Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shari Brown is the Controller of Gloss Inc., She is currently preparing the calculation for basic and diluted earnings per share. The following has

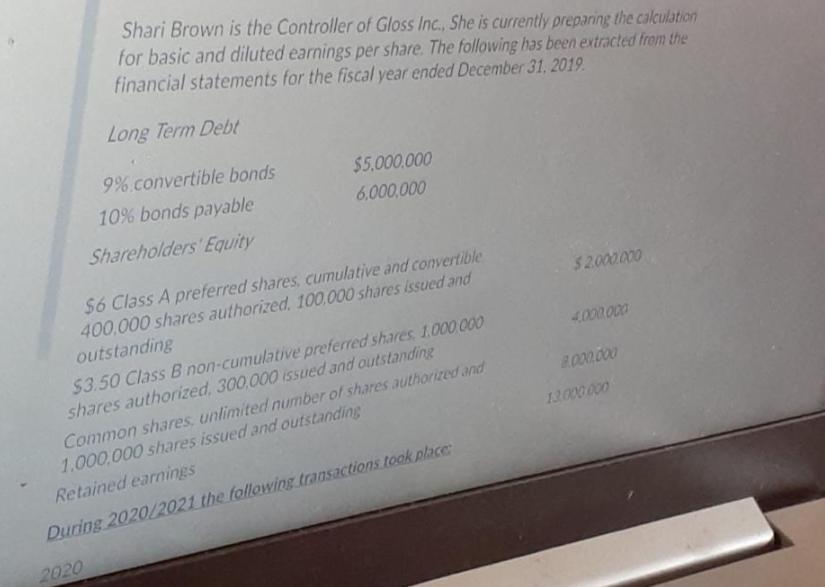

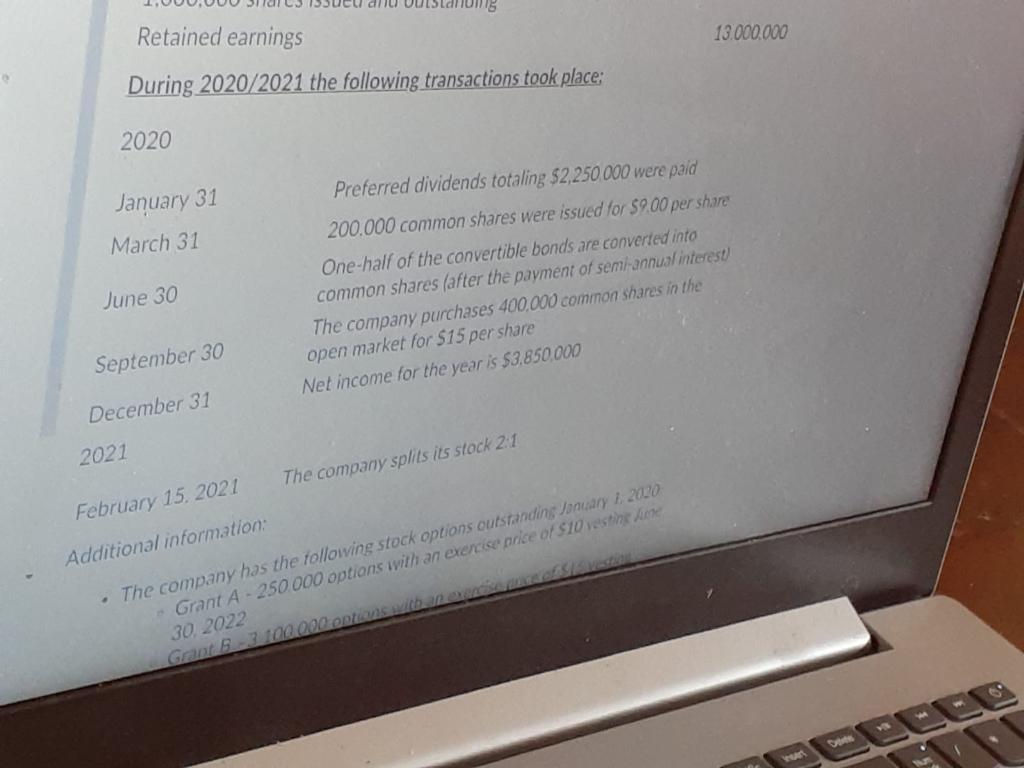

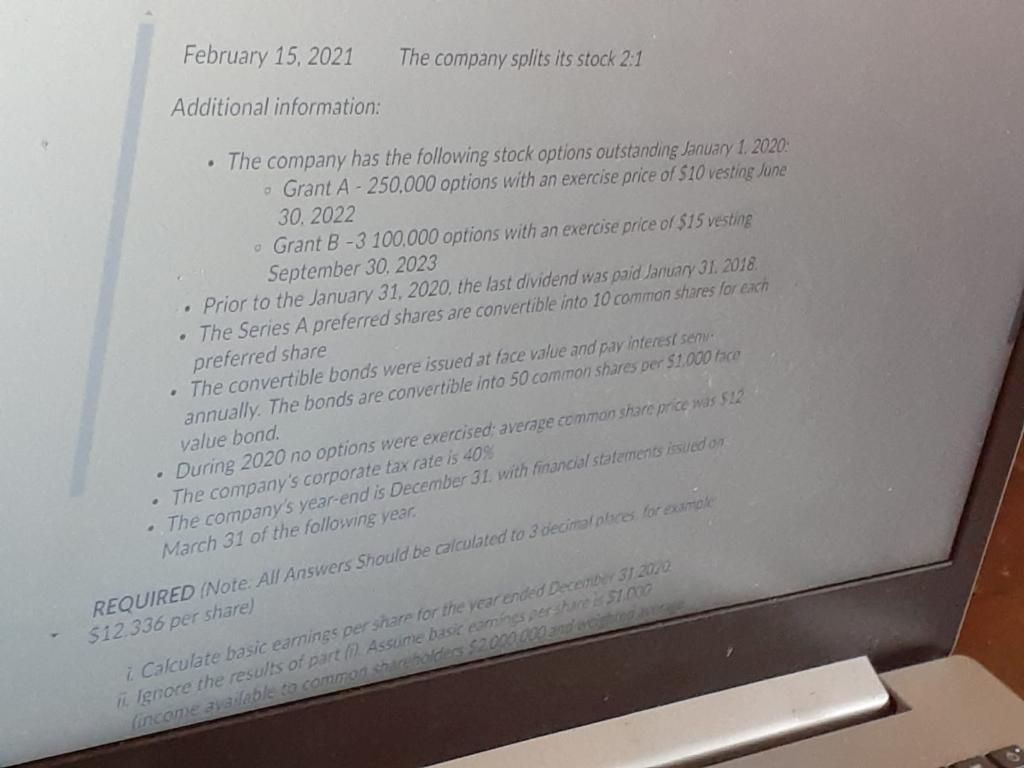

Shari Brown is the Controller of Gloss Inc., She is currently preparing the calculation for basic and diluted earnings per share. The following has been extracted from the financial statements for the fiscal year ended December 31, 2019. Long Term Debt 9% convertible bonds $5.000.000 10% bonds payable 6.000,000 Shareholders Equity $6 Class A preferred shares, cumulative and convertible 400,000 shares authorized, 100,000 shares issued and outstanding $2.000.000 $3.50 Class Bnon-cumulative preferred shares 1.000 000 shares authorized, 300,000 issued and outstanding Common shares, unlimited number of shares authorized and 1.000,000 shares issued and outstanding 4.000.000 8.000.000 13000000 Retained earnings During 2020/2021 the following transactionstoak place 2020 Retained earnings During 2020/2021 the following transactions took place: 13.000.000 2020 January 31 Preferred dividends totaling $2,250 000 were paid March 31 200.000 common shares were issued for $9.00 per share One-half of the convertible bonds are converted into common shares (after the payment of semi annual interest) June 30 The company purchases 400,000 common shares in the open market for $15 per share September 30 December 31 Net income for the year is $3.850,000 2021 The company splits its stock 2:1 February 15. 2021 The company has the following stock options outstanding January 1.2020 Grant A- 250 000 options with an exercise price of $10 vesting Ane 30.2022 Grant B-3 00 000 options with an evercie eof Sestion Additional information: Dee February 15, 2021 The company splits its stock 2:1 Additional information: The company has the following stock options outstanding January 1.2020: Grant A-250,000 options with an exercise price of $10 vesting June 30, 2022 o Grant B -3 100,000 options with an exercise price of $15 vesting September 30, 2023 Prior to the January 31, 2020, the last dividend was paid Januay 31. 2018. The Series A preferred shares are convertible into 10 common shares for each preferred share The convertible bonds were issued at face value and pay interest sem annually. The bonds are convertible into 50 common shares per $1.000 face value bond. During 2020 no options were exercised: average common share price was $12 The company's corporate tax rate is 40% The company's year-end is December 31. with financial statements issued on March 31 of the following year. REQUIRED (Note. All Answers Should be calculated to 3 odecimal places forexample $12.336 per share) 7 Calculate basic earnings per share for the year ended December 31 20/2 L Ignore the results of part (). Assume basic eamines pershareis ST.000 (income ayailable to common sharebolders$2000000and citoaoe TIC LUITpainy 5 ycal CIiu 15 UCLCIIUCI U1, WILI IidiiLiai staicICILD 1Sucu u March 31 of the following year. REQUIRED (Note: All Answers Should be calculated to 3 decimal places, for example $12.336 per share) i. Calculate basic earnings per share for the year ended December 31.2020 ii. Ignore the results of part (i). Assume basic earnings per share is $1.000 (income available to common shareholders $2,000,000 and weighted average shares outstanding 2,000,000). Calculate diluted earnings per share BIU Paragraph Shari Brown is the Controller of Gloss Inc., She is currently preparing the calculation for basic and diluted earnings per share. The following has been extracted from the financial statements for the fiscal year ended December 31, 2019. Long Term Debt 9% convertible bonds $5.000.000 10% bonds payable 6.000,000 Shareholders Equity $6 Class A preferred shares, cumulative and convertible 400,000 shares authorized, 100,000 shares issued and outstanding $2.000.000 $3.50 Class Bnon-cumulative preferred shares 1.000 000 shares authorized, 300,000 issued and outstanding Common shares, unlimited number of shares authorized and 1.000,000 shares issued and outstanding 4.000.000 8.000.000 13000000 Retained earnings During 2020/2021 the following transactionstoak place 2020 Retained earnings During 2020/2021 the following transactions took place: 13.000.000 2020 January 31 Preferred dividends totaling $2,250 000 were paid March 31 200.000 common shares were issued for $9.00 per share One-half of the convertible bonds are converted into common shares (after the payment of semi annual interest) June 30 The company purchases 400,000 common shares in the open market for $15 per share September 30 December 31 Net income for the year is $3.850,000 2021 The company splits its stock 2:1 February 15. 2021 The company has the following stock options outstanding January 1.2020 Grant A- 250 000 options with an exercise price of $10 vesting Ane 30.2022 Grant B-3 00 000 options with an evercie eof Sestion Additional information: Dee February 15, 2021 The company splits its stock 2:1 Additional information: The company has the following stock options outstanding January 1.2020: Grant A-250,000 options with an exercise price of $10 vesting June 30, 2022 o Grant B -3 100,000 options with an exercise price of $15 vesting September 30, 2023 Prior to the January 31, 2020, the last dividend was paid Januay 31. 2018. The Series A preferred shares are convertible into 10 common shares for each preferred share The convertible bonds were issued at face value and pay interest sem annually. The bonds are convertible into 50 common shares per $1.000 face value bond. During 2020 no options were exercised: average common share price was $12 The company's corporate tax rate is 40% The company's year-end is December 31. with financial statements issued on March 31 of the following year. REQUIRED (Note. All Answers Should be calculated to 3 odecimal places forexample $12.336 per share) 7 Calculate basic earnings per share for the year ended December 31 20/2 L Ignore the results of part (). Assume basic eamines pershareis ST.000 (income ayailable to common sharebolders$2000000and citoaoe TIC LUITpainy 5 ycal CIiu 15 UCLCIIUCI U1, WILI IidiiLiai staicICILD 1Sucu u March 31 of the following year. REQUIRED (Note: All Answers Should be calculated to 3 decimal places, for example $12.336 per share) i. Calculate basic earnings per share for the year ended December 31.2020 ii. Ignore the results of part (i). Assume basic earnings per share is $1.000 (income available to common shareholders $2,000,000 and weighted average shares outstanding 2,000,000). Calculate diluted earnings per share BIU Paragraph Shari Brown