Answered step by step

Verified Expert Solution

Question

1 Approved Answer

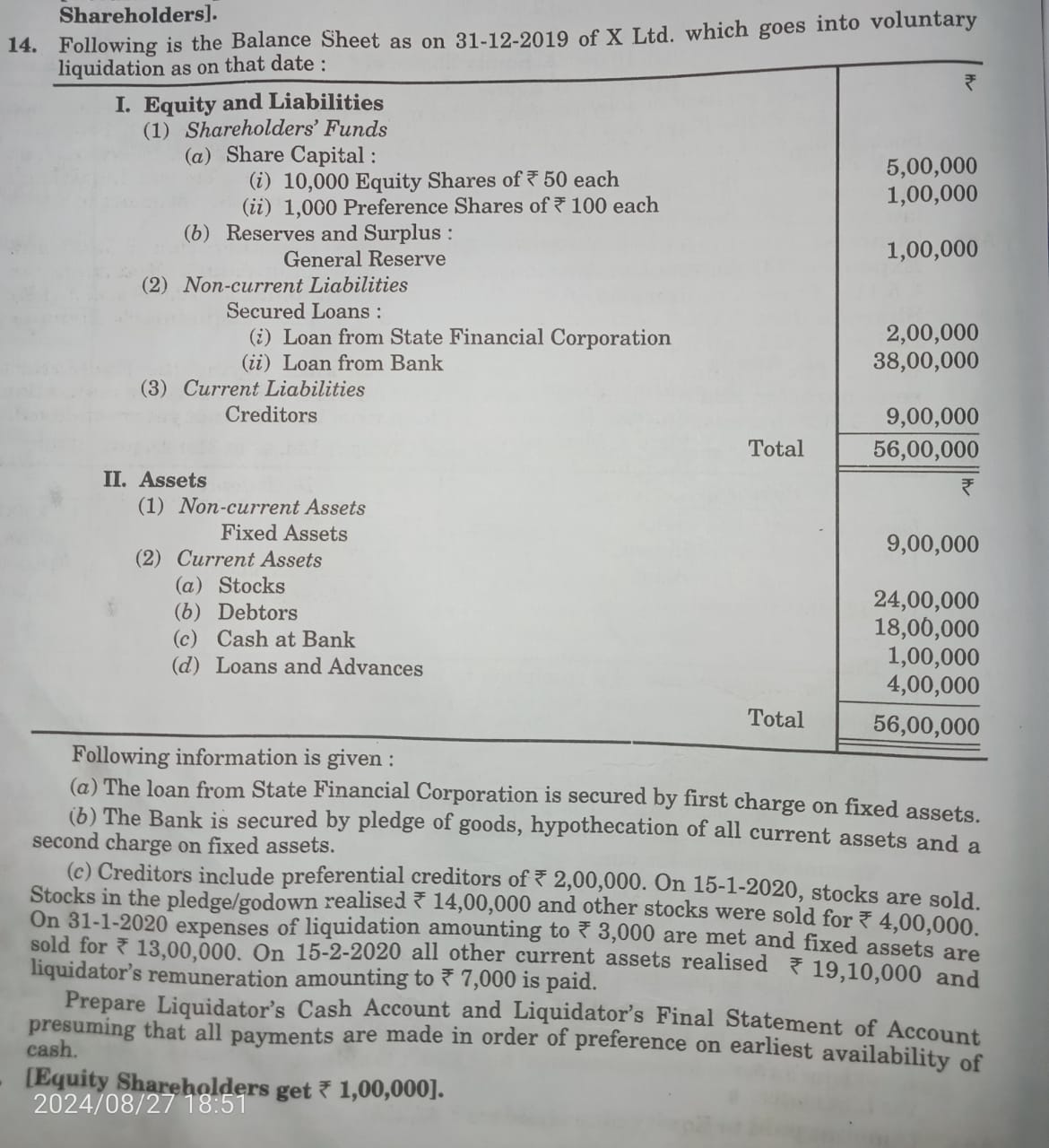

Shareholders ] . Following is the Balance Sheet as on 3 1 - 1 2 - 2 0 1 9 of X Ltd . which

Shareholders

Following is the Balance Sheet as on of X Ltd which goes into voluntary

liquidation as on that date :

I. Equity and Liabilities

Shareholders' Funds

a Share Capital :

i Equity Shares of each

ii Preference Shares of each

b Reserves and Surplus:

General Reserve

Noncurrent Liabilities

Secured Loans :

i Loan from State Financial Corporation

ii Loan from Bank

Current Liabilities

Creditors

II Assets

Noncurrent Assets

Fixed Assets

Current Assets

a Stocks

b Debtors

c Cash at Bank

d Loans and Advances

Following information is given :

a The loan from State Financial Corporation is secured by first charge on fixed assets.

b The Bank is secured by pledge of goods, hypothecation of all current assets and a

second charge on fixed assets.

c Creditors include preferential creditors of On stocks are sold.

Stocks in the pledgegodown realised and other stocks were sold for

On expenses of liquidation amounting to are met and fixed assets are

sold for On all other current assets realised and

liquidator's remuneration amounting to is paid.

Prepare Liquidator's Cash Account and Liquidator's Final Statement of Account

presuming that all payments are made in order of preference on earliest availability of

cash.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started