Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shareholders equity A5,964 Exercise 4-21 Calculating the debt to equity ratio LO7 Refer to the information in Exercise 4-20. You, business analyst at Organic Catering,

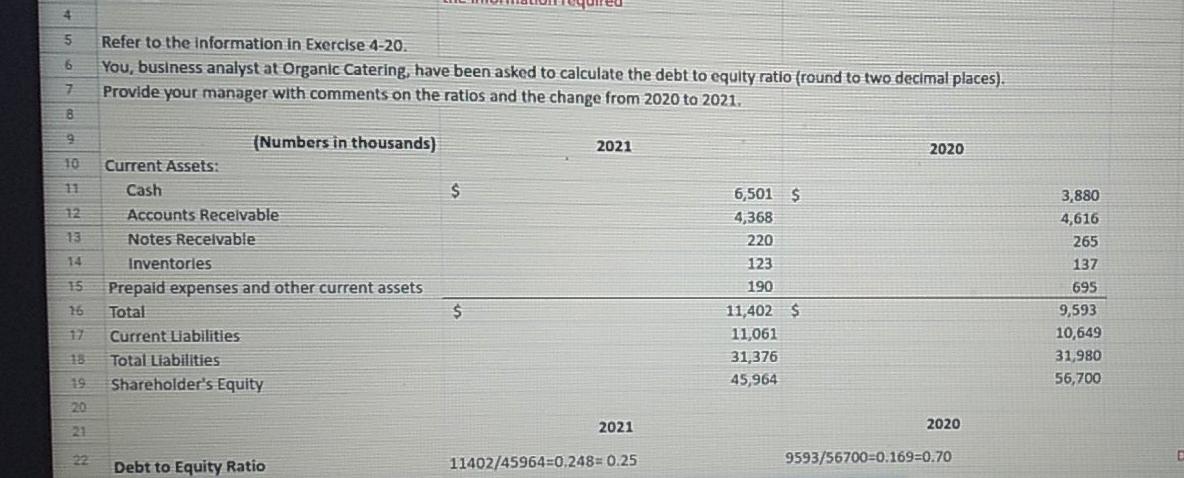

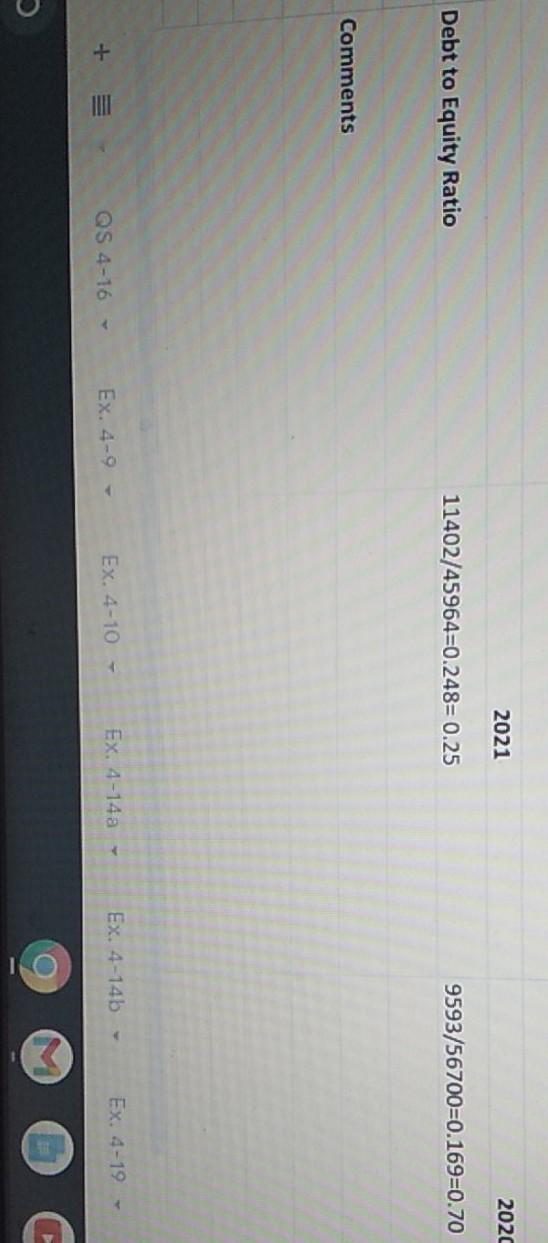

Shareholders equity A5,964 Exercise 4-21 Calculating the debt to equity ratio LO7 Refer to the information in Exercise 4-20. You, business analyst at Organic Catering, have been asked to calcu- late the debt to equity ratio (round to two decimal places). Provide your manager with comments on the ratio and the change from 2020 to 2021. *Exercise 4-22 Reversing entries LOS 4 4 5 6 Refer to the information in Exercise 4-20. You, business analyst at Organic Catering, have been asked to calculate the debt to equity ratio (round to two decimal places). Provide your manager with comments on the ratlos and the change from 2020 to 2021. 7 B 9 2021 2020 10 11 $ 6,501 $ 4,368 13 220 (Numbers in thousands) Current Assets: Cash Accounts Receivable Notes Receivable Inventories Prepaid expenses and other current assets Total Current Liabilities Total Liabilities Shareholder's Equity 123 190 15 3,880 4,616 265 137 695 9,593 10,649 31,980 56,700 15 $ 11,402 $ 11,061 31,376 45,964 20 2021 2020 23 11402/45964=0.248=0.25 9593/56700=0.169=0.70 Debt to Equity Ratio 2021 2020 Debt to Equity Ratio 11402/45964=0.248= 0.25 9593/56700=0.169=0.70 Comments Ex. 4-14b Ex. 4-19 Ex. 4-14a - Ex. 4-10 - Ex. 4-9- QS 4-16

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started