Answered step by step

Verified Expert Solution

Question

1 Approved Answer

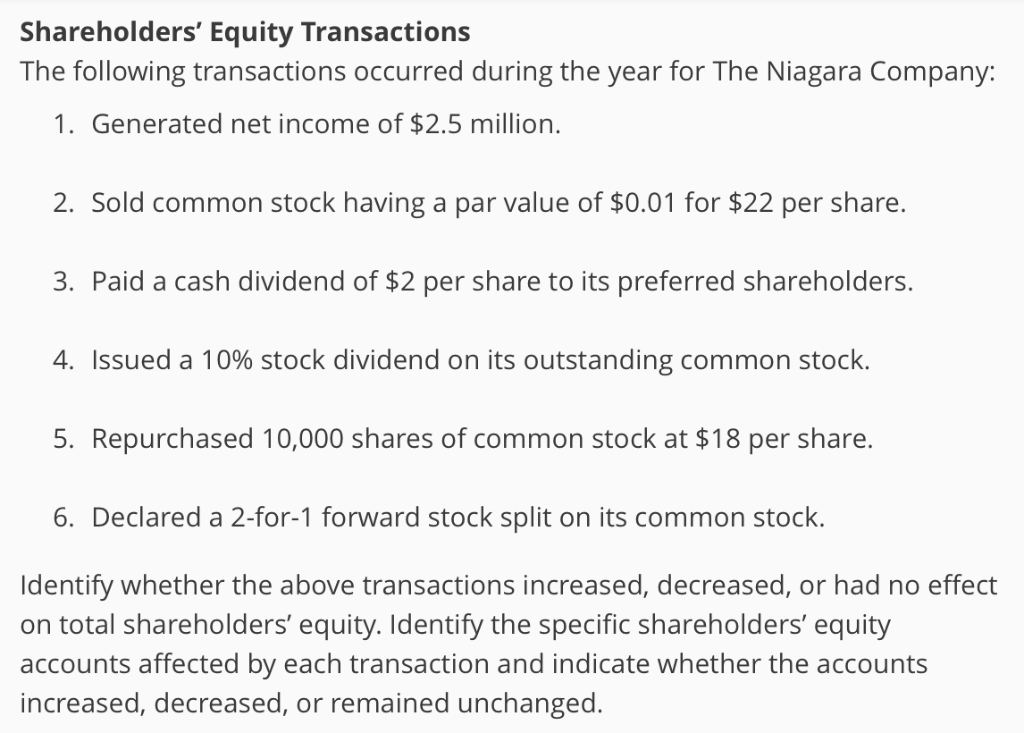

Shareholders Equity Transactions The following transactions occurred during the year for The Niagara Company: Generated net income of $2.5 million. Sold common stock having a

Shareholders Equity Transactions The following transactions occurred during the year for The Niagara Company:

- Generated net income of $2.5 million.

- Sold common stock having a par value of $0.01 for $22 per share.

- Paid a cash dividend of $2 per share to its preferred shareholders.

- Issued a 10% stock dividend on its outstanding common stock.

- Repurchased 10,000 shares of common stock at $18 per share.

- Declared a 2-for-1 forward stock split on its common stock.

Identify whether the above transactions increased, decreased, or had no effect on total shareholders equity. Identify the specific shareholders equity accounts affected by each transaction and indicate whether the accounts increased, decreased, or remained unchanged.

