Answered step by step

Verified Expert Solution

Question

1 Approved Answer

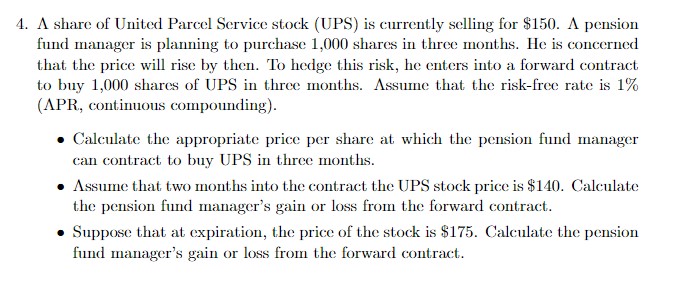

share of United Parcel Service stock ( UPS ) is currently selling for $ 1 5 0 . pension fund manager is planning to purchase

share of United Parcel Service stock UPS is currently selling for $ pension

fund manager is planning to purchase shares in three months. He is concerned

that the price will rise by then. To hedge this risk, he enters into a forward contract

to buy shares of UPS in three months. Assume that the riskfree rate is

continuous compounding

Calculate the appropriate price per share at which the pension fund manager

can contract to buy UPS in three months.

ssume that two months into the contract the UPS stock price is $ Calculate

the pension fund manager's gain or loss from the forward contract.

Suppose that at expiration, the price of the stock is $ Calculate the pension

fund manager's gain or loss from the forward contract.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started