Answered step by step

Verified Expert Solution

Question

1 Approved Answer

shared question 3 Create a table showing how your NPV from question 3 changes if EBIT increases and decreases by 10% and 20%. That is,

shared question 3

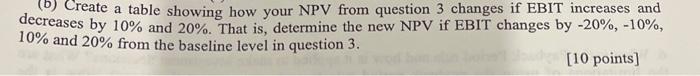

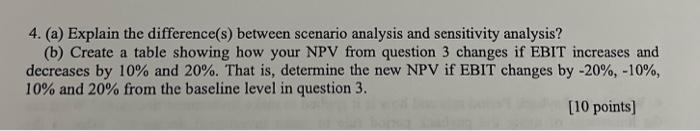

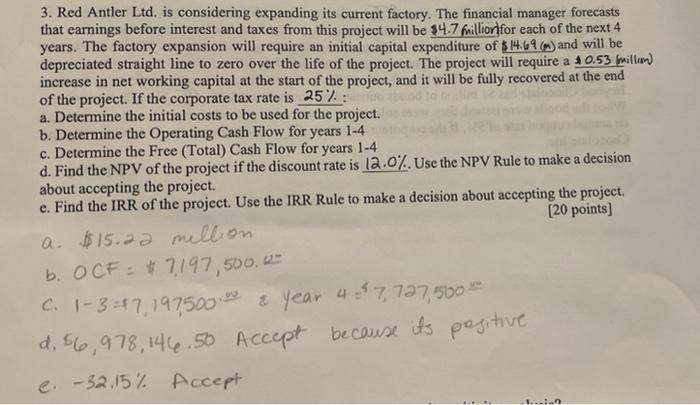

Create a table showing how your NPV from question 3 changes if EBIT increases and decreases by 10% and 20%. That is, determine the new NPV if EBIT changes by -20%, -10%, 10% and 20% from the baseline level in question 3. [10 points) 4. (a) Explain the difference(s) between scenario analysis and sensitivity analysis? (b) Create a table showing how your NPV from question 3 changes if EBIT increases and decreases by 10% and 20%. That is, determine the new NPV if EBIT changes by -20%, -10%, 10% and 20% from the baseline level in question 3. [10 points) 3. Red Antler Ltd. is considering expanding its current factory. The financial manager forecasts that earnings before interest and taxes from this project will be $4.7 fmillion for each of the next 4 years. The factory expansion will require an initial capital expenditure of $14.69 (w) and will be depreciated straight line to zero over the life of the project. The project will require a 10.53 mil.com increase in net working capital at the start of the project, and it will be fully recovered at the end of the project. If the corporate tax rate is 25% : a. Determine the initial costs to be used for the project. b. Determine the Operating Cash Flow for years 1-4 c. Determine the Free (Total) Cash Flow for years 1-4 d. Find the NPV of the project if the discount rate is 12.07. Use the NPV Rule to make a decision about accepting the project. e. Find the IRR of the project. Use the IRR Rule to make a decision about accepting the project. [20 points] a $15.22 million. b. OCF7197,500.- C. 1-3=47,197500.40 a year 47,727,500 ** & 4 d. 56,978, 146.50 Accept because its positive e. -32.15% Accept Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started