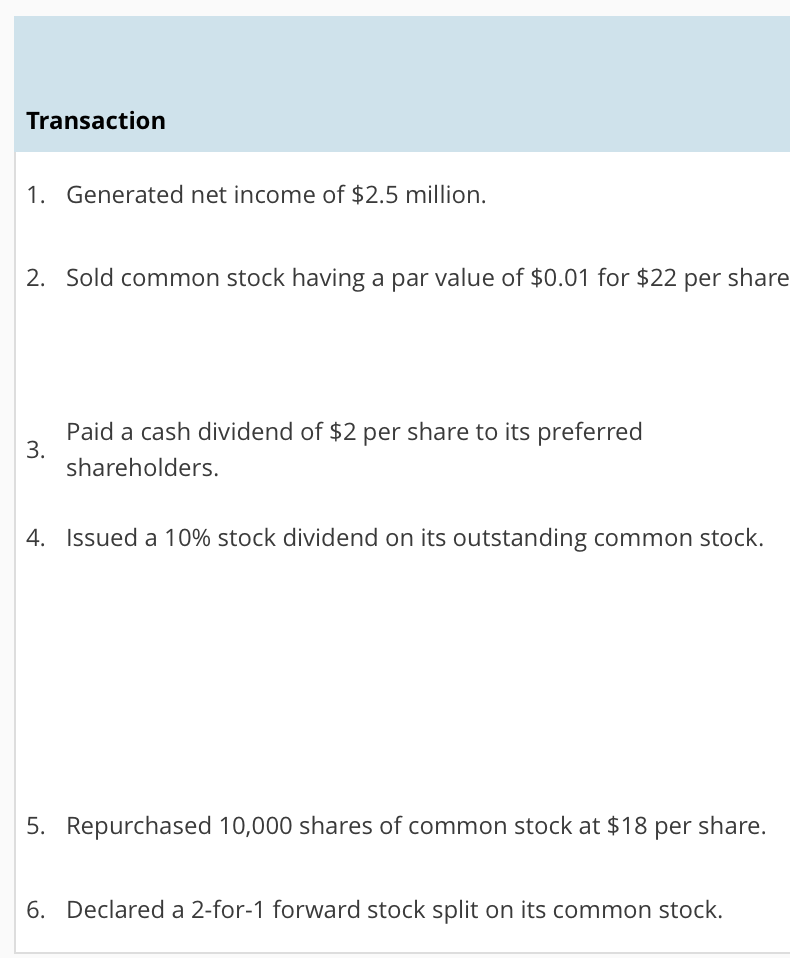

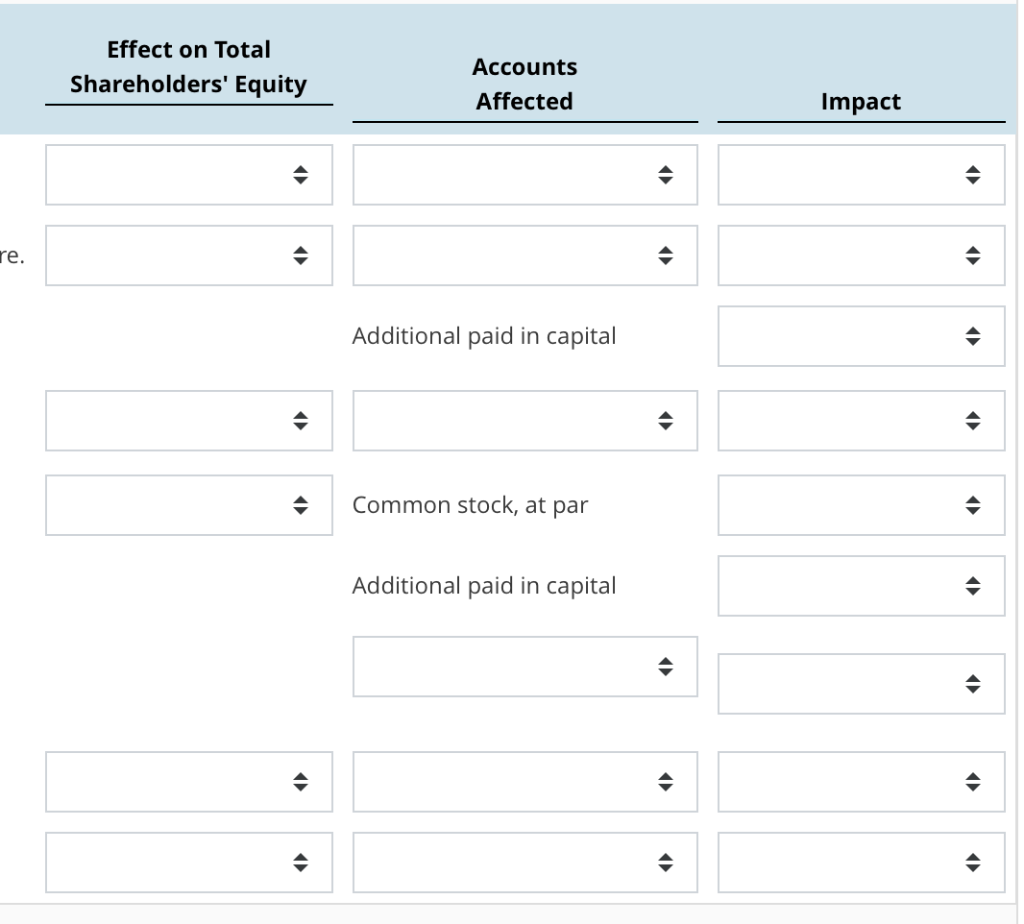

| Transaction | Effect on Total Shareholders' Equity | Accounts Affected | Impact | |

|---|---|---|---|---|

| 1. | Generated net income of $2.5 million. | IncreaseDecreaseNo effect | Retained earningsCommon stock, at parAdditional paid in capitalTreasury stockNo accounts affected | IncreaseDecreaseNo effect |

| 2. | Sold common stock having a par value of $0.01 for $22 per share. | IncreaseDecreaseNo effect | Retained earningsCommon stock, at parAdditional paid in capitalTreasury stockNo accounts affected | IncreaseDecreaseNo effect |

| Additional paid in capital | IncreaseDecreaseNo effect | |||

| 3. | Paid a cash dividend of $2 per share to its preferred shareholders. | IncreaseDecreaseNo effect | Retained earningsCommon stock, at parAdditional paid in capitalTreasury stockNo accounts affected | IncreaseDecreaseNo effect |

| 4. | Issued a 10% stock dividend on its outstanding common stock. | IncreaseDecreaseNo effect | Common stock, at par | IncreaseDecreaseNo effect |

| Additional paid in capital | IncreaseDecreaseNo effect | |||

| Retained earningsCommon stock, at parAdditional paid in capitalTreasury stockNo accounts affected | IncreaseDecreaseNo effect | |||

| 5. | Repurchased 10,000 shares of common stock at $18 per share. | IncreaseDecreaseNo effect | Retained earningsCommon stock, at parAdditional paid in capitalTreasury stockNo accounts affected | IncreaseDecreaseNo effect |

| 6. | Declared a 2-for-1 forward stock split on its common stock. | IncreaseDecreaseNo effect | Retained earningsCommon stock, at parAdditional paid in capitalTreasury stockNo accounts affected | IncreaseDecreaseNo effect |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started