is the Controller of Gloss Inc., She is currently preparing the calculation for basic and diluted earnings per share. The following has been extracted from the financial statements for the fiscal year ended December 31, 2019. Long Term Debt 9% convertible bonds $5.000.000 10% bonds payable 6.000,000 Shareholders Equity $6 Class A preferred shares, cumulative and convertible 400,000 shares authorized, 100,000 shares issued and outstanding $2.000.000 $3.50 Class Bnon-cumulative preferred shares 1.000 000 shares authorized, 300,000 issued and outstanding Common shares, unlimited number of shares authorized and 1.000,000 shares issued and outstanding 4.000.000 8.000.000 13000000 Retained earnings During 2020/2021 the following transactionstoak place 2020 Retained earnings During 2020/2021 the following transactions took place: 13.000.000 2020 January 31 Preferred dividends totaling $2,250 000 were paid March 31 200.000 common shares were issued for $9.00 per share One-half of the convertible bonds are converted into common shares (after the payment of semi annual interest) June 30 The company purchases 400,000 common shares in the open market for $15 per share September 30 December 31 Net income for the year is $3.850,000 2021 The company splits its stock 2:1 February 15. 2021 The company has the following stock options outstanding January 1.2020 Grant A- 250 000 options with an exercise price of $10 vesting Ane 30.2022 Grant B-3 00 000 options with an evercie eof Sestion Additional information: Dee February 15, 2021 The company splits its stock 2:1 Additional information: The company has the following stock options outstanding January 1.2020: Grant A-250,000 options with an exercise price of $10 vesting June 30, 2022 o Grant B -3 100,000 options with an exercise price of $15 vesting September 30, 2023 Prior to the January 31, 2020, the last dividend was paid Januay 31. 2018. The Series A preferred shares are convertible into 10 common shares for each preferred share The convertible bonds were issued at face value and pay interest sem annually. The bonds are convertible into 50 common shares per $1.000 face value bond. During 2020 no options were exercised: average common share price was $12 The company's corporate tax rate is 40% The company's year-end is December 31. with financial statements issued on March 31 of the following year. REQUIRED (Note. All Answers Should be calculated to 3 odecimal places forexample $12.336 per share) 7 Calculate basic earnings per share for the year ended December 31 20/2 L Ignore the results of part (). Assume basic eamines pershareis ST.000 (income ayailable to common sharebolders$2000000and citoaoe TIC LUITpainy 5 ycal CIiu 15 UCLCIIUCI U1, WILI IidiiLiai staicICILD 1Sucu u March 31 of the following year. REQUIRED (Note: All Answers Should be calculated to 3 decimal places, for example $12.336 per share) i. Calculate basic earnings per share for the year ended December 31.2020 ii. Ignore the results of part (i). Assume basic earnings per share is $1.000 (income available to common shareholders $2,000,000 and weighted average shares outstanding 2,000,000). Calculate diluted earnings per share BIU Paragraph Shari Brown is the Controller of Gloss Inc., She is currently preparing the calculation for basic and diluted earnings per share. The following has been extracted from the financial