Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Share splits, consolidations and conversions On 31 March 2017, the share capital of Rho Ltd showed: Share capital 25000 'A' ordinary shares paid to $2

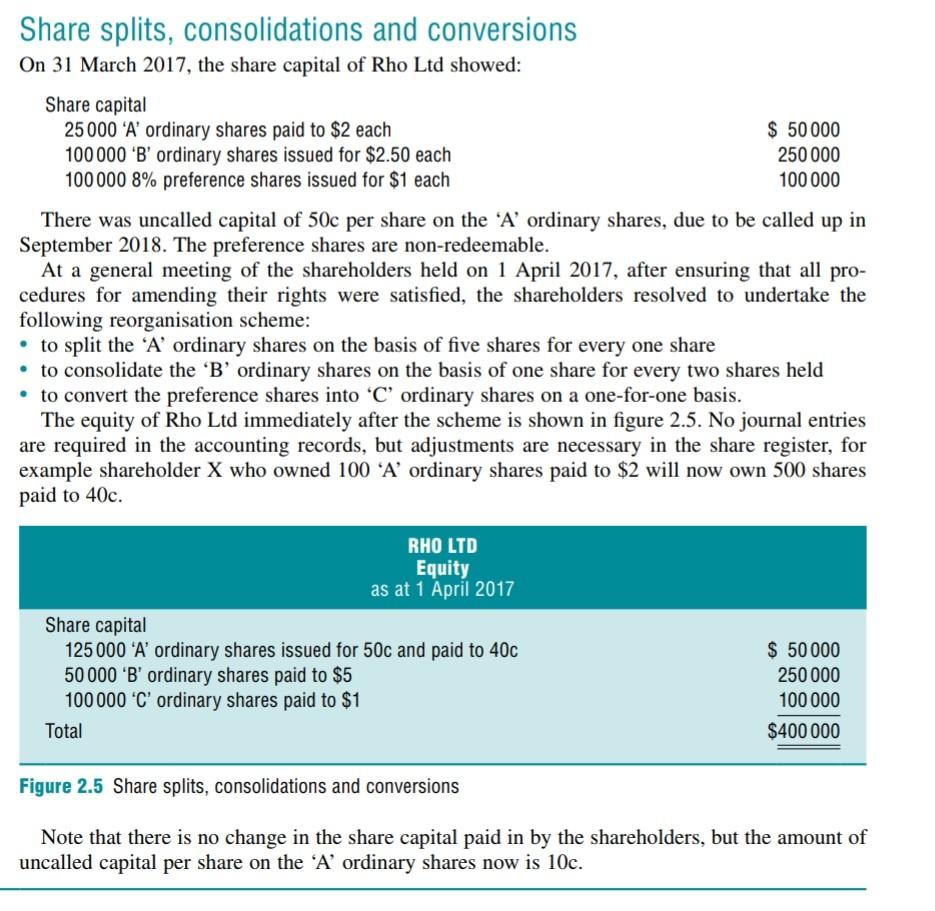

Share splits, consolidations and conversions On 31 March 2017, the share capital of Rho Ltd showed: Share capital 25000 'A' ordinary shares paid to $2 each 100 000 'B' ordinary shares issued for $2.50 each 100000 8% preference shares issued for $1 each $ 50 000 250 000 100 000 There was uncalled capital of 50c per share on the 'A' ordinary shares, due to be called up in September 2018. The preference shares are non-redeemable. At a general meeting of the shareholders held on 1 April 2017, after ensuring that all pro- cedures for amending their rights were satisfied, the shareholders resolved to undertake the following reorganisation scheme: to split the A ordinary shares on the basis of five shares for every one share to consolidate the 'B' ordinary shares on the basis of one share for every two shares held to convert the preference shares into 'C' ordinary shares on a one-for-one basis. The equity of Rho Ltd immediately after the scheme is shown in figure 2.5. No journal entries are required in the accounting records, but adjustments are necessary in the share register, for example shareholder X who owned 100 A ordinary shares paid to $2 will now own 500 shares paid to 40c. RHO LTD Equity as at 1 April 2017 Share capital 125000 'A' ordinary shares issued for 50c and paid to 40c 50 000 'B' ordinary shares paid to $5 100000 'C' ordinary shares paid to $1 $ 50 000 250 000 100 000 Total $400 000 Figure 2.5 Share splits, consolidations and conversions Note that there is no change in the share capital paid in by the shareholders, but the amount of uncalled capital per share on the A ordinary shares now is 10c. Share splits, consolidations and conversions On 31 March 2017, the share capital of Rho Ltd showed: Share capital 25000 'A' ordinary shares paid to $2 each 100 000 'B' ordinary shares issued for $2.50 each 100000 8% preference shares issued for $1 each $ 50 000 250 000 100 000 There was uncalled capital of 50c per share on the 'A' ordinary shares, due to be called up in September 2018. The preference shares are non-redeemable. At a general meeting of the shareholders held on 1 April 2017, after ensuring that all pro- cedures for amending their rights were satisfied, the shareholders resolved to undertake the following reorganisation scheme: to split the A ordinary shares on the basis of five shares for every one share to consolidate the 'B' ordinary shares on the basis of one share for every two shares held to convert the preference shares into 'C' ordinary shares on a one-for-one basis. The equity of Rho Ltd immediately after the scheme is shown in figure 2.5. No journal entries are required in the accounting records, but adjustments are necessary in the share register, for example shareholder X who owned 100 A ordinary shares paid to $2 will now own 500 shares paid to 40c. RHO LTD Equity as at 1 April 2017 Share capital 125000 'A' ordinary shares issued for 50c and paid to 40c 50 000 'B' ordinary shares paid to $5 100000 'C' ordinary shares paid to $1 $ 50 000 250 000 100 000 Total $400 000 Figure 2.5 Share splits, consolidations and conversions Note that there is no change in the share capital paid in by the shareholders, but the amount of uncalled capital per share on the A ordinary shares now is 10c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started