Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shares in TPG Telecom Limited (TPM) were trading for $1.63 on 23 August 2023. TPM paid a total dividend of around 3.9 cents per

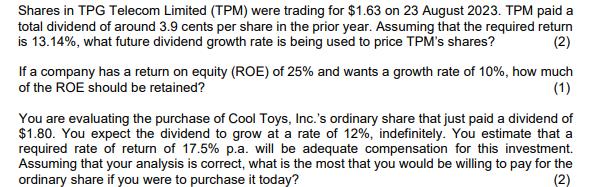

Shares in TPG Telecom Limited (TPM) were trading for $1.63 on 23 August 2023. TPM paid a total dividend of around 3.9 cents per share in the prior year. Assuming that the required return is 13.14%, what future dividend growth rate is being used to price TPM's shares? (2) If a company has a return on equity (ROE) of 25% and wants a growth rate of 10%, how much of the ROE should be retained? (1) You are evaluating the purchase of Cool Toys, Inc.'s ordinary share that just paid a dividend of $1.80. You expect the dividend to grow at a rate of 12%, indefinitely. You estimate that a required rate of return of 17.5% p.a. will be adequate compensation for this investment. Assuming that your analysis is correct, what is the most that you would be willing to pay for the ordinary share if you were to purchase it today?

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 To determine the retention ratio we can use the formula Retention Ratio 1 Growth R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663df82822b57_960738.pdf

180 KBs PDF File

663df82822b57_960738.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started