Answered step by step

Verified Expert Solution

Question

1 Approved Answer

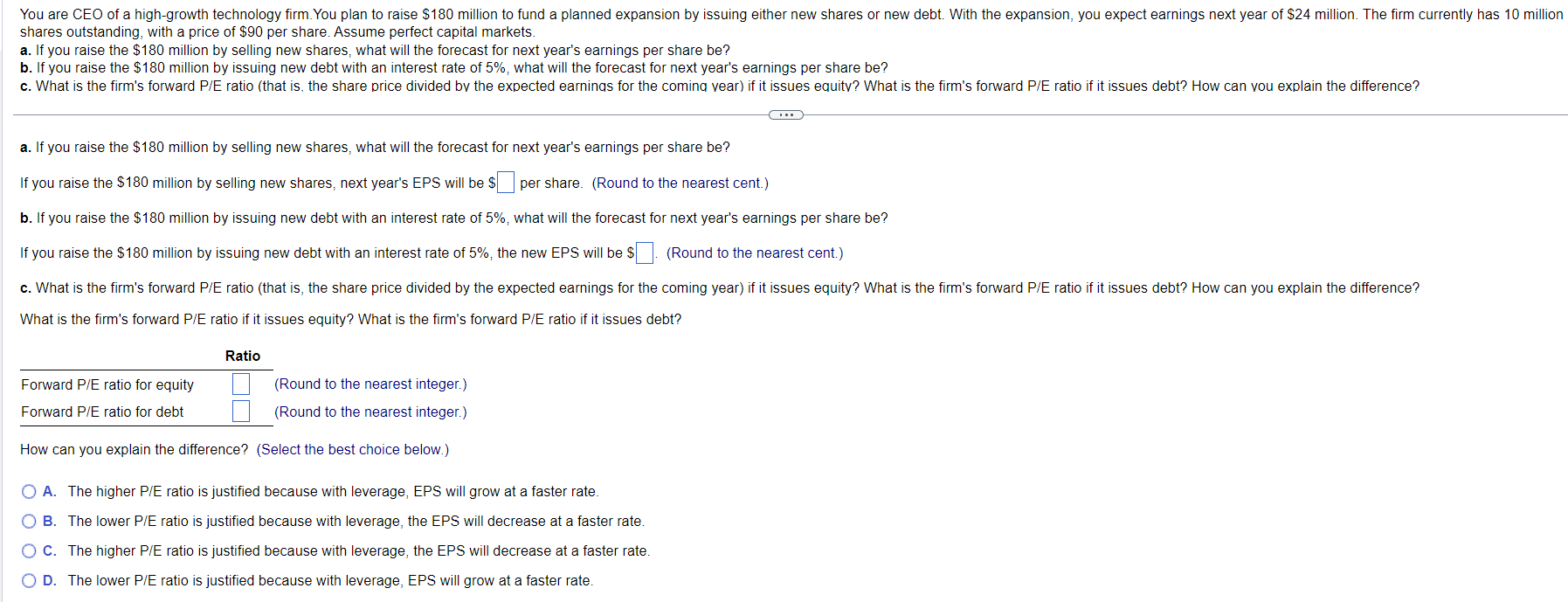

shares outstanding, with a price of $ 9 0 per share. Assume perfect capital markets. a . If you raise the $ 1 8 0

shares outstanding, with a price of $ per share. Assume perfect capital markets.

a If you raise the $ million by selling new shares, what will the forecast for next year's earnings per share be

b If you raise the $ million by issuing new debt with an interest rate of what will the forecast for next year's earnings per share be

a If you raise the $ million by selling new shares, what will the forecast for next year's earnings per share be

If you raise the $ million by selling new shares, next year's EPS will be $ per share. Round to the nearest cent.

b If you raise the $ million by issuing new debt with an interest rate of what will the forecast for next year's earnings per share

If you raise the $ million by issuing new debt with an interest rate of the new EPS will be $Round to the nearest cent.

What is the firm's forward PE ratio if it issues equity? What is the firm's forward PE ratio if it issues debt?

Ratio

Forward PE ratio for equity

Round to the nearest integer.

Forward PE ratio for debt

Round to the nearest integer.

How can you explain the difference? Select the best choice below.

A The higher PE ratio is justified because with leverage, EPS will grow at a faster rate.

B The lower PE ratio is justified because with leverage, the EPS will decrease at a faster rate.

C The higher PE ratio is justified because with leverage, the EPS will decrease at a faster rate

D The lower PE ratio is justified because with leverage, EPS will grow at a faster rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started