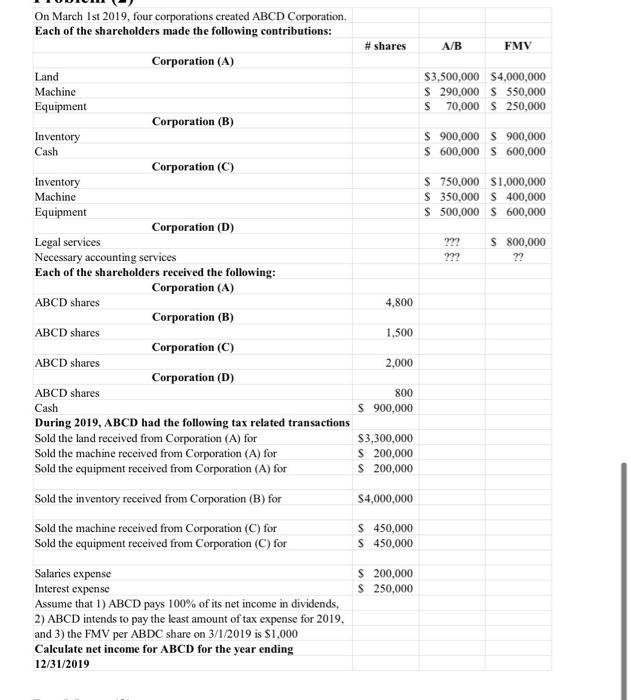

# shares A/B FMV $3,500,000 $4,000,000 $ 290,000 $ 550,000 $ 70,000 $ 250,000 $ 900,000 $ 900,000 $ 600,000 S 600,000 $ 750,000 $1,000,000 $ 350,000 $ 400,000 $ 500,000 S 600,000 On March 1st 2019, four corporations created ABCD Corporation Each of the shareholders made the following contributions: Corporation (A) Land Machine Equipment Corporation (B) Inventory Cash Corporation (C) Inventory Machine Equipment Corporation (D) Legal services Necessary accounting services Each of the shareholders received the following: Corporation (A) ABCD shares Corporation (B) ABCD shares Corporation (C) ABCD shares Corporation (D) ABCD shares Cash During 2019, ABCD had the following tax related transactions Sold the land received from Corporation (A) for Sold the machine received from Corporation (A) for Sold the equipment received from Corporation (A) for 222 ??? S 800,000 ?? 4,800 1,500 2,000 800 $ 900,000 $3,300,000 $ 200,000 $ 200,000 $4,000,000 $ 450,000 S 450,000 Sold the inventory received from Corporation (B) for Sold the machine received from Corporation (C) for Sold the equipment received from Corporation (C) for Salaries expense Interest expense Assume that 1) ABCD pays 100% of its net income in dividends, 2) ABCD intends to pay the least amount of tax expense for 2019. and 3) the FMV per ABDC share on 3/1/2019 is $1,000 Calculate net income for ABCD for the year ending 12/31/2019 $ 200,000 $ 250,000 # shares A/B FMV $3,500,000 $4,000,000 $ 290,000 $ 550,000 $ 70,000 $ 250,000 $ 900,000 $ 900,000 $ 600,000 S 600,000 $ 750,000 $1,000,000 $ 350,000 $ 400,000 $ 500,000 S 600,000 On March 1st 2019, four corporations created ABCD Corporation Each of the shareholders made the following contributions: Corporation (A) Land Machine Equipment Corporation (B) Inventory Cash Corporation (C) Inventory Machine Equipment Corporation (D) Legal services Necessary accounting services Each of the shareholders received the following: Corporation (A) ABCD shares Corporation (B) ABCD shares Corporation (C) ABCD shares Corporation (D) ABCD shares Cash During 2019, ABCD had the following tax related transactions Sold the land received from Corporation (A) for Sold the machine received from Corporation (A) for Sold the equipment received from Corporation (A) for 222 ??? S 800,000 ?? 4,800 1,500 2,000 800 $ 900,000 $3,300,000 $ 200,000 $ 200,000 $4,000,000 $ 450,000 S 450,000 Sold the inventory received from Corporation (B) for Sold the machine received from Corporation (C) for Sold the equipment received from Corporation (C) for Salaries expense Interest expense Assume that 1) ABCD pays 100% of its net income in dividends, 2) ABCD intends to pay the least amount of tax expense for 2019. and 3) the FMV per ABDC share on 3/1/2019 is $1,000 Calculate net income for ABCD for the year ending 12/31/2019 $ 200,000 $ 250,000