statements for the fiscal year ended December 31, 2019. Long Term Debt 9% convertible bonds $5.000.000 10% bonds payable 6.000,000 Shareholders Equity $6 Class A preferred shares, cumulative and convertible 400,000 shares authorized, 100,000 shares issued and outstanding $2.000.000 $3.50 Class Bnon-cumulative preferred shares 1.000 000 shares authorized, 300,000 issued and outstanding Common shares, unlimited number of shares authorized and 1.000,000 shares issued and outstanding 4.000.000 8.000.000 13000000 Retained earnings During 2020/2021 the following transactionstoak place 2020 Retained earnings During 2020/2021 the following transactions took place: 13.000.000 2020 January 31 Preferred dividends totaling $2,250 000 were paid March 31 200.000 common shares were issued for $9.00 per share One-half of the convertible bonds are converted into common shares (after the payment of semi annual interest) June 30 The company purchases 400,000 common shares in the open market for $15 per share September 30 December 31 Net income for the year is $3.850,000 2021 The company splits its stock 2:1 February 15. 2021 The company has the following stock options outstanding January 1.2020 Grant A- 250 000 options with an exercise price of $10 vesting Ane 30.2022 Grant B-3 00 000 options with an evercie eof Sestion Additional information: Dee February 15, 2021 The company splits its stock 2:1 Additional information: The company has the following stock options outstanding January 1.2020: Grant A-250,000 options with an exercise price of $10 vesting June 30, 2022 o Grant B -3 100,000 options with an exercise price of $15 vesting September 30, 2023 Prior to the January 31, 2020, the last dividend was paid Januay 31. 2018. The Series A preferred shares are convertible into 10 common shares for each preferred share The convertible bonds were issued at face value and pay interest sem annually. The bonds are convertible into 50 common shares per $1.000 face value bond. During 2020 no options were exercised: average common share price was $12 The company's corporate tax rate is 40% The company's year-end is December 31. with financial statements issued on March 31 of the following year. REQUIRED (Note. All Answers Should be calculated to 3 odecimal places forexample $12.336 per share) 7 Calculate basic earnings per share for the year ended December 31 20/2 L Ignore the results of part (). Assume basic eamines pershareis ST.000 (income ayailable to common sharebolders$2000000and citoaoe TIC LUITpainy 5 ycal CIiu 15 UCLCIIUCI U1, WILI IidiiLiai staicICILD 1Sucu u March 31 of the following year. REQUIRED (Note: All Answers Should be calculated to 3 decimal places, for example $12.336 per share) i. Calculate basic earnings per share for the year ended December 31.2020 ii. Ignore the results of part (i). Assume basic earnings per share is $1.000 (income available to common shareholders $2,000,000 and weighted average shares outstanding 2,000,000). Calculate diluted earnings per share BIU Paragraph

Step by Step Solution

★★★★★

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Determination of weighted average number of ordinary shares Adjust the pre dividend number of shares to post dividend number of shares It can be done by multiplying the number of shares prior to decla...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started