' 11 ce Custom 2X Delete Sensil te B I U $ % 9 Conditional Format as Cell Formatting Table Styles Analyze Data Sort & Find & Filter Select Format Sensit Cells Number Alignment board Analysis Editing Styles Font is =130*131 G H D B E F 1. Fill in the grid below with simple one or two word answers. Examples are listed and the first column is completed for an example. General Partnership "S" Corp. Characteristic Partnership Proprietorship LLP LLC Personal Liability (Personal, Company Only, Depends) Personal Taxation (Personal, Company/Double) Harder Ease of Outside Fund Raising (Easier/Harder) Very Easy Set Up and Governance (Easier/Cheaper - Harder/Expensive) One Person Typical Users (Company Size or Type) Sheet1 Sheet2 Sheet3 (+ O AutoSave Off Entity Type Grid HOMEWORK 081818 (3) Protected View Search Saroj Nepal SN File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing x B40 X fr E F H B C D 22 ete the grid below to understand the tax implications of these types of organizations. 23 24 Proprietorship 100,000 0% LLP General Partnership 100,000 Partnership 100,000 0% LLC 100,000 "S" Corp. 100,000 100,000 25 TAXES 26 Net Income Before Taxes 27 Corporate Tax Rate @ 25% 28 Corporate Taxes Paid 29 30 Net Income Before Taxes 31 Personal Income Tax Rate @ 25% 32 Personal Taxes Paid 33 "C" Corp. 100,000 25 25,000 100,000 100,000 0% 100,000 100,000 100,000 25% 25,000 100,000 75,000 25 18,750 34 Total Taxes Paid 25,000 43,750 35 36 37 38 39 40 41 42 43 44 45

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started