Answered step by step

Verified Expert Solution

Question

1 Approved Answer

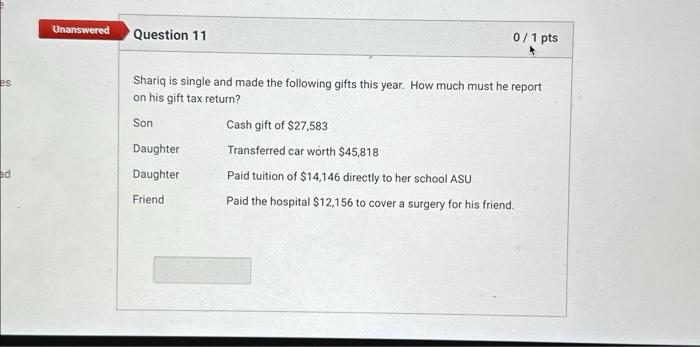

Shariq is single and made the following gifts this year. How much must he report on his gift tax return? Son Daughter Daughter Friend Cash

Shariq is single and made the following gifts this year. How much must he report on his gift tax return? Son Daughter Daughter Friend Cash gift of $27,583 Transferred car worth $45,818 Paid tuition of $14,146 directly to her school ASU Paid the hospital $12,156 to cover a surgery for his friend

Shariq is single and made the following gifts this year. How much must he report on his gift tax return? Son Daughter Daughter Friend Cash gift of $27,583 Transferred car worth $45,818 Paid tuition of $14,146 directly to her school ASU Paid the hospital $12,156 to cover a surgery for his friend

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started